Hi, it's Roman - welcome back to the Partner Insight newsletter.

Before we dive into this week's insights, a quick reminder: FINAL CALL for our exclusive Google Next Strategic Debrief for Cloud GTM Leaders tomorrow at Google's San Francisco office (April 15, 5:30 PM PDT).

This is your last opportunity to join Google Cloud executives, AI and Cloud GTM leaders as we break down key insights from Next '25, revealing high-impact implementation strategies for marketplace growth, agentic AI and more.

Now, let's explore the latest insights reshaping cloud GTM & AI partnerships.

Inside Google Cloud AI & Marketplace Strategies: Next Highlights Partners Need to Know

Thomas Kurian’s keynote at Google Cloud Next last week underscored a shift in Google's partnership strategy – AI Agents becoming the centerpiece of its ecosystem play.

While Gemini 2.5 grabbed headlines, most conversations today revolved around agents and the launch of Agent Development Kit and Agent2Agent Protocol, establishing a multi-agent economy promising to transform how GCP and partners create value.

The timing couldn't be better

Recent Canalys research (thanks Jay McBain!) announced by Colleen Kapase revealed a staggering $7.05 partner revenue multiplier for every $1 of Google Cloud consumption – one of the highest partner leverages. This represents a massive service opportunity in the AI era, spanning consulting, architecture, implementation, and managed services.

Here are key partner themes that stood out:

Cross-Agent Communication Protocol

Google introduced an Agent2Agent Protocol enabling agents to communicate regardless of underlying model or framework - supported by partners across the multi-agent ecosystem.

Marketplace as the Central Hub

"You have access to these ISV solutions which are pre-integrated and easily deployed from Google Cloud Marketplace," CEO of Google Cloud emphasized to customers.

This positions Marketplace as the primary distribution channel for partner-built agents and AI solutions.

Services Partner Momentum

Accenture, Capgemini, Deloitte, HCLTech, KPMG, TCS and Wipro all announced agent initiatives with Google Cloud. Partners are bringing industry-specific expertise to create thousands of specialized agents that extend Google's core technology.

The enterprise examples were equally compelling

Salesforce expanded its relationship with "Agentforce" powered by Gemini. Intuit leveraging Document AI; Deutsche Bank built an AI-powered research agent on Gemini/Vertex AI; and McDonald's is transforming operations with Edge Computing from GCP.

Openness and interoperability are core tenets of GCP strategy

Google's strategy stands out through openness and interoperability with existing customer IT, robust security (highlighted by the Wiz acquisition), and partner recognition.

Partnerships are explicitly recognized and valued

Numerous collaborations with major companies like Deloitte, NVIDIA, Salesforce, Samsung, Adobe, and service integrators like Accenture, Capgemini, etc. were highlighted.

This underscores Google Cloud's commitment to its partner ecosystem and signals opportunities for new and deeper collaborations.

The sheer scale of partners present today at Next and major announcements by key partners reinforces the potential of this collaborative approach.

Tomorrow at Google SF: Next Strategic Debrief for Cloud GTM Leaders

It's hard to believe that Google Cloud Next '25 already wrapped up, but the strategies for marketplace growth, partnerships and AI agents are just being formed.

That's why I'm thrilled to invite you to our special Google Next Strategic Debrief in San Francisco on Tuesday, April 15th at Google's office.

I'm particularly excited to welcome Subhash Jawahrani, Head of Databases & Analytics at Google Cloud Marketplace, as a featured speaker.

Subhash brings unique insights from leading one of the top categories in GCP Marketplace in addition to extensive experience across the cloud ecosystem. Having led strategic marketplace and business development initiatives at Fivetran, AWS, Elastic and others.

The announcements and conversations with leaders at Next 2025 highlight rapid evolution in Google's marketplace strategy - from the centrality of AI Agents to the evolution of co-sell and partner models.

But the real value comes from understanding implementation strategies that actually work.

Our Executive Speaker Lineup Includes:

Jobi George – Global VP of Business Development & Partnerships at Weaviate (the AI Native Vector Database), frm. Elastic, Microsoft

Trunal Bhanse – CEO of Clazar, powering marketplace success for Pinecone, Perplexity, and other AI leaders

Roman Kirsanov - CEO of Partner Insight

You'll get practical insights on:

Key AI and GTM insights from Google Next '25 for partners

$93Bn+ opportunity and tactics to tap into Google Cloud commits via marketplace

AI agent opportunities unique to Google Cloud

What's driving actual marketplace transactions now - not just theory, but insights from the field

The timing is perfect – fresh from Google Next, while insights are still hot and implementation strategies are being formed.

📅 Join us on Tuesday, April 15th, 5.30-7.30pm

Where: Google office, 300 Clay Street, San Francisco

Will AI Agent Marketplace Transform ISV Monetization?

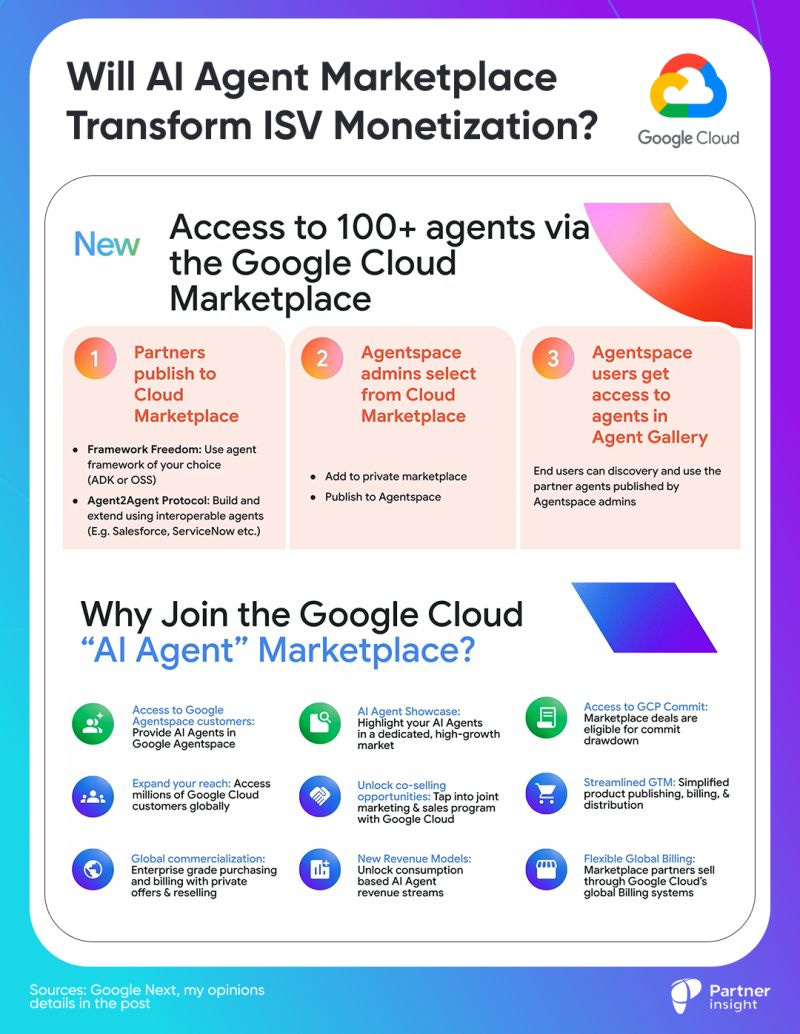

Google's AI Agent Marketplace is poised to significantly accelerate cloud GTM: partners can now directly monetize agents within the cloud marketplace while customers easily deploy agents there.

This marks a major evolution from traditional cloud offerings to function-specific AI components at scale.

What's happening:

At Google Cloud Next '25, Google unveiled a dedicated AI Agent Marketplace within Google Cloud Marketplace

Partners can now list their AI agents directly on GCP Marketplace where customers can discover, purchase, and deploy them.

What makes this powerful is the direct connection to Agentspace - where customers’ employees can interact with partner agents alongside Google's own agents.

This tight technical integration creates a commercial flywheel:

partners build agents → customers buy through marketplace → admins enable in Agentspace → employees use daily → driving more adoption and revenue.

Key opportunities for alliance leaders:

New monetization route: Package your AI capabilities as agents and sell directly through Google Cloud Marketplace

Co-sell advantage: Google is creating GTM and co-sell programs with increased field alignment

Budget access: Customers can use their committed cloud spend for purchasing via marketplace

Partners already capitalizing: Accenture, Deloitte, UiPath, HCLTech, VMware and others are already offering agents through the marketplace.

Resourcing to capture opportunity:

Google is backing this with significant resources - a 2X increase in funding for AI opportunities over the past year and improved field co-sell alignment.

Kevin Ichhpurani, President of Global Partner Organization, highlighted that their "partners have already built more than 1,000 AI agent use cases for customers across nearly every industry."

Agent2Agent (A2A) open protocol

What makes this even more transformative is the introduction of the new open A2A Protocol - supported by 50+ enterprise tech companies including Salesforce, ServiceNow, and SAP.

It will allow AI agents to communicate with each other, securely exchange information, and coordinate to execute tasks across various enterprise platforms.

As Kevin Ichhpurani stressed, "We believe the A2A framework will add significant value for customers, whose AI agents will now be able to work across their entire enterprise application estates."

GCP partner-centric AI agent strategy also extends beyond technical innovation to commercial outcomes.

New processes to better capture partner contributions in co-selling will help Google's team connect customers with the right ISV and services partners.

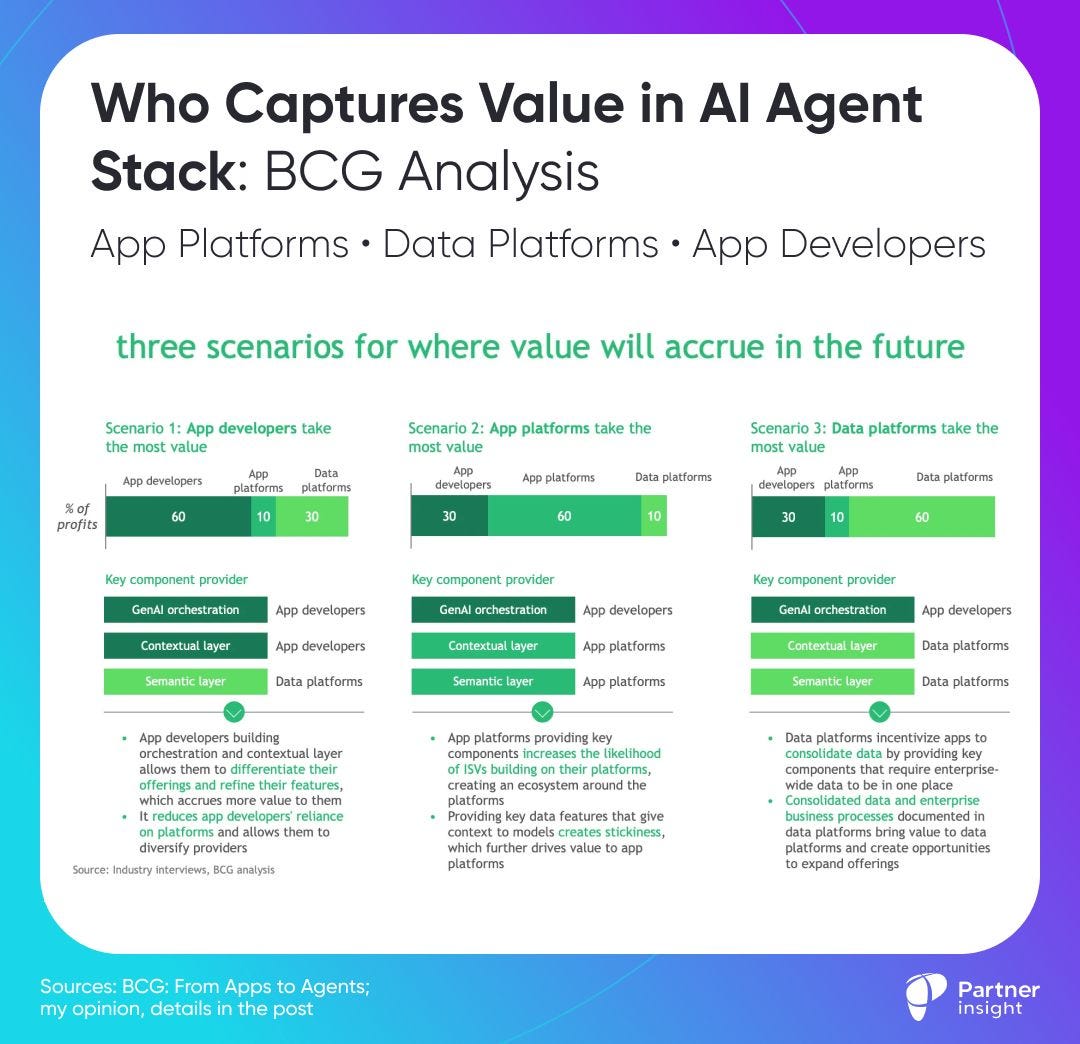

Who Captures Value in AI Agent Stack: BCG analysis

AI agents may reshape software market. Let's break down which part of the stack could accumulate the most of value in the AI Agent era.

The Rise of AI Agents

Unlike traditional apps with defined workflows, coming AI agents will make decisions, and take autonomous actions. This shift is profound - we're moving from apps that follow rules to agents that understand context and reason about business processes.

In this new agentic era, Boston Consulting Group (BCG)'s analysis reveals 3 key players could each capture major value, but with different strengths:

👩🏻💻 App Developers

Examples: Ema, Glean

Emerge with the highest probability to win, expected to capture 30-60% of value in any scenario.

Why? They own the critical GenAI orchestration layer that manages AI models, optimizes performance, and handles complex reasoning.

This can't be easily commoditized because it requires deep use-case understanding and continuous innovation.

🗃️ Data Platforms

Examples: Snowflake, Databricks

Data Platforms show remarkable potential, capturing 30-60% of value in 2 out of 3 scenarios.

Their power comes from providing the foundation for AI applications: enterprise-wide data integration, semantic understanding, and contextual intelligence. As AI apps become more sophisticated, this foundation becomes increasingly critical.

But here's where it gets interesting:

📊 App Platforms:

Salesforce, SAP

They face a stark contrast. In 2 out of 3 scenarios by BCG, they're getting just 10% of value.

But there's one scenario where they capture 60% - the highest potential share. What drives this dramatic difference?

The winning scenario for App Platforms hinges on their unique advantages:

Control of domain-specific data and business logic

Ability to create sticky solutions by embedding AI directly into existing workflows

Power to build ecosystems around their platforms

But BCG missed another category of players reshaping the game entirely:

☁︎ Cloud Hyperscalers with their marketplaces

Their position is more nuanced and powerful than it might appear at first glance.

They span all three categories:

As Infrastructure Providers

Offer essential AI/ML services

Power the compute needed for AI workloads.

As App Platforms:

Run powerful cloud marketplaces, with growing ecosystems of B2B apps and services

Enable deep integration across services

As Data Platforms:

Provide enterprise-scale data infrastructure

Offer advanced AI/ML tooling

Enable cross-service data integration

This triple position gives them unique advantages.

While app developers, data platforms, and app platforms fight for dominance in their respective layers, clouds are in a prime position to win regardless of which scenario plays out.

They're building the entire ecosystem that everyone else will operate within.

Live launch: 2025 State of Cloud Marketplace & Co-Sell: Key Insights for Revenue Teams

In 2024, the fastest-growing ISVs saw 2-4X larger deal sizes on cloud marketplaces vs direct sales. Clearly cloud GTM is no longer a "nice-to-have" but a strategic growth channel. But here's the challenge:

While nearly half B2B SaaS companies report their top-performing deals involve marketplace or co-sell, most teams still struggle with fundamental questions:

Does the marketplace truly drive net-new revenue or just shift channels?

How do co-sell vs. non-co-sell deal sizes and win rates actually compare?

What operational tactics correlate most with marketplace success?

Why do some teams see 40X+ marketplace growth while others stall after initial transactions?

The market is flooded with opinions but starved for concrete data and benchmarks.

That's why we've partnered with Clazar to launch the "2025 State of Cloud Marketplace & Co-Sell" - a comprehensive research into what's actually working for top-performing teams.

After collecting insights from cloud GTM leaders across growth stages, the patterns emerging are fascinating (and sometimes counterintuitive).

Join Our Live Data Reveal Online: April 24th, 10-11AM PDT

For the first time, we'll unpack the findings with standout Cloud GTM leaders:

Manik Rane - Global Head of Microsoft Alliance at NetApp

Casey Newton - Global AWS Leader at Zoom

Sarah Jackson - Cloud & Partner Alliances Director, UserTesting

Trunal Bhanse - CEO of Clazar

As a bonus, registrants will first receive access to the full report. This is the playbook many of you have been asking for, backed by actual performance data rather than theory.

So cool. One reason why o spend some time to build a2adirectory.co

The revenue multiplier effect highlighted here underscores the immense potential of AI agent marketplaces. In my latest post, I discuss building such a marketplace to tap into these emerging opportunities.