EXCLUSIVE: 62% Report Net-New Revenue on Marketplaces & Enterprises Consolidate Spend to Fund AI+Cloud

Hi, it's Roman - welcome back to the Partner Insight newsletter.

This week I’ll reveal exclusive data from our new marketplace research where the majority of software companies are generating net-new revenue on cloud marketplaces.

We'll also break down BCG's latest IT spending pulse showing companies are massively increasing AI and Cloud investments while simultaneously cutting legacy budgets and consolidating vendors.

Plus, insights from our Google Next Strategic Debrief in San Francisco where we explored how the marketplace opportunity is being transformed by AI agents.

💡 Upcoming Events (details below):

Join our research webinar this Thursday (April 24th), where we’ll reveal key insights and discuss what sets top marketplace performers apart

Meet me at AWS Summit London (April 30th) - I'm hosting an early breakfast for Cloud GTM leaders

State of Marketplaces: Net new growth or deal shift?

An impressive 62% of software companies are seeing net-new revenue from cloud marketplaces, not just shifted deals - our findings from the "2025 State of Cloud Marketplace & Co-Sell" report reveal.

Cloud marketplaces have clearly evolved beyond just procurement convenience to become genuine growth engines for ISVs.

Over the past few months together with Clazar we surveyed alliance leaders from companies across the range of scale and marketplace maturity, so here is a sneak peek before we publish this research on Thursday.

What makes this significant?

The high net new data (62%) shows cloud marketplaces are opening doors to customers that may have been unreachable through traditional channels — driven by faster procurement, budget utilization, and strategic co-sell alignment with hyperscalers.

This directly challenges the belief some still held in the industry that marketplaces may be just shifting existing pipelines.

Interestingly, only 30% of respondents indicated existing deals shifting from direct sales channels to marketplaces. This suggests the "cannibalization concern" keeping some ISVs from fully embracing cloud GTM may be overblown.

Reality check: net-new on marketplaces

Real-world validations come from companies like World Wide Technology, which shared their latest marketplace results with Google Cloud at our recent event: $250M+ in marketplace revenue with 234% YoY growth with 40% of business net-new.

WWT's 40% net-new figure closely aligns with findings from Forrester TEI study (Sept '23), which found ISVs channel partners selling through AWS Marketplace generated 40% net-new business via private offers. Although these results focused on channel partners, they underscore marketplace net-new revenue potential.

Achieving 40% net-new total revenue via Cloud GTM is very impressive. However, our broader statistic—62% of ISVs reporting some net-new marketplace revenue—is equally transformative.

The strategic implications:

Marketplaces drive additive growth rather than mere deal shift

Hyperscaler co-sell and partnerships provide leverage far beyond simplified procurement

Customer cloud commit utilization remains a powerful buying motivation

But what's driving the successes of top performing ISVs on marketplaces? Is it better alignment with cloud field sales, customer cloud spend commitments, or something else entirely?

📅 Join us on Thursday (April 24th, 10-11AM PDT) for the full research reveal

We'll unpack what separates top performers from the rest and share actionable insights to accelerate your cloud GTM.

We'll also discuss the findings with standout Cloud GTM leaders:

Manik Rane - Global Head of Microsoft Alliance at NetApp

Casey Newton - Global AWS Leader at Zoom

Sarah Jackson - Cloud & Partner Alliances Director, UserTesting

Trunal Bhanse - CEO of Clazar

As a bonus, registrants will first receive access to the full report. This is the playbook many of you have been asking for, backed by actual performance data rather than theory.

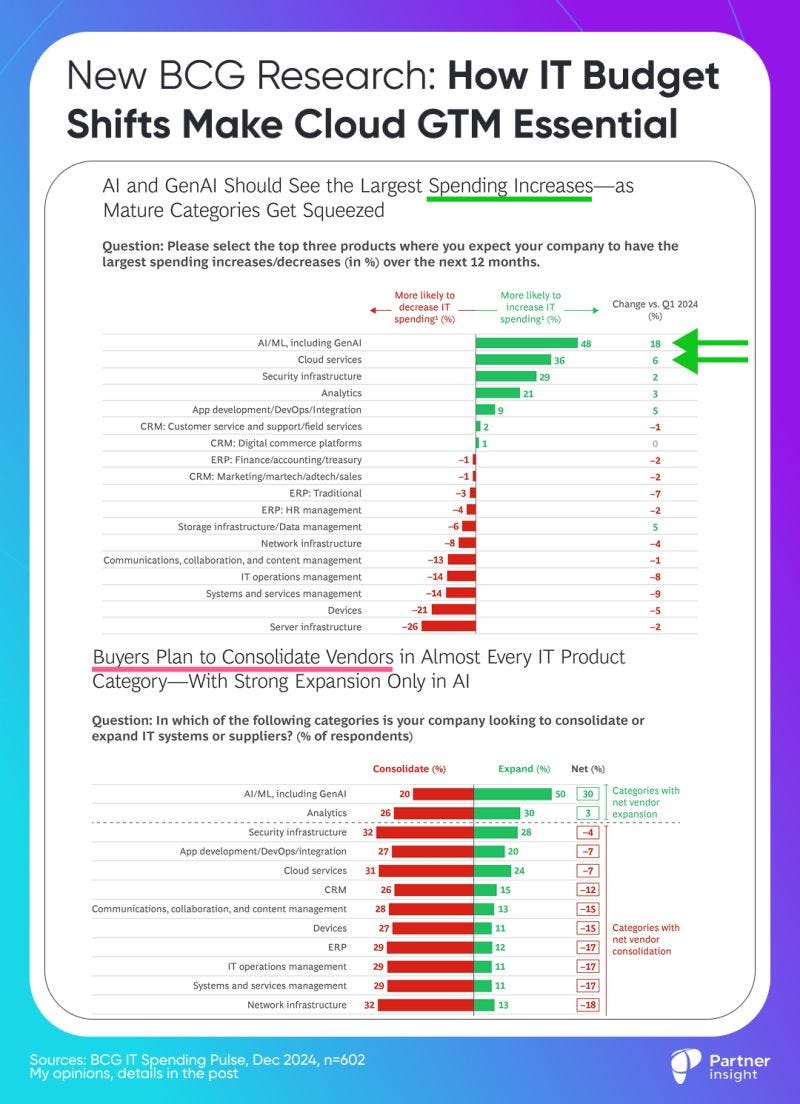

IT Spend Trends: How IT Budget Shifts Make Cloud GTM Essential

AI and Cloud investments are surging in lockstep as companies ruthlessly reallocate IT budgets for 2025.

BCG's latest data shows tech leaders are aggressively funding AI (48% increasing spend) and cloud services (36% growing) while simultaneously slashing legacy infrastructure budgets.

This insight comes from Boston Consulting Group (BCG)'s just-released IT Spending Pulse—a major survey of 602 tech leaders conducted in December. The elephant in the room: this predated US tariffs, but the fundamental direction of travel remains clear and compelling.

What's fascinating is how AI, cloud, and security are growing hand-in-hand, creating a powerful flywheel effect.

To fully leverage AI capabilities, companies must consolidate their data and modernize infrastructure—driving cloud migration and creating demand for enhanced security.

This virtuous cycle explains why these three categories dominate spending increases while traditional categories face deep cuts.

“Cloud services and security infrastructure are indispensable for scaling, resilience, and safe and reliable operations. They’re prerequisites for unleashing transformative technologies like AI.” - BCG

Perhaps most interesting is the ongoing vendor consolidation trend:

Organizations are actively reducing vendor counts in nearly every area EXCEPT AI—where 50% are expanding their roster while just 20% are consolidating. For established technologies, companies are moving toward integrated solutions over patchworks of standalone tools.

Here's why cloud marketplaces are becoming mission-critical for software sellers: They perfectly align with this dual strategy.

As buyers consolidate vendors and optimize spend, marketplaces offer a streamlined procurement channel where they can leverage existing cloud commitments for third-party purchases—creating a win-win for both buyers and sellers in this new landscape.

For those questioning the AI investment surge, the ROI data is staring to look appealing: High-maturity AI companies are seeing 15% returns—nearly 70% higher than limited adopters. Even more telling, AI agents are delivering 13.7% ROI, outperforming traditional GenAI applications.

With AI adoption reaching 80% of surveyed companies and 58% already implementing AI agents, the message is clear: companies not prioritizing AI-cloud integration risk falling behind competitors who are reaping measurable rewards from their investments.

(Source: BCG IT Spending Pulse)

AI Agent Impact: Insights from Google Next Strategic Debrief in San Francisco

The AI agent economy is already here – and it will accelerate and transform cloud GTM. Last week at our Google Next Strategic Debrief, alliance leaders from Google Cloud, NVIDIA, IBM, Conviva and others gathered to decode the $93Bn+ opportunity in the GCP marketplace.

Our San Francisco gathering last week brought together alliance leaders to dissect Google's AI Agent strategy and translate Next '25 announcements into actionable revenue strategies:

Subhash Jawahrani, Head of Databases & Analytics at Google Cloud Marketplace, shared how Google's infrastructure is evolving to support AI-native applications across six product lines. His insights into Google Agentspace (GCP fastest-growing enterprise offering) showcased how the new Agent Gallery, Agent Designer, and Chrome Enterprise integration are transforming how companies across industries use AI and operate.

The multi-agent economy promised by Google's Agent Development Kit and Agent2Agent Protocol is creating opportunities for partners to build specialized agents that extend Google's core technology and help customers solve their key use cases.

Trunal Bhanse, CEO of Clazar, unpacked Google's AI monetization flywheel, where ISVs can build, leverage communities, co-sell solutions, and monetize through its marketplace.

His data point from our recent research that 63% of companies view co-selling as the primary reason to be listed on cloud marketplaces reinforced why integration into Google's ecosystem is crucial in 2025.

Jobi George, Global VP of Business Development at Weaviate, highlighted the emergence of AI-native and agentic stacks. Leaning on his experience scaling marketplace revenue at multiple high-growth companies we discussed co-sell with attendees looking to accelerate their GCP marketplace.

Throughout our discussions, one message was clear: the need for complete solution via co-building with partners is driving a shift in how cloud sellers approach the market.

Google Cloud's $7+ partner revenue multiplier is reinforcing the opportunity to lean into joint (AI) monetization - partners are now generating over $7 for every $1 of GCP consumption.

Special thank you to Subhash Jawahrani not only for his insights but for hosting us at Google's office, and to Dai Vu, Managing Director of Google Cloud Marketplace, for helping turn this event into reality.

And a big thank you to our partner Clazar, whose Cloud Sales Acceleration Platform is helping companies like Pinecone, Perplexity, and others power their marketplace success through automation.

As AI Agent Marketplace (with 100+ agents already live on GCP) emerges as a key distribution channel for AI partner solutions, the question becomes: are you building for the cloud marketplace of yesterday, or the AI agent ecosystem of tomorrow?

Next week: Looking forward to connecting at AWS Summit London on April 30th!

As more buyers earmark ever-larger slices of their IT spend to marketplaces, I'm excited to discuss the latest trends and Cloud GTM strategies with the UK community at AWS Summit London (April 30).

Over 50% of $1M+ B2B deals will be sold this year (2025) via self-serve digital channels like marketplaces (Forrester).

AI and Cloud investments are surging in lockstep as companies ruthlessly reallocate IT budgets for 2025 (BCG).

Meanwhile, our recent research shows that over half of software companies also now use marketplaces to sell their products.

This shift is reshaping how software, AI and services are discovered, purchased and deployed globally.

I’m excited to continue our Cloud GTM gatherings around key events

Thinking of hosting an early breakfast on April 30th during AWS Summit London.

Small room, great minds sharing insights on marketplace growth strategies, co-sell frameworks that are working now, and how to tap into enterprises adopting cloud marketplaces as their default procurement channel.

If you'll be around and want to join or meet, just reply to this email or DM me on LinkedIn.

Would love to connect with fellow Cloud GTM leaders in London!