62% via Cloud GTM: The C3 AI Playbook & How to Turn Cloud Co-Sell from Good to Great

Hi, it's Roman from Partner Insight—welcome to my weekly newsletter on winning Cloud GTM strategies, and trends in tech partnerships.

The impact of marketplaces speaks for itself: 62% of C3 AI’s deals now close with 3 hyperscalers, and Dynatrace has doubled deal sizes when they sell on marketplaces. But what makes some cloud alliances and co-sell opportunities truly great?

Today, we'll dissect C3 AI's alliance playbook and Microsoft's insider checklist for turning good co-sell leads into great ones.

With McKinsey projecting cloud services to grow 11X+ to up to $3.4T by 2040 and AI to accelerate 35X+, the stakes couldn’t be higher.

💡 Tomorrow, January 14th we kick off Cohort 9 of our Cloud GTM Leader course —your last chance to join 200+ alliance leaders who are closing millions in marketplace deals. Many scaled to significant marketplace revenue within months of completing the program.

Now, let’s decode the strategies driving marketplace success in 2025.

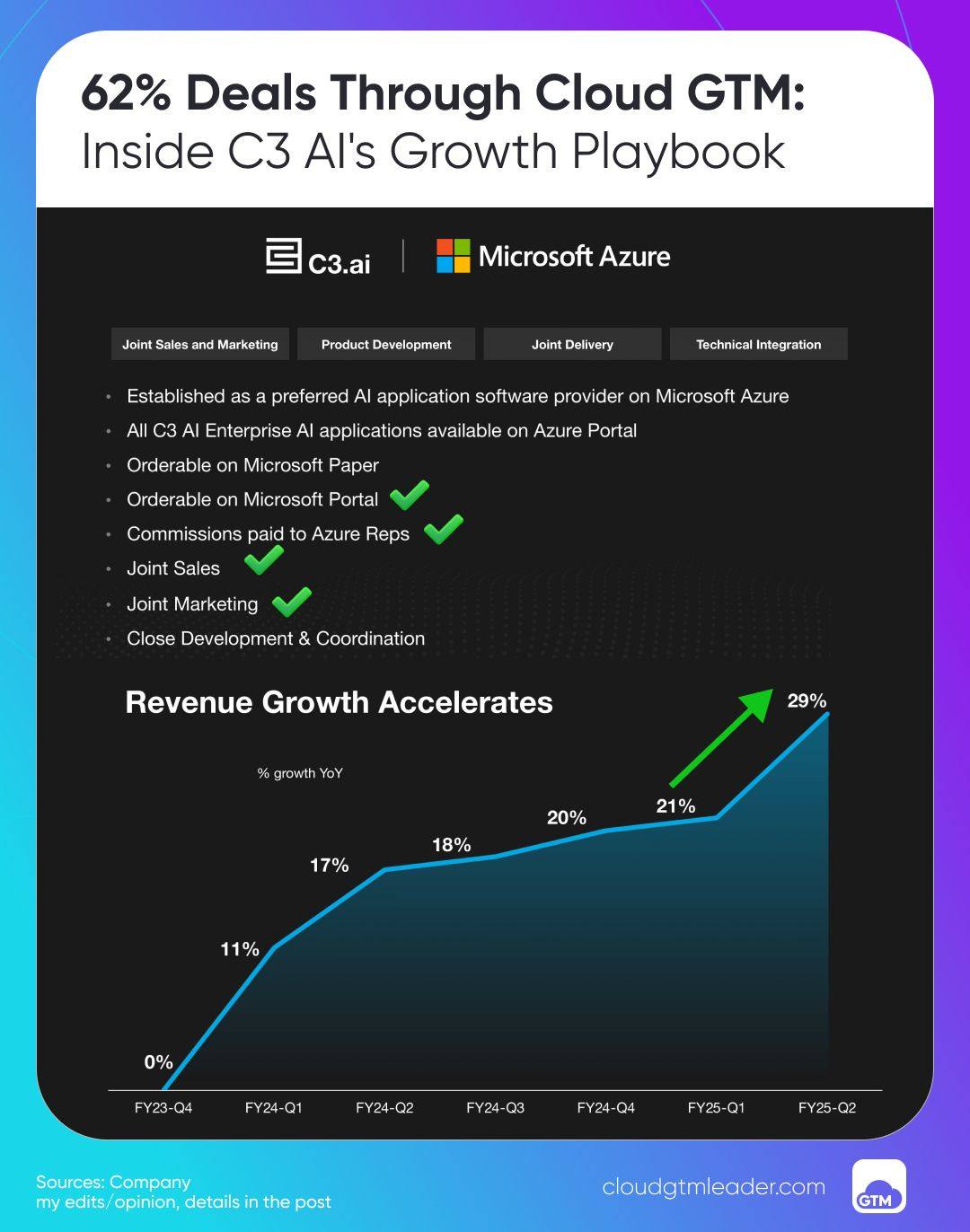

62% Deals Through Cloud GTM: Inside C3 AI's Growth Playbook

62% of C3 AI agreements last quarter were "closed with or through Google Cloud, AWS, and Azure," stressed Tom Siebel, as C3 AI also won 20 deals with GCP (+180% YoY) and signed a major alliance with Microsoft Azure.

Here's a page from their Cloud GTM playbook:

The context is compelling:

95% of C3 AI's customer base runs on public clouds:

51% on Google Cloud

24% on AWS

21% on Azure

This shows how deeply B2B AI revenue is now integrated with cloud consumption.

But the recent C3+Microsoft alliance stands out as "the most significant event in company's history" for these strategic reasons, explains CEO:

1️⃣ Sales Compensation Alignment

"Azure salespeople will receive design win credits for each Azure C3 AI sale" - a crucial move that aligns field incentives (notably, he mentioned this first).

2️⃣ Enterprise Access Leverage

All C3 AI solutions are now orderable on the Azure Marketplace.

"All C3 AI products are now orderable on Microsoft paper, incorporating Microsoft's enterprise licensing agreement with over 95% of Fortune 500."

As Siebel emphasizes, "This will dramatically shorten C3 AI sales cycles."

3️⃣ Pilot Funding Support

"Microsoft will subsidize C3 AI pilots and C3 AI production deployments on Azure over the term of this agreement" - reducing adoption friction.

The reach scale-up is massive:

As a result of Microsoft's reach, "the effective number of C3 AI sellers will grow from...order of 100 sales professionals at C3 AI as of October 1, 2024, to potentially order of 10,000 sales professionals operating in every geography, in every vertical market."

But wait, isn't C3 AI competitive with Azure/OpenAI?

Tom Siebel stressed that they're not competing with Azure's AI services - they're building on top of them:

"We use all Azure AI services, but deliver them packaged in turnkey applications that offer economic benefit in a very short period of time."

He also highlighted that C3 AI sales count toward customers' Microsoft commitments - a crucial detail when enterprises have "hundreds of millions and in some cases billions of dollars commitments" to Microsoft.

Going All-In on Cloud Alliances

Microsoft is "an order of a $250 billion business. And so this by far overshadows anything that we've done...

Given the magnitude and great potential of the new Microsoft alliance, we are going to invest in the partnership in a big way. To not do so would be nonrational" - emphasized CEO.

C3 is scaling sales teams, customer support, and marketing to support the alliance.

So here's the question to you:

In an era where every company aims to be an AI company, is deeply integrating with cloud giants' sales motions and marketplaces becoming the new imperative for enterprise scale?

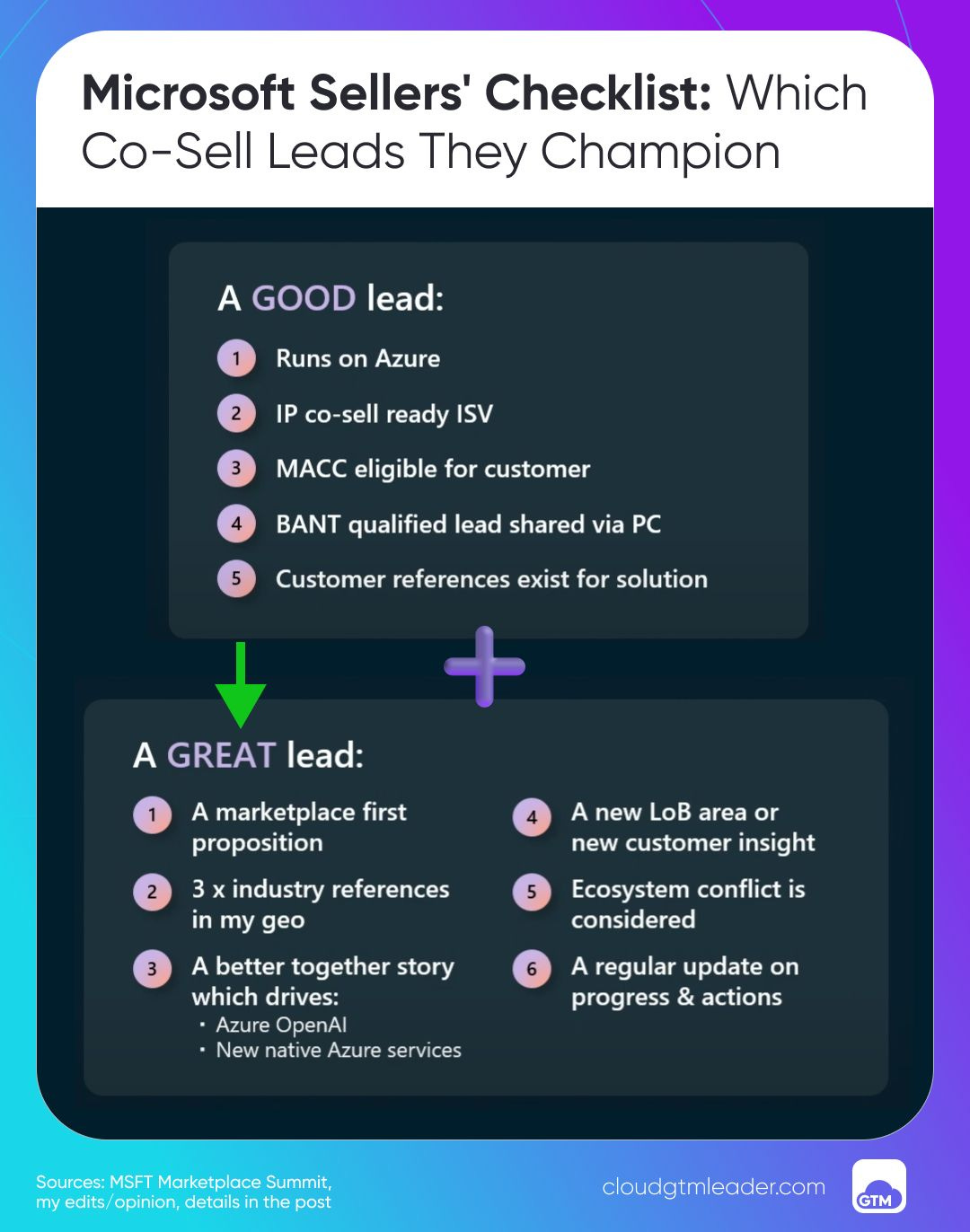

Microsoft Sellers' Checklist: Which Co-Sell Leads They Actually Champion

Want to know what really makes Microsoft sellers 🙌 champion your solution? They can 2X your deal size through co-sell and marketplace, but most ISVs miss critical nuances in execution.

Here is what I learned from Lee Corbett, Microsoft UK's ISV & SaaS Recruit Lead on how to turn good opportunities into great ones that cloud sellers help to win.

Context first:

With MSFT marketplace growing 100% YoY and 35,000 Microsoft sellers globally, the stakes to co-sell for software companies are huge.

What’s more: 80% of customers with Microsoft Azure Consumption Commitments (MACCs) now buy via marketplace, creating a unique budget opportunity smart ISVs are leveraging.

Now you can join them too.

From Good to Great in Co-sell in 2 steps:

Good opportunities nail the foundations:

Your solution must be Azure-native and IP co-sell ready (includes revenue threshold). This isn't just technical validation, it unlocks seller compensation. Add MACC eligibility and solid customer references, and you've got sellers' attention.

Be thorough - no fishing expeditions! You need a real qualified opportunity with clear info in the Partner Center.

🏆 But here's how great opportunities (and sellers) separate themselves:

Lead with marketplace-first deals

Optimize your solution for marketplace and leverage its benefits. Help customers maximize commits, use private offers strategically. Show cloud sellers you understand their world.

Prove local relevance

Have several industry references in the seller's territory and regional compliance awareness to give sellers confidence to champion you.

Drive growth of native Microsoft Azure services

Best deals help to accelerate Azure consumption and/or AI adoption. Think Azure OpenAI integration and clear technical dependencies that expand the platform footprint.

Open new doors

Help sellers open doors to a new line of business for Microsoft, expand reach or provide unique insights within existing customers. This transforms you from vendor to strategic ally.

Navigate the ecosystem

Map relationships to ensure there are no conflicts with other partners already working with the customer or within the Microsoft ecosystem.

When you nail these elements, Microsoft's teams become your force multipliers, unlocking:

Deep customer intelligence on modernization initiatives

Executive stakeholder mapping and access

MACC budget cycle insights

Partner landscape navigation to accelerate deals

The results?

Dynatrace sees marketplace deals 2X larger than direct sales. Profisee achieved 800% YoY marketplace growth. Wiz drives 70% of revenue through marketplaces.

Here's the real question:

With billions in cloud commits that customers use via cloud marketplace, are you giving cloud sellers all they need to help you drive growth of your products?

Join 200+ alliance leaders who’ve mastered cloud marketplaces with our course. Our alumni are closing $MMs in marketplace deals and scaling fast.

Last chance to join Cohort 9 starting on January 14th!

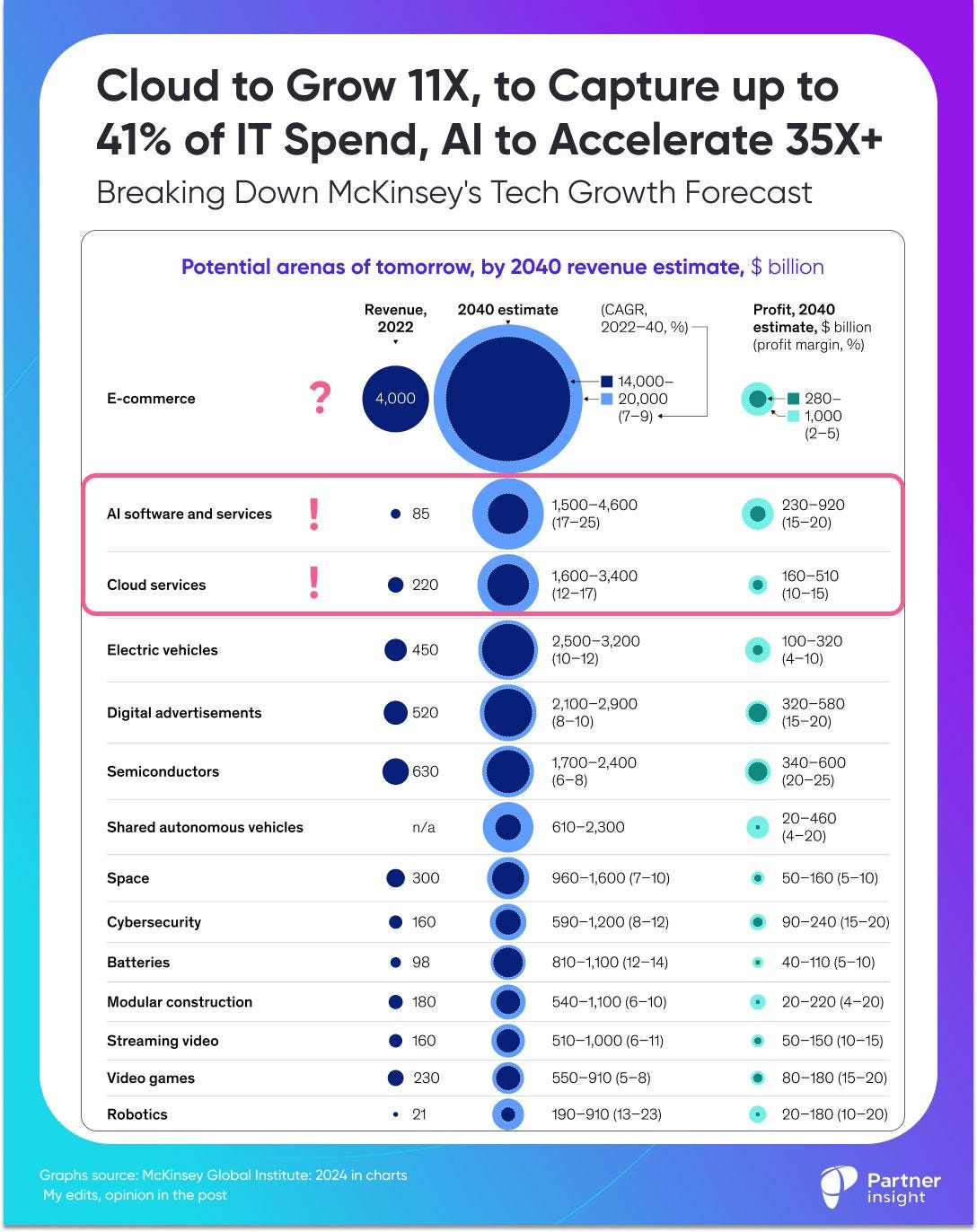

Cloud to Grow 11X, to Capture up to 41% of IT Spend, AI to Accelerate 35X+

McKinsey's research on future growth predicts a transformation of tech markets. While AI will grow the fastest, Cloud (currently “just” 8% of global IT spend) could capture up to 41% by 2040. Is it even possible?

Let’s start 2025 with a big picture breakdown:

In recent research, McKinsey & Company, identified key sectors (arenas) expected to grow the fastest in the next 15 years.

Three Fastest Growing Tech Arenas of all?

AI Software/Services: $85B → $1.5-4.6T (17-25% CAGR) in 2040

Cloud Services: $220B → $1.6- 3.4T (12-17% CAGR)

Robotics: $21B → $910B (13-23% CAGR)

Projections on Cloud and AI seem overly ambitious - until we examine the underlying transformation/

Today 94% of enterprises use the cloud, but only 20% of workloads are currently in the cloud (McK). The survey of $1B+ revenue companies showed that most plan to 2X+ (double) their cloud usage by 2026.

Why? By 2030, cloud could generate $3T of EBITDA uplift for Forbes 2000 by helping them digitize operations, accelerate product development, etc.

Turns out, we're still in the early innings of the migration journey.

☑️ Growth Numbers Reality Check:

McKinsey pegs global external IT spending at ~$3T (2022) and expects it to grow to $8T in 2040, at 6.5% CAGR.

Cloud, which was 8% of global IT spending in 2022 will take 19-41% of its share by 2040.

So IT spend is expected to 2X+, while cloud to grow 7-10X and AI will 18- 50X. This is the power of compounding growth at 2-4X multiple of the market rate.

2024 acceleration showed us that cloud hyperscalers can indeed grow at 20%-30% range rates. Many experts predict cloud growth to somewhat moderate from 2026.

✳️ AI as Cloud Growth Multiplier

McKinsey highlights that “all cloud providers are likely to see themselves as AI providers, and cloud is necessary for the computation-at-scale requirements of AI, these two arenas are inextricably linked”.

AI is set to re-shape and accelerate the IT spend, growing itself from $85B to $1.5-4.6T.

Speaking of Gen AI - McKinsey predicted that 3/4 of its value would be in 4 areas:

Customer operations

Marketing and sales

Software engineering

R&D

But here's the elephant in the room:

The largest McK tech “arena” by 2040 isn't even cloud or AI - it's e-commerce at $14-20T!

Similar to cloud adoption, the retail e-commerce segment is currently “just” 20% of global retail revenues, and is expected to reach 27-38% by 2040.

♾️ Connect the dots:

These are B2C e-commerce numbers, but if B2B follows B2C's digital transformation path (as it historically has), B2B e-commerce (including cloud marketplaces) is similarly positioned to become a dominant B2B distribution channel.

Cloud providers therefore aren't just laying and selling cloud/AI infrastructure - they're building the whole ecosystems where software is built, bought and sold. The implications for the IT industry and its GTM is profound.

How are you changing your strategy in 2025?

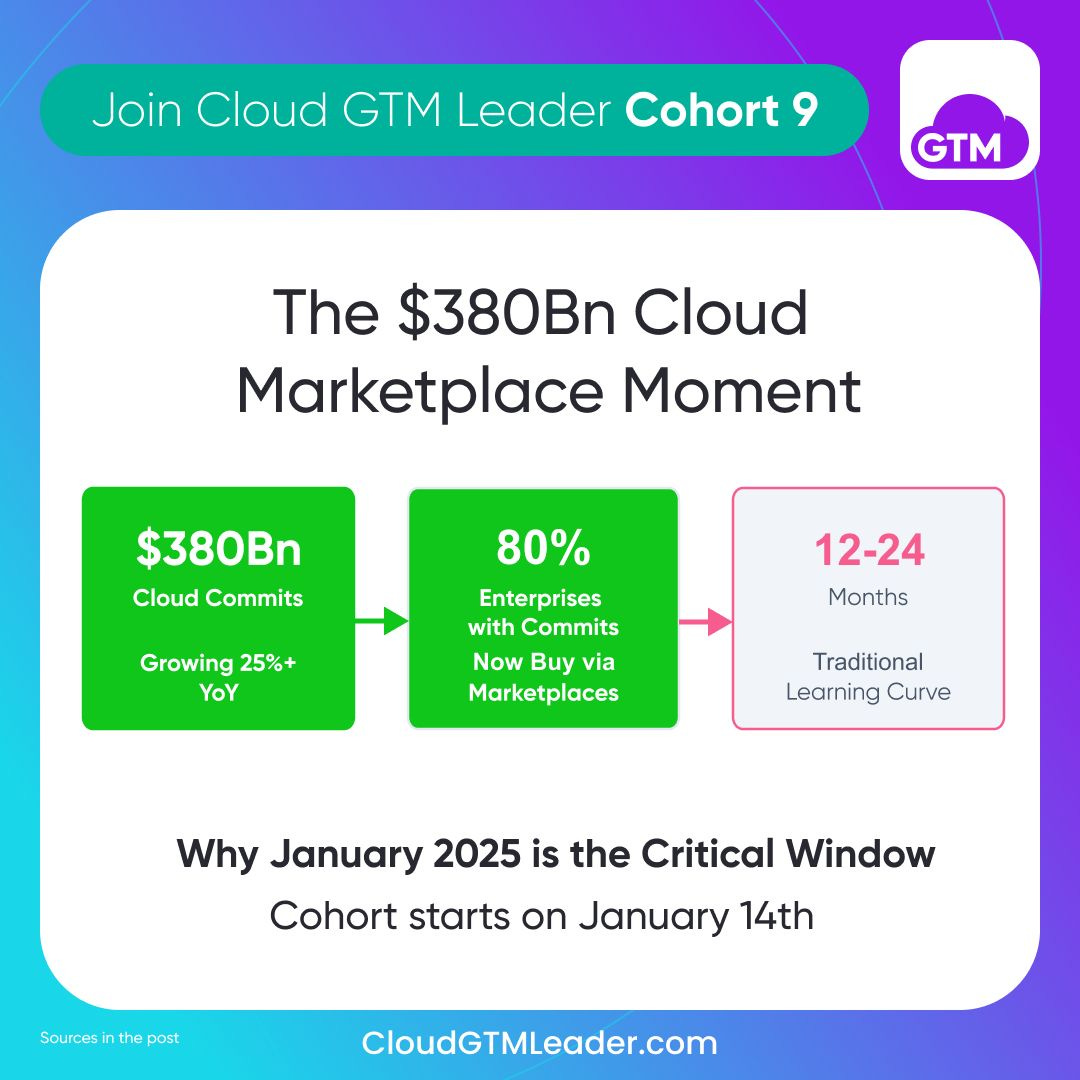

Last chance to Enroll in Cloud GTM Leader Cohort 9: Capture $380Bn Marketplace Moment

The $380Bn Cloud Marketplace opportunity is accelerating faster than anticipated — but so is the cost of not executing well in 2025. Let’s break them down.

Cloud GTM opportunity:

$380Bn in enterprise cloud commits that are growing 25%+ YoY

80% of enterprises with Microsoft commits now buying via its marketplace

99% of AWS's top customers buying via its marketplace

50%+ of large B2B purchases in 2025 will be processed through Digital Self-Serve Channels (Forrester)

📈 Market leaders demonstrated breakthrough success in 2024:

Salesforce: 3 of their top 10 deals in Q2 closed through AWS marketplace

Dynatrace: 2X larger deals via marketplace; 15 of 18 seven-figure deals in Q2 closed through hyperscalers and GSIs

Wiz: 70% of revenue through marketplace

Yet most companies spend 12-24 months "figuring out" marketplace strategy through trial and error.

🚧 They face two distinct challenges:

For Teams Starting Their Journey:

12-24 months lost to "figuring out" marketplace strategy

Missing early 2025 budget cycles pushes major deals to 2026

Competitors capturing key enterprise cloud commits

For Teams Already Listed:

Breaking through noise - marketplace listings grew 160%+ in 2024 (MSFT)

Scaling co-sell when cloud sellers are overwhelmed with hundreds of partner products

Converting cloud commits and marketplace potential into actual revenue

Here's the real cost of sub-par execution in 2025:

💲💲 Direct Revenue Impact

While 58% report longer sales cycles (SaaStr), marketplace can accelerate deals by 42% and increase win rates by 35% (Google Cloud)

Starting in January captures 2025 budget cycles, while missing may push major deals to 2026

First-mover advantage in categories vanishing rapidly

Cloud commits, once allocated to competitors, become unavailable

💲 Hidden Organizational Costs

12+ months of scattered team efforts

Missed co-sell opportunities with cloud sellers

Strained cloud provider relationships when deals underperform

Lost momentum with enterprise customers moving to cloud procurement

📊 In 2025 leading companies aren't just "on marketplaces." They're honing strategies to:

Capture enterprise cloud commits before competitors

Turn cloud sellers into revenue multipliers with smart co-sell strategies

Make their products essential to cloud-customer conversations

💡 This is why 200+ alliance leaders have joined our Cloud GTM Leader course.

Instead of 12-24 months of costly trial and error, they get proven frameworks and insider strategies in 5 weeks, plus ongoing value through our community.

Cohort 9 starts Tuesday, January 14th. Very last chance to join us.

The math is simple:

Course investment is negligible compared to the cost of a 12-month delay (often 100x more in missed opportunities)

Don't let another year of marketplace opportunity slip by.

P.S. If you find these insights valuable, please share this newsletter with your network - it’s free.