AWS re:Invent Breakdown: Key Marketplace Strategy Shifts

Hi, it's Roman - welcome back to the Partner Insight newsletter.

Before we dive into this week's insights, a quick reminder: Our special Cloud GTM Leader gathering in San Francisco is tonight at 6:30 PM PT.

It's your last chance to join fellow marketplace leaders as we unpack key insights from AWS re:Invent (and Ignite), focusing on what will drive marketplace growth strategies in 2025.

Now, let's explore the latest insights reshaping cloud marketplace strategies.

Inside AWS's Marketplace Strategy: re:Invent Highlights Partners Need to Know

Ruba Borno's keynote at AWS re:Invent last week revealed a watershed moment in software distribution. Not only are 99% of AWS's top customers now buying via Marketplace, but the new 🛒“Buy with AWS” for partners is set to accelerate this shift dramatically.

📈 Compelling Growth Numbers

Ruba Borno, VP, Global Specialists and Partners at AWS highlighted that the public sector alone transacted $1Bn+ on Marketplace this year.

This shift is supported by the impressive economics of marketplace adoption by channel partners.

Partners building marketplace practices achieve "234% return on investment, 50% faster deal closures, and 4-5 times richer deal sizes." (Forrester research)

These are step-function changes in channel GTM efficiency enabled by marketplaces.

But the real story isn’t just in the numbers.

💳 "Buy with AWS": A Game-Changer

AWS just made "Buy with AWS" generally available, enabling partners to turn their websites into Marketplace storefronts.

“Customers can access AWS Marketplace from any partner's website. Partners can now provide customers with co-branded search, discovery, and procurement experiences directly from their websites.”

This is transformative. Alliance leaders can now embed Marketplace buying experiences anywhere, dramatically expanding distribution potential.

🎯 ISV Benefits Expansion

Amazon Web Services (AWS) continues to lower barriers for Marketplace adoption. Starting in January, SaaS co-sell benefits will be expanded:

“We want to encourage more and more partners to reach customers through AWS Marketplace.… Starting in January, SaaS co-sell benefits will be expanded to all ISV Accelerate partners, including eligible startups.”

💰 Uncapped Modernization Incentives

Modernization is another major theme, with AWS committing to more funding for partners to help customers move faster.

“We restructured the incentives so that AWS can offer partners more funding support on larger modernization deals. This means there are no more caps on how much funding you can receive.”

Ruba Borno's call to action for partners:

“Think bigger with our customers because they want to modernize and need your help.”

AWS is also focusing on Greenfield Customers, emphasizing the importance of partner involvement:

“Last year, we implemented the Greenfield Customer Engagement Incentive, and since then, 80% of Greenfield customers have a partner involved in their migrations.”

📈 Strategic Growth Message from AWS CEO

Matt Garman left partners with a powerful message:

“There’s a lot of optimism that folks [customers] have for growth, and they’re really thinking about revenue. That is a great opportunity for you all to help them lean in, help people go faster, and help them understand your products and how they interact with AWS products.”

💡 If you’re in San Francisco this evening, Tuesday, Dec 10th at 6:30pm, join our event for Cloud GTM leaders, where we’ll debrief key re:Invent highlights.

SaaS sprawl hits breaking point: Cloud marketplaces are emerging as the unlikely hero

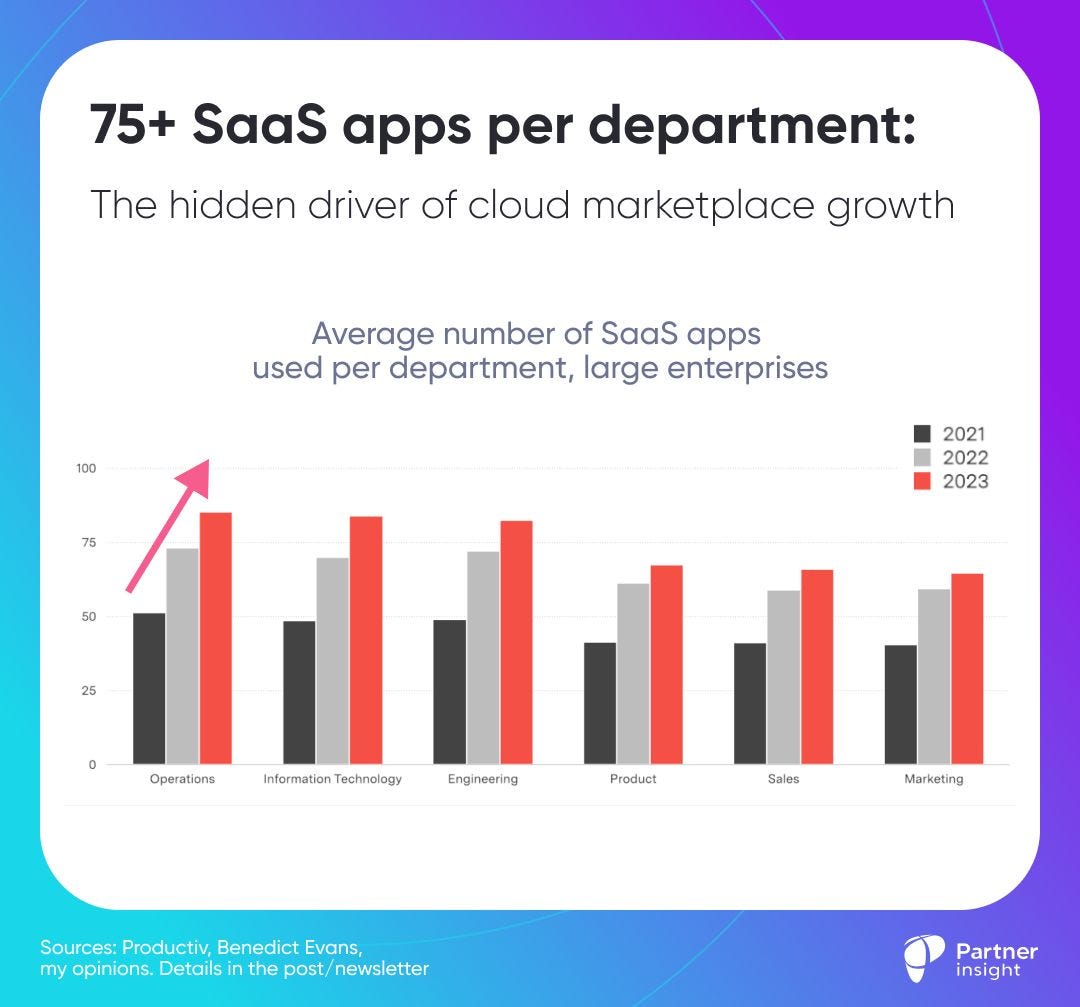

75+ SaaS apps per key enterprise department - up from 50 in 2021! Imagine selling another tool to a department already juggling all these apps

📊 Let's break down what the data reveals

Operations, IT, and Engineering departments lead the pack, each managing 80-85 different SaaS applications - a staggering 70% increase from 2021.

Even traditionally lighter tech users like Marketing now juggle 60+ apps, up from 40 in 2021.

💎 This proliferation creates three critical challenges for enterprises and software vendors:

Procurement Complexity:

Enterprise sales cycles become increasingly burdensome as companies manage more vendors, contracts, and renewal dates.

Budget Fragmentation:

With departments running dozens of subscriptions, software budgets are scattered across multiple cost centers and purchasing channels.

Integration Overhead:

IT teams struggle to secure, manage, and integrate an ever-expanding portfolio of applications.

🛒 Here's the reality check:

Imagine selling another tool to a department already managing 80+ apps. Not only do they barely track what they have, but their management now scrutinizes every new line item.

🎯 This explains the unprecedented growth of cloud marketplaces.

Their advantages for procurement and security teams are compelling:

Consolidated procurement and billing

Simplified vendor management

Leverage of existing cloud commits

Native integration with cloud infrastructure

Enhanced security and compliance

Recent Boston Consulting Group (BCG) data confirms this shift: 55% of enterprise buyers now spend over 10% of their IT budgets through marketplaces, with two-thirds planning to increase this channel.

⚡ For software vendors who sell to enterprises, the winners in 2025 won't just be those who list on marketplaces - they'll be the ones who transform their entire GTM strategy around this new purchasing reality.

What's your approach to navigating this fundamental shift in enterprise software consumption?

Reflections: Cloud GTM Gathering at re:Invent24

What a fantastic breakfast we had with our Cloud GTM Leader alumni at AWS re:Invent! The energy in the room was incredible as we discussed AWS Marketplace's undeniable momentum and rapidly expanding influence on how customers buy software.

Lewis Howarth, WW Leader AWS Marketplace Scale Adoption, shared in-depth insights on what's working for ISVs successfully scaling on Amazon Web Services (AWS) Marketplace with our alumni.

💡 A few takeaways from our discussion:

Next-gen buyers are choosing marketplace for its simplified purchasing experience

Successful ISVs are strategically leveraging the characteristics of successful sellers (COSS) framework to evaluate their alignment and build a successful marketplace sales strategy

Marketplace transactions are gradually becoming as natural as traditional procurement

Channel partner influence on cloud GTM is strategic and rapidly growing

AWS Marketplace is quickly evolving and emerging as the center of enterprise software buying

💜 Special thanks to incredible leaders at HashiCorp:

Michael Meijers, Cloud Engagement Lead EMEA (& our alum)

Tricia Apperson, Global Cloud GTM Leader

for not only sharing their marketplace insights but also hosting us at their stunning restaurant.

The strength of our Cloud GTM Leader alumni community was on full display.

The level of conversation, insight sharing, and peer learning was exceptional. Thank you to everyone who joined us.

💡 If you’re happen to be in San Francisco this evening, Tuesday, Dec 10th at 6:30pm, join our event for Cloud GTM leaders.

re:Invent Strategic Debrief: Special Cloud GTM Leaders Gathering in San Francisco

I'm excited about our 🤝 exclusive gathering in San Francisco today, on December 10th. We will unpack key insights from re:Invent (and Ignite) for cloud alliance leaders and what actually matters for your marketplace growth strategies in 2025.

🎯 Why this gathering is unique:

Curated evening focused on actionable cloud marketplace strategies

Intimate group of decision-makers driving cloud GTM in leading ISVs

Interactive format optimized for peer learning & networking

Agenda designed for maximum value:

⚡ Five exceptional speakers:

Vineet Anshuman, who leads AWS Marketplace - Technology Business Development & Partnerships in Security & AI

Roman Kirsanov - CEO of Partner Insight

Neeti Gupta - Founder & CEO of AI Partnerships Consultancy; frm Head of Hyperscaler Business Development at VMware, x-Microsoft, Amazon, Meta

Rolf Heimes - IBM Ecosystem Leader, Public Sector; frm VP Global Channel and Alliances in Talend, CA Technologies

Trunal Bhanse - CEO of Clazar

✔️ Lightning Talks

Beyond the headlines: Key marketplace shifts from re:Invent & Ignite

Data from the field: Which marketplace trends are actually gaining traction (based on training 150+ alliance leaders in Cloud GTM Leader course)

What's working now for fastest-growing ISVs in cloud marketplaces

✔️ Peer Discussions

Common challenges, solutions and implementation strategies that work

Questions we should all be asking to accelerate Cloud GTM in 2025

Practical applications for different partnership models

✔️ Curated Networking

Continued discussions with over drinks

Kindly provided by our partner Clazar

🎯 This is For: Senior cloud alliance & GTM leaders who want to:

Cut through the avalanche of information from re:Invent & Ignite

Connect with peers driving marketplace growth in prominent companies

Get actionable insights for your Cloud GTM strategy in 2025

✔️ Our confirmed participants: Cloud GTM leaders from leading companies and alumni from our 150+ strong Cloud GTM Leader course community.

📅 Tuesday, Dec 10th, 6:30-8:30 PM PST

Central San Francisco location (near the Ferry Building)

Join me and senior cloud GTM leaders for an evening of strategic insights and connections!

To bring this free event to you we partnered with

Clazar is the leading Cloud Sales Acceleration Platform for GTM teams to scale revenue on AWS, Azure, and Google cloud marketplaces. From listing to co-selling to revenue reconciliation and recognition, our platform helps companies streamline and automate their entire cloud sales journey from a single, unified platform—with zero operational overhead.