Hyperscalers' Platform Strategies Fueling $1/3 Trillion Momentum

Hi, it’s Roman from Partner Insight. Welcome back to my newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in the rapidly evolving cloud marketplaces and partnerships.

Today we'll dive into how and why hyperscalers are becoming platforms, explore the major advantages and significant costs of adopting a platform strategy, and discuss the latest insights on growing cloud commitments.

But before we dive in, a quick thank you to all supporters of our Cloud GTM Leader Course, which has surpassed the milestone of 100 alumni. We’re kicking off our 💡 Cohort 6 on June 4th, and a few early bird seats are still available—hurry if you want to catch one. Scroll below for more details.

Hyperscalers Vie for Platform Dominance

In our recent event, Jay McBain of Canalys underscored a critical trend: the largest companies across industries are striving to become platforms. Nowhere is this more evident than among hyperscalers, that are competing to become the foundational layer for their customers, leveraging their cloud marketplaces as extensions of their platforms.

“That's what Wall Street, by putting Microsoft ahead of Apple in valuation, is reminding everyone: if you can grab the platform in front of every one of your customers and own the marketplace, you are... a 3 trillion dollar valued company.”

If you missed our event, this clip from Jay’s keynote is highly recommended:

This pursuit of platform dominance is driving hyperscalers and major tech companies to establish themselves as the primary platform for buyers. Cloud marketplaces are a crucial component of this strategy.

"There's this linkage between marketplace being the center of a platform. The person who owns the biggest marketplace or the biggest platform is correlated as the winner in that economy."

Jay highlighted that modern tech purchases are complex, involving multiple layers. The average deal now includes seven layers from various companies.

Cloud marketplaces are seen as the ideal tool for the new digital-first buyer to build their multi-layer stack. Hyperscalers recognize this, which is why they invest heavily in building and enhancing these marketplaces, enabling vendors to integrate partners into marketplace transactions.

"They want to own the marketplace. They want to own the seven-layer stack. They want to own seven partners," Jay explained, emphasizing the strategic importance hyperscalers place on marketplaces and becoming platforms.

It’s clear that having a robust platform strategy helps top tech companies to lock in their customers and win the competitive race. But what does it take for a company to truly become a platform?

Platform Strategy Demystified: Big Wins at a High Cost

Accenture recently published a cross-industry study on platform companies, offering several key insights. These insights are crucial for understanding how to build successful platform businesses.

Successful platform businesses focus on three key unlocks:

Creation of completely new customer experiences

Development of new business models

Delivering more value to customers and partners

The platform business model helps companies achieve stronger performance, unique capabilities, and better customer experiences.

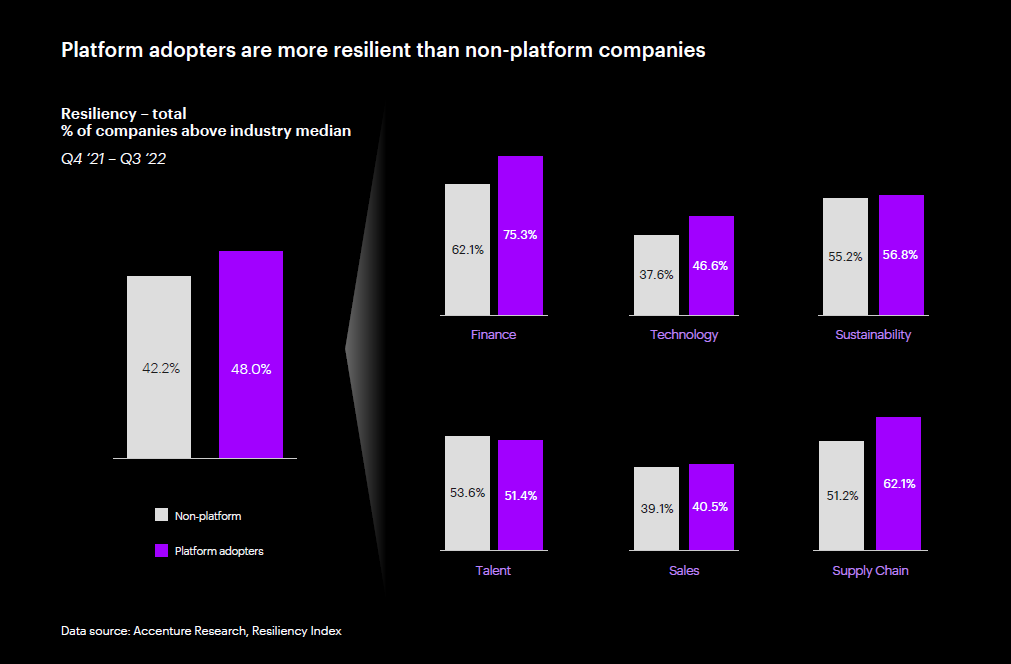

Importantly, Accenture's analysis has found that platform companies show higher levels of business resilience in nearly every measure, including financial discipline, sales, technology, sustainability, and supply chain operations.

Platform companies from the tech sector are almost 25% more resilient than their non-platform counterparts.

While platform strategies are business-led, they are tech-enabled. The best strategies are executed in collaboration with ecosystem partners, ensuring usability and delivering immediate results that amplify over time.

“With a platform strategy, you can have a major impact on your company’s agility, time-to-market, efficiency and innovation with a very light lift, and you can start to see immediate benefits. Over time, the strategy generates even greater dividends.” - highlighted Chris Kasten, SVP, Common Platforms at PayPal in the report.

Platforms Emphasize Ecosystem Value 20X More Often

It’s no surprise that platform companies form more partnerships and place a significant focus on their ecosystem of partners and users. After all, the enterprise value for platform companies ultimately comes from the value they create for their ecosystem.

In fact, platform companies are 20 times more likely to highlight their “ecosystem value” in their communications.

Successful platform adoption also requires creating a culture where knowledge is shared openly. This requires leaders to ensure their employees are willing to give up their knowledge ownership for the greater good.

The High Price of Platforms: >2X Greater Tech Investment

While the platform model is business-led strategy, it must be enabled by a robust tech infrastructure. As a result, building a platform business requires significantly higher tech spending.

Accenture’s research found that successful platform adopters invest 2.3x more in tech than non-platform companies, with “cloud investments making up a huge part of this spending”.

Platform companies invest more than 2X as much in technology, such as cloud and AI, and 2.6X more in integration and orchestration middleware.

Although the initial investment is high, a platform strategy delivers more value over time. It allows companies to control costs in areas such as technical debt and reinvent workflows across their business.

“Once the business has improved its operations, it is ideally placed to drive value for its industry ecosystem partners.”

If you’d like to dive deeper into the platform business model, I’d recommend watching our insightful episode with Marshall Van Alstyne, author of Platform Revolution.

You can also find Accenture research here.

The 1/3 Trillion Dollar Momentum of Hyperscalers

One of the best illustrations of a power of platform business model is hyperscalers, whose focus on marketplaces and push into AI drive incredible growth both in revenue and their cloud commits (customer revenue backlog).

In my recent analysis, hyperscaler cloud commits surged to a staggering $348 Bn last quarter, adding $66Bn in just one year. Numbers tell an insightful story, if we reflect on the last 12 months.

Not only has each of 3 hyperscalers accelerated actual revenue growth, surprising even the most optimistic Wall Street analysts, but they also grew customer cloud commits (booked backlog).

Clouds are now driving the entire tech industry forward, helping companies to leverage AI, move to the cloud, modernize infrastructure and buy SaaS products via their cloud marketplaces.

We talked at length that marketplaces have nearly doubled YoY, becoming the dominant SaaS distribution channel.

Let's delve into the specifics:

💲💲💲 Amazon Web Services (AWS)

Last quarter commits: $157.7Bn

Growth 12 month: $37.5 Bn (29%)

💲💲 Microsoft Azure

Last quarter commits: $117.5Bn*

Growth 12 month: $19Bn (20%)

💲 Google Cloud

Last quarter's commits: $72.5Bn

Growth 12 month: $10Bn (17.5%)

This $66 Bn collective increase in cloud commitments in just a year tells a story of robust tech ecosystem health and rapid innovation.

Interestingly, while AWS's actual revenue growth rate has moderated to 17% (last quarter vs 31% Azure and 28% GCP growth), its commitment growth outpaces its rivals, nearly doubling that of its closest competitor in absolute terms.

Amazon CEO Andy Jassy aptly captured the essence of this trend, stating in the recent call:

“Companies have largely completed the lion's share of their cost optimization and turned their attention to newer initiatives.

Before the pandemic, companies were marching to modernize their infrastructure, moving from on-premises infrastructure to the cloud to save money, innovated at a more rapid rate, and to drive more developer productivity. The pandemic and uncertain economy that followed distracted from that momentum, but it's picking up again.”

💲 Finally, you might think that only B2B companies sign large cloud commitments with hyperscalers. But that's not the case. Take Reddit, Inc., for example.

These insights not only affirm the sustained growth of cloud but also the vital role of cloud marketplaces in shaping the future of technology consumption.

If you’re not yet leveraging cloud GTM, now is the time to explore this accelerating route for growth.

Unlock Cloud Marketplaces: Join Cohort 6

I’m thrilled to invite you to join Cohort 6 of our Cloud GTM Leader course starting on June 4th to unlock and accelerate your traction in cloud marketplaces.

Here are what alums from Cohort 5 said on why you should join us:

🔀 Transformative Experience

"It's a game changer to really understand the potential and the opportunity… knowing what it takes… how complex the path can be."

💡 Actionable Cloud GTM Strategies

"This was really amazing... I learned a lot." "The different speakers from across the domains covering different aspects of the entire GTM were very helpful."

🛠️ Practical Implementation

"I really loved the discussion on internal versus external…why co-selling is important, why the marketplace is important…and I truly resonated with everything that was said... because that's something I struggle with on a daily basis."

📢 Join Cloud GTM Leader Cohort starting on June 4th

Don't miss out on your chance to be a part of this transformative experience.

Join 20+ alliance leaders for a 5-week cohort course to learn and apply proven Cloud GTM strategies to accelerate your revenue growth on cloud marketplaces of Amazon Web Services (AWS), Microsoft Azure and Google Cloud.

📅 What’s on the Agenda:

✔️ 10 In-depth Expert Sessions - explaining key aspects of successful Cloud GTM

✔️ 5 Masterminds - get your questions answered and learn from each other

✔️ 5 VP-level Mentors who can support you and answer your questions

✔️ Slack community for supporting you

By the end of this course, you'll have actionable strategies that are proven to drive sales from $0 to $MM+ on marketplaces for software companies.

Join us starting on June 4th and learn how to unlock cloud co-sell, leverage your superpowers to get your share of the $348 Bn market opportunity, and more.

Hurry up to catch a few early bird tickets while they are still available.