0 to $30M in 30 Months: How a Marketing Analytics Company Cracked the Marketplace Code

Hi, it's Roman from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

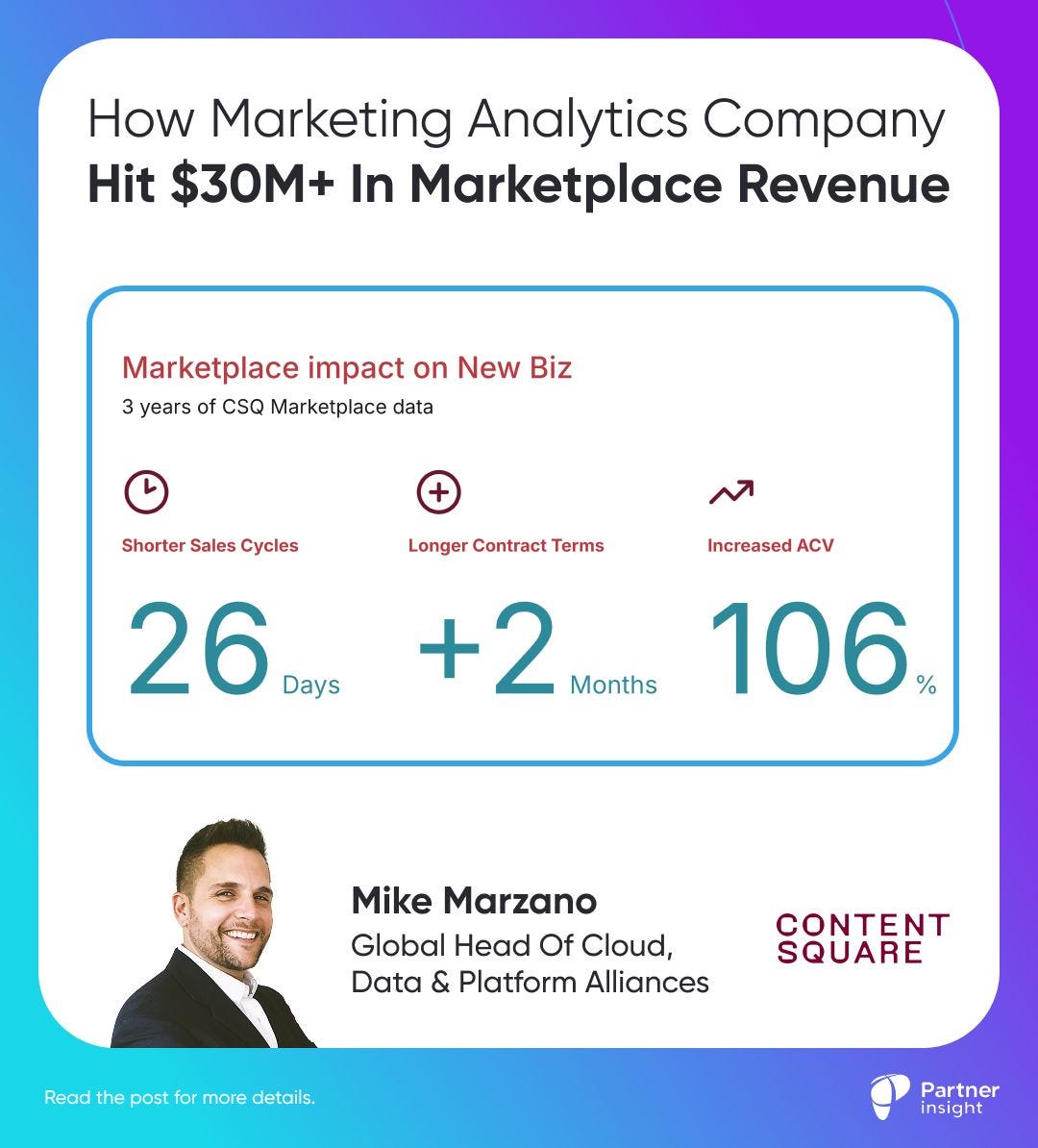

This week, we're spotlighting how Contentsquare—a marketing analytics SaaS —shattered the myth that only core IT products win big on marketplaces. They scaled from $0 to $30M+ in marketplace revenue in just 30 months, achieving 81% larger deals and 26-day shorter sales cycles while selling to CMOs, not CIOs.

Plus, Oracle's explosive cloud growth reveals a powerful 5X cloud consumption multiplier strategy that every alliance leader should understand.

Before we dive in, if you haven't subscribed yet, hit the button below to join 3,500+ alliance leaders getting these exclusive Cloud GTM strategies weekly:

How Contentsquare Built a $30M+ Cloud Marketplace Business: Playbook

Many tech leaders still believe cloud marketplaces favor infrastructure and security vendors. Contentsquare just proved them wrong—scaling from $0 to $30M+ in marketplace revenue while selling to CMOs, not CIOs.

When Mike Marzano - Global Head of Cloud, Data & Platform Alliances, joined Contentsquare three years ago, the digital analytics company had zero presence on cloud marketplaces. Today, they're closing deals 81% larger through co-sell, shortening new deal sales cycles by 26 days, and sitting on both Microsoft and AWS Partner Advisory Councils.

The kicker? They did it selling marketing analytics—not databases, not security tools, not infrastructure.

Here's the tactical playbook they used, broken down into four strategic pillars that your company can replicate.

1. The Pipeline Leverage Strategy

Contentsquare couldn't compete on typical marketplace drivers, like dragging major cloud consumption or technical integration depth.

But they had one strategic asset clouds really care about: massive pipeline volume.

"I knew we could kick ass with the pipeline," Marzano explained during our Cloud GTM Leader course session. "We had tons of opportunities, and we could create more. If we hit this hard enough with really positive numbers, we'd get attention."

Key insight: When you lack technical differentiation, lead with commercial opportunity. Clouds will help you close the gap if the numbers are compelling.

The tactical approach:

Started with Microsoft

Focused on a few large enterprise deals via private offers and consistently shared them via Partner Center

Closed first deals, created momentum with Microsoft

Used success to unlock internal executive buy-in

Built pipeline visibility showing $XXM in Microsoft-eligible deals, with only $XM trending toward marketplace

Used this gap as leverage: "Microsoft, help us get this through the marketplace. You want it, we want it."

2. Operations Before Everything

While most companies think about marketplace ops last, Contentsquare invested in marketplace operations from early on in the journey. Their operations lead, Dico Angelo, transformed processes that took days into minutes.

The operational foundation they built:

Automated pipeline syncing between Salesforce and Partner Center/ACE

Created a partner attachment scoring matrix (not just sourced vs influenced)- more on this here

Tracked marketplace eligibility on every opportunity

Built multi-year contract visibility for program tier advancement

"Good operations are worth their weight in gold," Marzano emphasized. "You need this data to prove ROI, qualify for programs, and scale without adding headcount."

Critical metric: Contentsquare tracks deals across a spectrum—from "partner answered an email" (low impact) to "partner sourced the deal" (high impact). This granular tracking revealed that cloud co-sell attachment correlates to:

81% ACV increase for new business

44% ACV increase for upsells

3. Turning Sellers Into Marketplace Champions

The most innovative part of Contentsquare's playbook? Their seller enablement strategy feels more like a TikTok influencer playbook than traditional enterprise sales. It’s also tied to the comp model.

Unique compensation formula:

Maintained compensation neutrality (no commission reduction for marketplace deals)

Sizable SPIFFs for sellers who record 2-3 minute video–how they won marketplace deal (+ benefits of GTM) and share with others

Extra SPIFFs for sharing compelling marketplace use cases in global sales Slack channels

Used cloud incentive funds to finance these programs

"Sellers don't want to hear from me about marketplace benefits," Marzano noted. "They want to hear from other sellers who've made money doing it."

Results: These peer testimonials created viral adoption internally. Sellers started seeking out marketplace-eligible deals, knowing their benefits and that they could earn extra cash just by sharing their success.

4. The Inflection Points That Matter

Contentsquare's journey reveals three critical inflection points every alliance leader should plan for:

Year 1: Prove the Model

Started with Microsoft

Focused on a few large enterprise deals via private offers

Used success to unlock executive buy-in

Year 2: Add the Second Cloud

Expanded to AWS, immediately capturing share (AWS wrote a case study on their impressive 14X YoY growth)

Leveraged their learnings from Microsoft for faster ramp

Key message to clouds: "Our customers want marketplace—help us close the gap and convert them"

Year 3: Operationalize for Scale

Moved from spiky quarterly performance to consistent growth

Planning increase self-serve (in addition to public offers) for the next phase

Winner of Microsoft Commercial Marketplace Partner of the Year 2024 (Regional)

Nominated to FY 25 Microsoft Retail Partner Advisory Council

Nominated to FY 25 AWS Marketplace Partner Advisory Council

Mike Marzano’s Playbook for Non-Infrastructure Companies

1. Start with where your strengths are and pick your cloud starting point strategically

Contentsquare started with Microsoft because of stronger existing relationships, then used that success to accelerate AWS adoption.

2. Measure everything, but focus on attachment

Forget the sourced vs. influenced debate. Track partner impact across a spectrum and tie it to business outcomes (ACV, velocity, retention).

3. Make the marketplace the default, not the exception

"We want to show this is business as usual, not a new activity," Marzano explained. This mindset shift is crucial for scaling beyond early marketplace adoption.

4. Invest in operations before scaling sellers

With only 3 people on the cloud team supporting 400 sellers, automation and process excellence became non-negotiable.

What's Next?

Contentsquare's 2025 priorities reveal where marketplace leaders are heading:

Self-serve and freemium offerings to capture SMB/mid-market

Co-build initiatives after mastering co-sell

Expanding to include Snowflake, Databricks, and platform partnerships

The message is clear: if a marketing analytics company can build a $30M+ marketplace business selling to CMOs, what's your excuse?

The clouds have 35,000+ sellers (Microsoft) and massive field teams (AWS) ready to help. The budgets exist—customers have already committed them. The only question is whether you'll learn how to capture your share.

Big thank you to Mike Marzano - Global Head of Cloud, Data & Platform Alliances at Contentsquare for sharing his incredible data-driven insights and helping us train the next generation of Cloud GTM leaders in our course across 10+ cohorts.

Industry Monitor

Oracle Cloud Boom & Multi-Cloud Strategy Fuel Industry’s Fastest-Growing Commits Backlog

Oracle's impressive earnings should make every cloud alliance leader pause and study its multi-cloud playbook.

Its customer cloud commits (RPO) hit $105B+, putting them ahead of Google Cloud's backlog. But the real story isn't the size—it's the velocity.

Oracle Cloud Infrastructure (OCI) consumption revenue grew 62% in Q4, with Oracle projecting cloud infrastructure revenue will grow over 70% in FY26.

What we can learn from their strategy:

The 5X Cloud Consumption Multiplier

Larry Ellison highlighted that cloud migration is still early and stressed how moving database to the cloud drags additional consumption:

"Let's say 10% — or $10 billion of our database support revenue, moves to the cloud. So that becomes at least $50 billion because it includes all the computers and all the networking... you move $10 billion of our database to the cloud, it becomes at least $50 billion in cloud revenue."

This cloud consumption multiplier isn't unique to Oracle. Many cloud migrations create similar expansion opportunities — compute, storage, networking, analytics layers all compound the original workload value.

This is the number you should track closely for your product - it’s your superpower in cloud co-sell conversations.

Multi-Cloud at Scale

Oracle's multi-cloud database revenue from AWS, Azure, and Google grew 115% quarter-over-quarter.

Ellison explained the strategy: "If you're dedicated to using Microsoft Azure, you can get the Oracle database in Microsoft Azure... You can get it at Google, you can get it in Amazon, you can get it at the Oracle Cloud. It's all the same in every place."

Oracle now operates 23 multi cloud regions with database services, with 47 to be built in the next year.

Supply Constraints Persist Due to AI-Driven Demand

Despite Oracle planning to invest over $25B in CapEx next year, Ellison admitted the capacity crunch, because “the demand is astronomical”:

"We recently got an order that said we'll take all the capacity you have wherever it is... I mean we never got an order like that before."

Oracle is literally scheduling customers into the future.

Oracle's playbook shows that being everywhere beats being exclusive

Their RPO grew 56% YoY, and with cloud accounting for 80% of $132B commits total, they already exceeds GCP's.

If it doubles as guided in FY26, they'll be knocking on AWS' and Microsoft doors.

The lesson?

In cloud partnerships, interoperability could be a new competitive moat. Oracle figured out that the path to $50B+ in cloud revenue isn't competing with hyperscalers—it's making their platforms incomplete without you.

CEO message is clear, as they expect "dramatically higher" growth rates in FY26:

“Oracle is well on its way to being not only the world’s largest cloud application company—but also one of the world’s largest cloud infrastructure companies.”

P.S. If you find these insights valuable, please share this newsletter with your network - it’s free.

And if there are topics you'd like us to explore in future editions, please reply to this email with your thoughts.