Inside the Cloud-AI Boost & Special AWS Marketplace Scale Strategy Event (Nov 13)

Hi, it's Roman - welcome back to the Partner Insight newsletter!

While everyone’s attention is fixed on the race in AI models, something even more profound is reshaping the tech industry—cloud hyperscalers are quietly expanding, while rapidly building their infrastructure. Strikingly, their AI opportunity could be as large as $2T.

This week, we’ll analyze what this seismic shift means for alliance leaders and explore how CrowdStrike masterfully leveraged its partner ecosystem and marketplaces to achieve one of tech’s most impressive comebacks of 2024.

Before we dive in, don’t miss our biggest cloud GTM event of the year "Scale Your Growth with AWS Marketplace in 2025" on November 13. This is the strategic briefing you need before re:Invent 2024 and setting your 2025 Cloud GTM strategy.

The event is free—please share it with your network.

Online Event: “Scale Your Growth with AWS Marketplace in 2025” in less than 2 days!

With top cloud commits hitting $380Bn, the opportunity in cloud marketplaces has never been bigger. Less than 2️⃣ days left to join 250+ leaders who’ve registered for our biggest cloud GTM event of the year.

Here's why you can't miss it:

Given AWS's leading role in Cloud GTM, this event will be packed with insights on leveraging cloud marketplaces. Our incredible lineup for Nov 13th includes:

Keynote from Lewis Howarth, WW Leader of Amazon Web Services (AWS) Marketplace Scale Adoption

Few leaders understand growing on AWS Marketplace better than Lewis Howarth who for over a decade has been leading teams across the organization within AWS.

Lewis brings unique insights into accelerating AWS Marketplace adoption through three key principles:

Normalization, Frictionless and Mainstream:

He highlights that cloud Marketplaces are growing faster than ever and underscores the growing adoption of channel-first ISVs on AWS Marketplace.

Keynote from Jay McBain, Chief Analyst at Canalys

The analyst whose 86% CAGR marketplace growth prediction became the industry's north star will share what's next.

Jay stresses the "continuing explosive growth of hyperscalers". He highlights that "we are talking about leaders in a $300Bn+ category continuing to grow at 20-30%".

Jay will unpack these trends and share what’s next, including why 50% of marketplace sales will flow through channel partners by 2027.

Special guest:

Andy Whyte, CEO of MEDDICC, joins keynotes to reveal how to integrate AWS co-sell and Marketplace into your own sales and channel teams "languages”.

Wait there's more.

Panel: Expand your Global Presence with AWS Marketplace with incredibly experienced leaders:

Arif Razvi, WW Leader, AWS Marketplace International Expansion & New Business

Francesca Bowen, Global Vice President, Cloud GTM, Darktrace

Brian Lawrence, Vice President of Sales, Clazar

Andy Whyte, CEO of MEDDICC

Panel: How ISVs use AWS Marketplace & Channel Partners for rapid growth

Franco Naling, Senior Manager, NAMER Channels, AWS Marketplace

Michael Musselman, M.B.A., VP of Partnerships at Astronomer, x-Lacework

Serge Durand, Head of AWS Marketplace EMEA, Channel

Moderated by Daniel Roppert, Channel & Alliances Leader - Central Europe at Wiz (scaled Okta's Cloud GTM to 8-figures in EMEA)

📅 Join us on November 13, 9-11 AM PT

In just 2 hours, 12 top experts will share insights that could transform your cloud GTM strategy and accelerate growth with AWS Marketplace.

The timing is strategic - just a few weeks before re:Invent 2024. You'll get the latest insights on AWS's marketplace and can focus on what matters most at re:Invent and in 2025.

This event is FREE - please share it with others.

Forget AI Models: Cloud's $2T Opportunity could be the real story

While everyone obsesses over AI models, a profound shift is happening in three cloud hyperscalers. Their cloud revenue, fueled by AI, is projected to double to over $0.5T in the next 4 years. Strikingly, their AI opportunity could be as large as $2T.

Recent Battery Venture's and Goldman Sachs research highlights that:

“AI is dramatically lifting the fortunes of the public cloud providers, namely AWS, Microsoft Azure and Google Cloud. We estimate that by 2030, cloud providers could capture an extra $2 trillion in cumulative revenue from AI.”

If this sounds like an exaggeration, here is a recent example:

Combined Value for Amazon, Microsoft, and Google has nearly doubled

Pre-ChatGPT:

Total Value of Amazon, Microsoft, and Google: $3,994 billion

Their Share in $8T Total Enterprise Value: 49.93%

Today:

Total Value of Amazon, Microsoft, and Google: $7,085 billion

Their Share in $16T Total Enterprise Value: 44.28%

While the enterprise value market doubled from $8T to $16T, the three cloud hyperscalers still hold nearly half of the market value. Their relative share has dropped slightly due to the faster growth in companies directly involved in AI technology, especially Nvidia, whose market cap grew 10X in the same period.

Still, cloud hyperscalers have been among the fastest growing companies with their market cap nearly doubling (2X) in this period, while many software companies couldn't show the same results.

This shift underscores the increasing importance of AI and it’s reliance on cloud in the tech ecosystem.

As Battery notes:

"with the market’s mega-cloud computing providers continuing to invest massively in AI infrastructure—particularly since the second quarter of 2023—we see growing capacity to handle a coming AI “supercycle”, a technology platform shift just as big as previous mobile and cloud-computing revolutions led by Apple and Amazon Web Services, respectively. Our estimate is that $4 trillion or more in market value is up for grabs as AI moves toward disrupting software, services and certain labor markets in the coming years”

How Hyperscalers are becoming AI Ecosystems

Hyperscalers are evolving beyond infrastructure to become the essential foundation for building, consuming and distributing AI.

Their $50B Investment Gap Is Staggering... Here's how they become AI ecosystems and why this matters.

The Investment Moat

Tech Titans (Amazon, Microsoft, Google) are each investing $50B+ in AI capex for 2024

In contrast, even the largest "AI Majors" like OpenAI (with major stake from MSFT) are spending “only” $18.9B

AI Challengers are operating at an even smaller scale of $100s of millions (Accel Euroscope)

This creates an insurmountable moat: hyperscalers are outspending OpenAI by 3x and AI challengers by 50x, cementing their position as the default AI infrastructure layer.

A "Minimum Viable Scale" Emerges

The three major cloud providers (AWS, Microsoft, Google) have remarkably similar capex ranges ($50-65B), suggesting a "minimum viable scale" for AI infrastructure.

With similar investment levels among cloud providers, differentiation and scale of adoption will likely come from partner ecosystems rather than raw infrastructure capability.

That’s why hyperscalers are laser focused on cloud marketplaces as their top 3 strategic priority.

Explosive AI Growth on Cloud Marketplaces

Cloud marketplaces are now becoming the fundamental part for AI monetization. Data from our recent event with Microsoft's marketplace leaders reveals stunning numbers of AI adoption in its marketplace:

188% YoY growth in AI and ML revenue

Multi-billion dollar transaction volume

50% increase in transactable AI offers

The scale of transactions suggests that marketplaces are key GTM infrastructure for AI solutions.

Market Value Recognition

The stock market is validating this platform play. Growth of all three hyperscalers, despite being mature companies, shows that investors see enormous value in their AI infrastructure positions.

Amazon market cap +54%, becoming $2T company, similar to Google

Microsoft's market cap grew 36% (to $3.2T) in 12 months

NVIDIA grew 177% (to $3T)

The Virtuous Cycle Emerges

New BCG research confirms:

"AI Leaders" make "twice the investment in digital, twice the people allocation, and twice the number of AI solutions scaled."

The ROI is already visible: "Even in 2024, [AI] leaders expect to realize more than twice the RoI from AI initiatives than other companies do."

This creates a powerful flywheel: AI investment → digital adoption → higher ROI → increased investment through hyperscaler ecosystems.

💬 Question for Alliance Leaders: Are your marketplace capabilities keeping pace with these ecosystems? Your competitors are likely asking the same question.

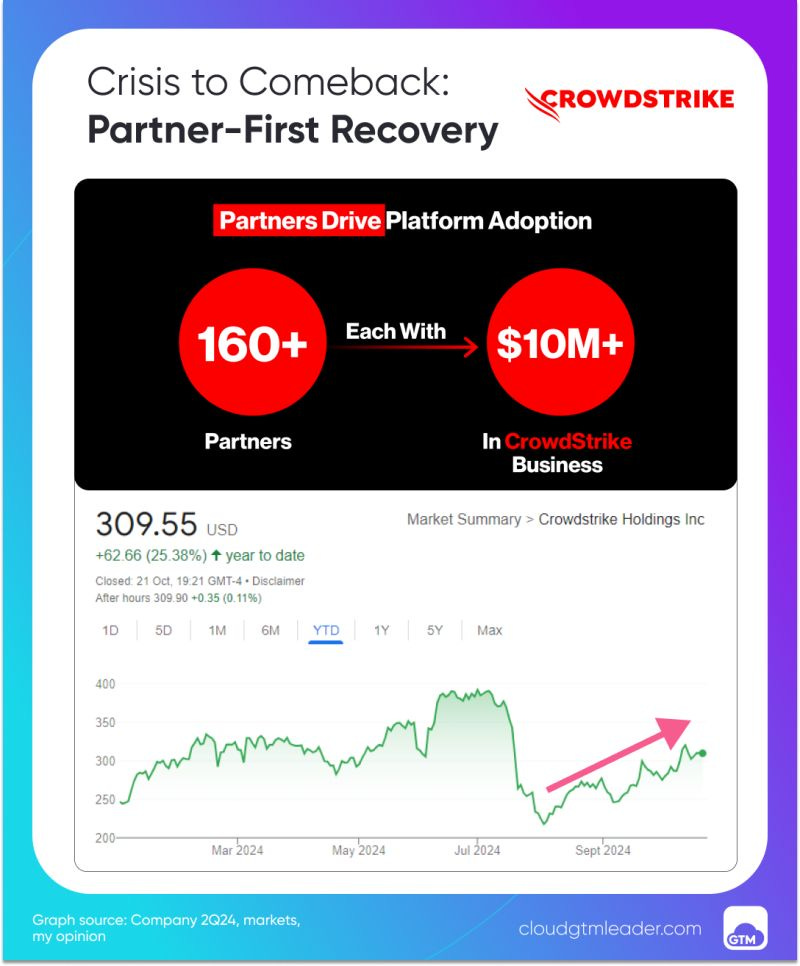

Crisis to Comeback: CrowdStrike’s Partner-First Recovery

CrowdStrike's stock is now ▲ back to Q1 level after it dropped ~50%🔻 after a major outage in July. The secret of such resilience?

Their partner ecosystem unified around cloud GTM. Here's how they did it...

After an incident, the cybersecurity giant has quickly recovered with shares now above $330 (as of Nov 11th 2024).

The answer lies in CrowdStrike's partner-first strategy and mastery of cloud marketplaces. Numbers tell a compelling story:

66% of new logo business now sourced by partners - up from 62% earlier this year

Systems integrator business grew >100% YoY

Fastest-growing cybersecurity vendor on Google Cloud Marketplace this year

Not only do partners source 2/3 of CrowdStrike's new business, but it's all tied to cloud marketplaces.

CEO George Kurtz's strategy is clear: "We unite and align our entire partner ecosystem with our use of cloud marketplaces in CrowdStrike's go-to-market."

Take their success with Amazon Web Services (AWS). CrowdStrike has long excelled in the AWS Marketplace, enabling customers to "procure CrowdStrike for the full range of their cybersecurity needs."

This marketplace approach isn't just about convenience - it's driving significant deal expansion.

A Fortune 500 insurance firm case study illustrates this perfectly:

5-year relationship starting with endpoint protection. Post-incident, accelerated consolidation on CrowdStrike, displacing 7 competing technologies.

Using AWS Marketplace, their spend with CrowdStrike grew >2X from $2.2M to $5M+ ARR.

This example showcases how CrowdStrike's platform approach, combined with the ease of procurement through cloud marketplaces, can drive massive customer expansion even in the wake of challenges.

What's truly impressive is how quickly CrowdStrike replicated this playbook on Google Cloud. In just two quarters, they've become the fastest-growing cybersecurity vendor on the Google Cloud Marketplace.

But it's not just about the marketplaces themselves. CrowdStrike's success is built on a foundation of deep partnerships across the ecosystem.

Global system integrators (GSIs) like Accenture, KPMG, and EY played crucial roles in helping customers recover post-incident. The company's new Falcon Flex subscription model resonates with GSIs, making them increasingly central to its strategy.

The lesson here for alliance leaders is profound:

CrowdStrike doesn't treat cloud marketplaces as a separate channel. They've aligned their entire ecosystem around it. This creates a unified GTM approach that amplifies results.

As Kurtz recently stressed, "Customers of all sizes are increasingly looking to utilize their committed hyperscaler spend, adding an additional layer of resilience through our go-to-market, aligning our entire ecosystem from reseller to systems integrator, MSSPs to distributors".

To bring to you this newsletter and our upcoming “Scale Your Growth with AWS Marketplace in 2025” event on November 13th we partnered with

Clazar is the leading Cloud Sales Acceleration Platform for GTM teams to scale revenue on AWS, Azure, and Google cloud marketplaces. From listing to co-selling to revenue reconciliation and recognition, our platform helps companies streamline and automate their entire cloud sales journey from a single, unified platform—with zero operational overhead.

Clazar integrates seamlessly with existing CRMs, offers robust governance controls, and fully complies with industry-leading security standards so that revenue teams can efficiently scale operations with complete peace of mind. Top companies like Pinecone, Perplexity, Cortex, CloudZero, and Secureframe trust Clazar to power their success on cloud marketplaces.

To learn more, please visit www.clazar.io