Breaking Through 20K+ Listings: PLG & Marketplace Discovery Strategies of Top ISVs

Hi, it's Roman from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week, we’ll focus on marketplace PLG strategies: discover Michael Musselman's PLG tactics for scaling marketplace revenue, learn how to boost discovery among 20,000+ listings, and understand the interconnected flywheels driving Cloud GTM success for leading ISVs.

Before we dive in:

Cloud GTM Leader Course Cohort 11 kicks off June 3rd with 10+ top alliance leaders sharing their battle-tested strategies and tactics. Early bird pricing ends this week – secure your spot to join 200+ alumni who've transformed their marketplace growth.

The Marketplace PLG Opportunities: 5 Key Insights from Michael Musselman

We recently had an insightful conversation with Michael Musselman, one of the most experienced cloud alliances leaders. We covered AWS's "everything store" strategy and marketplace evolution – but his insights on Product-Led Growth (PLG) strategies for cloud marketplaces were particularly eye-opening.

Michael Musselman is co-founder of PCAN and former VP of Partnerships at Astronomer. Previously he led Lacework's Cloud GTM, scaling its marketplace revenue from $0 to $50M+ with 300-700% YoY growth.

Here are 5 key Insights on PLG from our conversation (check the full episode below):

1️⃣ PLG doesn't mean all-or-nothing for enterprise products

Even with complex enterprise products you can create simplified PLG entry points without a full product overhaul.

"At Lacework, we slowly added something... We didn't really do it like a full 'here's all of Lacework'... We actually just took what we could and built a really simple assessment… It was a very guided experience to connect it to your test environment and maybe your production environment. Couple of clicks. Couple of minutes. Boom! You get an answer that says, 'Hey, on a score of one to a hundred, here's kind of how risky you are.'"

2️⃣ AWS Seller Prime is a game-changer for PLG

This often-overlooked AWS program (now available for partners) provides critical marketplace analytics while helping you fund your PLG marketing efforts with cloud provider dollars. Michael leaned on this program at Astronomer.

"That program did two things... Number one, it came with a whole bunch of MDF, like tens of thousands of dollars... The second thing is it also unlocked open telemetry. You can't always see who's hitting your marketplace…that program also unlocks a bunch of analytics”"

3️⃣ Use marketplace tiers to create natural upgrade paths

The smartest companies build a seamless journey from self-service discovery to enterprise contracts – all within the marketplace ecosystem.

At Astronomer, Michael strategically used different product tiers to allow customers to start on a marketplace with free and lower-tier offerings and naturally progress to more comprehensive solutions.

"We also had 3 tiers of product, and our marketplace listing only had the developer tier... we unlocked the free, the developer tier with the teams tier. So now you can go Pay-As-You-Go directly onto the marketplace... And then when we sold business or enterprise, obviously you were engaged with us."

4️⃣ Even largest enterprise customers sometimes prefer using PAYG on marketplace

Contrary to common belief, some large enterprises deliberately choose consumption-based PAYG purchasing to maintain flexibility.

"We had Fortune 500 companies that started that way and wanted to stay that way. They didn't want to commit. They just wanted to be able to unplug at any time, but you'd see them spending 10, 20, 30 grand a month on our pay-go."

5️⃣ Optimize your marketplace listing like you would your website

Most companies treat marketplace listings as static catalogs rather than discovery engines that respond to optimization.

"All of those little features or telemetries I mentioned - vendor insight, built on AWS - these are all tags... Amazon- they're not a search engine, but they run a marketplace. Clearly the more bells and whistles and buttons I push and filters that I have, it's probably in their algorithms that can help me.

Most people don't realize you can upload assets. You can upload videos. There's no different than SEO."

As cloud marketplace adoption accelerates, use these practical insights on PLG from someone who's lived the journey.

What's your biggest challenge with marketplace PLG strategies?

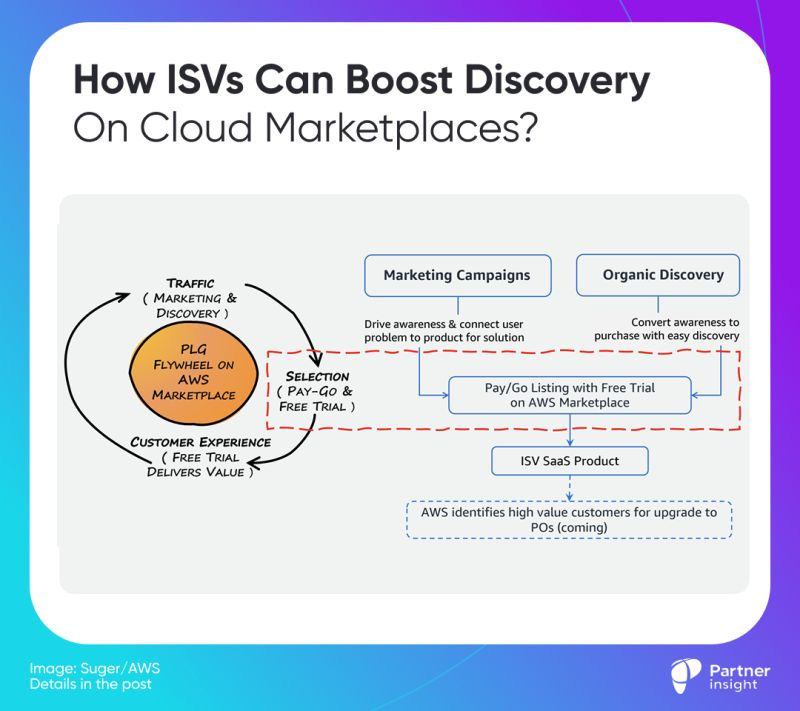

How ISVs Can Boost Discovery on Cloud Marketplaces?

With 20K+ listings on AWS Marketplace alone and hyperscalers doubling down on Product-Led Growth (PLG), the question every ISV alliance leader is asking: How do you get discovered on increasingly crowded marketplaces?

After analyzing buyer behavior and hyperscaler communication to procurement teams, here are strategies that ISVs can use to boost discovery:

Optimize for Console Search & Filtering

Buyers naturally get overwhelmed by 20K+ listings and will rely heavily on filtering to cut through the noise. Successful ISVs optimize for specific buyer preferences including:

Free trials (available on 2K+ AWS listings)

Usage-based pricing options (7K+)

Standardized contracts for faster procurement

ISVs should also optimize their listings to be categorized and tagged in these systems. Structured metadata (deployment models, compliance certifications, etc.) helps CSPs surface your solution in relevant filtered views.

Plus: Your product should include outcomes-focused descriptions.

If you’d like me to cover broader listing optimization for search in later posts - comment below.

Frictionless Free Trials + Conversion Paths

Free trials are now expected by most buyers, with 25% of AWS Marketplace customers refusing to even consider products without them (my previous post on this).

The highest-converting path: Free Trial → Pay-As-You-Go → Enterprise Contract.

Data from AWS shows conversion from Free Trial to PAYG is 3X higher than direct-to-contract conversions. Why? It aligns with how modern tech buyers actually want to purchase.

As self-service free trials are becoming the standard expectation, the key is making them truly frictionless.

Reviews & Social Proof

As the volume of marketplace transactions grows and more customers search marketplaces, reviews become increasingly important.

You can already find G2 reviews integrated on AWS marketplace, and this trend is accelerating. Top ISVs actively solicit reviews from successful implementations to create a virtuous discovery cycle.

While organic discovery will naturally improve as marketplaces mature and volume of customers grow, relying solely on it remains risky.

Successful marketplace strategies combine optimized listings, external demand generation (via marketing campaigns) that directs buyers to specific marketplace pages, and strategic co-sell with clouds.

The Future of Marketplace Discovery

Drawing parallels with B2C e-commerce evolution, we'll likely soon see:

Sponsored listings and promo placements

AI-powered recommendations based on usage patterns

Intent-based discovery tied to resource utilization and workloads

How do your buyers discover your marketplace listings today? Have you found effective solutions that others might learn from?

What % of your total revenue comes via marketplaces?

What differentiates companies generating 20%+ of revenue on cloud marketplaces from those barely scratching the surface? Here’s what you can learn from leaders, based on data:

Our new research of cloud GTM leaders with Clazar reveals a striking performance gap.

While 89% of companies are listed on marketplaces, only 22% generate more than 20% of their revenue there - a growth milestone that transforms marketplaces into a core revenue driver.

If 20% doesn’t sound too big, it's a meaningful threshold many struggle to reach.

For context, marketplace prime example CrowdStrike reported $1Bn+ in sales via AWS Marketplace last year, representing ~30% of their $3.4B revenue in 2024.

Meanwhile, 41% of companies in our research still see less than 5% of revenue from marketplaces.

What are top performers doing differently?

The data shows they outperform across every core sales KPI:

Higher win rates: 75% vs 47% (+28 pts)

Higher deal values: 75% vs 42% (+33 pts)

Faster customer acquisition: 63% vs 44% (+19 pts)

What drives these results isn't just executive alignment or formal programs. The difference lies in operational excellence and field engagement:

94% of top performers engage hyperscaler field teams consistently, building deeper relationships that deliver higher-quality pipeline

They treat co-sell as a systematic motion, not sporadic transactions

They've systematized partner collaboration - among companies with 20%+ partner-influenced deals, 64% saw higher win rates

Importantly, 62% of companies are generating truly net-new revenue through marketplaces, reaching customers they wouldn't otherwise - not just shifting existing pipeline.

A large majority of companies (81%) also claim some level of co-sell. However, less than a third (32%) have established structured, proactive cadences for this engagement, which I’d call “true co-sell”. This is a significant missed opportunity that you can optimize this year.

Other key operational blockers to learn from:

59% cite lack of internal training

51% struggle with complex co-sell requirements (co-sell isn't easy, but it's learnable)

37% report difficulty integrating marketplace data with existing workflows

Looking ahead, marketplace leaders are prioritizing:

Specialized training - going beyond basics to cover co-sell, marketing strategies, and field engagement best practices

New pricing models - implementing PLG motions, free trials, consumption-based options and self-service tiers that align with cloud spending patterns

Deeper channel partner relationships - leveraging mechanisms like CPPO/MPO to create a "multiplier effect" that accelerates marketplace scale

This signals a continuous shift toward marketplace selling, where this motion is deeply embedded in GTM and automated.

What's your strategy to make marketplaces a core revenue driver?

We've created a 52-page report to help you create and refine it:

Power of Cloud Marketplace Flywheels: What ISV Alliance Leaders Must Know

The hyperscaler cloud marketplace ecosystem has quietly become a juggernaut, with cloud commits growing by $91B in the last 12 months alone to reach $439B.

What differentiates leaders from laggards? Understanding that marketplace success hinges on activating and accelerating growth flywheels.

Cloud marketplaces transform GTM by creating three interconnected flywheels that build momentum over time. When synchronized, these flywheels drive up to 40% faster sales cycles and 80% larger deals.

The Customer Acquisition Flywheel: Co-Market

Co-Market starts with enhanced visibility to millions of embedded buyers (e.g., 6M on Azure). Streamlined marketplace procurement leads to initial customer wins, generating reviews and usage data, which further enhances visibility, attracting additional customers and cloud provider attention.

The Co-Sell Flywheel

Marketplace traction qualifies ISVs for co-sell programs, incentivizing cloud provider sales teams to help sell your solutions. Customers buying ISV solutions via Marketplace boost not only ISV revenue but also cloud consumption, creating a virtuous cycle. Providers increasingly promote successful ISVs through formal co-sell programs to drive further marketplace revenue.

The Product Innovation Flywheel: Co-Build

Marketplace customer interactions produce insights enabling rapid product improvements. Deep integration with advanced cloud services (AI/ML, analytics) creates differentiated offerings that drive higher customer satisfaction and more innovation data.

Leading ISVs use marketplace data to identify high-converting product features and valuable cloud integrations.

While "better together" and co-sell are critical, top-performing ISVs leverage additional accelerants:

Financial Alignment as Accelerant

Allowing customers to utilize pre-existing cloud commitments aligns three-way incentives, shifting conversations from new budgets to strategic use of existing funds—accelerating deals.

Product-Led Growth as the New Frontier

While private offers drove initial marketplace adoption, hyperscalers increasingly focus on product-led growth. ISVs must optimize self-service, free trials, and PAYG alongside traditional enterprise sales.

Channel Partners as Scaling Engines

Leveraging channel, SI, and distributors through programs like CPPO, MPO, and DSOR significantly boosts marketplace efficiency. Partners bridge sales, hyperscalers, and customers, eliminating friction that could slow momentum.

The Multi-Cloud Meta-Flywheel

Finally, advanced ISVs create a "meta-flywheel," where success in one marketplace boosts credibility and efficiency in others.

However, prematurely expanding multi-cloud strategies can dilute efforts. Master one flywheel before scaling further.

What's your strategy?

Unlock Your Growth on Cloud Marketplaces: Cohort 11 starts June 3

I'm thrilled to invite you to join Cohort 11 this June! We recently celebrated our milestone tenth cohort, but with so much momentum and innovation happening in cloud marketplaces, we're just getting started.

Our Cloud GTM Leader course has grown into the industry's leading program for mastering cloud marketplaces, with 200+ alumni accelerating their growth on AWS, Azure, and Google Cloud.

But here's what truly excites me - the wins our alumni are consistently achieving:

"We went from 0 to millions on Marketplaces. Definitely have more buy-in now across the org." - one of them shared.

This doesn't happen by accident. The playbook to unlock Cloud marketplaces isn't obvious. That's why we've worked with 50+ exceptional speakers and mentors who’re sharing their actual battle-tested strategies in our courses.

💡 Why join Cohort 11?

Learn directly from VPs of Partner of the Year winners and hyperscaler experts

Master co-sell tactics that drive real pipeline ($0 to $200K+ in 8 weeks for one alumni)

Get practical frameworks to align your org and accelerate cloud GTM

Join a growing community of 200+ cloud alliance leaders

But don't just take my word for it. We asked our recent alums, and here's what they highlighted:

“I came in knowing almost nothing and now I feel equipped to have in depth conversations with leadership and stakeholders“

“The highlight was learning a clear, actionable GTM framework and how to align teams around cloud buyer needs through ecosystem partnerships.”

Our alums highlighted the "open discussion with peers from different business functions and companies covering SaaS, Cybersecurity and Hyperscalers." They loved the "tactical elements and the measurement tools to measure progress."

"People with real experience sharing the how - how did they win, how did they fail, how did they tackle challenge X or Y”

Ready to master cloud marketplaces and accelerate your growth?

Cohort 11 kicks off on June 3rd (early bird discount ends this week) - don't miss out on your chance to join this transformative program recognized by Canalys as a Top Education Program for Channel & Partnership professionals.