Microsoft: Slash AI Time-to-Production by 80% with Marketplace & Box's New Partner Playbook

Hi, it's Roman from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week: Microsoft just revealed developers are slashing AI time-to-production by 80%—not through better code, but through marketplace integration. Plus, I'll break down Box's new partner GTM and partner economics playbooks; and reveal how binding cloud commitments of companies like SailPoint, MongoDB, and Lyft create guaranteed marketplace opportunities worth hundreds of millions.

Before we dive in:

Don't miss our free online workshop this Wednesday, May 28 on "5 Co-Sell Strategies to Drive $1M+ Cloud Marketplace Growth"

And if you're ready to accelerate your growth, Cohort 11 of our Cloud GTM Leader course kicks off next week on June 3—join 200+ alumni who've scaled on AWS, Azure and Google Cloud marketplaces.

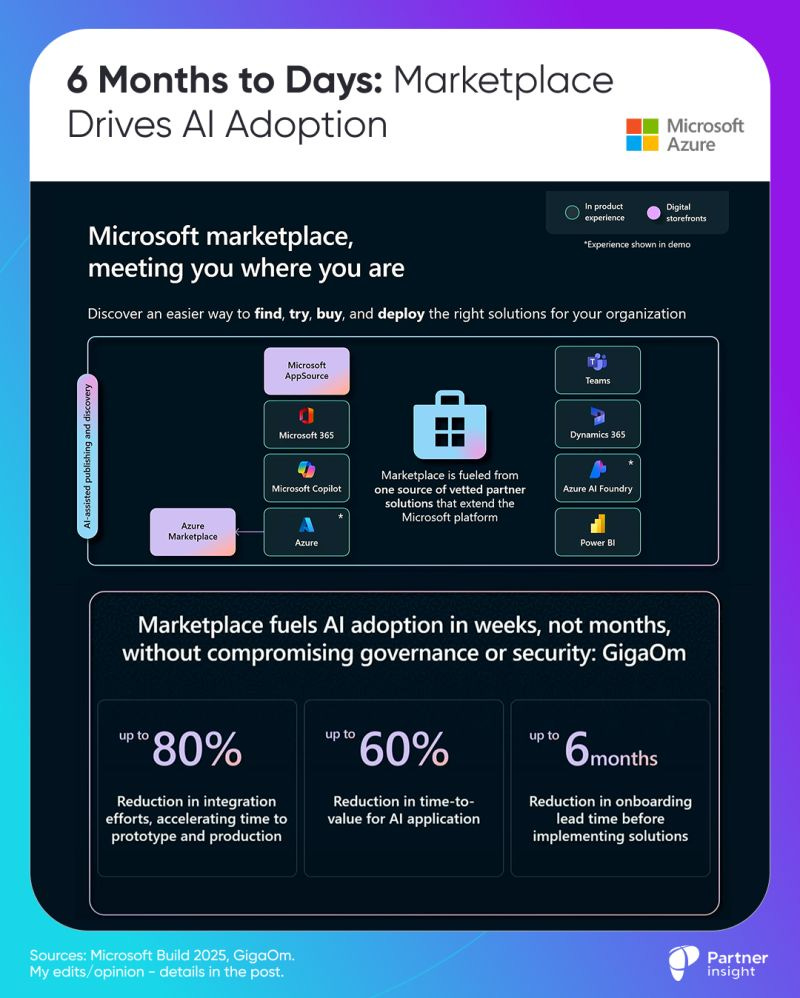

6 Months to Days: Microsoft Marketplace Boosts AI Adoption

Microsoft just revealed AI developers are cutting time-to-production by 80% – not through better code, but by using the marketplace as part of their development process.

The shift from "build everything" to "compose intelligently" is rewriting how developers and enterprises build and ship AI products.

At Build 2025, Microsoft unveiled data that should make every alliance leader rethink their AI distribution strategy.

A recent study shows that developers using MSFT Marketplace for AI development achieve up to 80% reduction in integration efforts and 60% faster time-to-value (GigaOm). Even more striking: onboarding times compress from 6 months to mere days.

Felipe Ospina, Principal PM for Microsoft Marketplace, framed the transformation:

"Through the marketplace, you can access a full stack of AI applications from models and agents... deploying directly from Azure with the security and governance that Azure provides."

Microsoft also has evolved the marketplace from a destination to infrastructure. Solutions now surface exactly where developers (and customers) work – within Microsoft Azure portal, AI Foundry and their other products.

This shifts the model from "go shopping for solutions" to "solutions are here when you need them."

The demo showed why developers are flocking to this approach

Within minutes, a developer deployed Cohere's LLM and Pinecone's database directly from Azure AI Foundry – no infrastructure setup, no maintenance overhead. The marketplace handles authentication, billing, and governance seamlessly through existing Azure environments.

This shows the collapse of traditional procurement barriers. Developers can prototype with credit cards, then scale through enterprise agreements or work with System integrators. Marketplace handles all of that (plus eligible purchases count toward existing MACC customer consumption commits).

What this means for Cloud GTM leaders:

Rethink distribution

If developers can discover and deploy your AI solution in minutes via marketplace vs months, how does that change your GTM?

Enable composability

Position your solutions as building blocks that integrate with other marketplace offerings (LLMs, databases, data tools).

Leverage in-product discovery

Your solution now appears where developers work: Azure portal, AI Foundry, even VS Code via Copilot recommendations.

Simplify commercial models

Support multiple purchase paths: free trials, PAYG, enterprise contracts

The implications run deeper than convenience, when deployment friction approaches zero:

Enterprises and devs can experiment with best-of-breed AI products without massive integration projects.

ISVs can reach developers at the exact moment of need.

Will “marketplace-first” become the default for enterprise AI?

Online Workshop “5 Co-Sell Strategies to Drive $1M+ Cloud Marketplace Growth”

Cloud sellers control the keys to much of $439B in enterprise cloud commits—yet many ISVs watch deals slip away (or never materialize) because they're "co-selling on marketplace" without actually co-selling.

After 10 cohorts of our Cloud GTM Leader course helping 200+ leaders grow revenue with AWS, Microsoft Azure and Google Cloud, one truth emerges: The gap between co-sell intention and execution costs millions. With AI agent acceleration, the timing to get this right is even more critical.

That's why I'm bringing together two of the sharpest minds in cloud partnerships—both mentors and speakers from our course—for a live workshop this Wednesday.

"5 Co-Sell Strategies to Drive $1M+ Cloud Marketplace Growth" on May 28, 9–10am PT.

Learn from the best:

Jonathan Kingsepp, CEO of Northbound Solutions, Inc., has been architecting cloud GTM strategies since before "cloud GTM" was even a term.

As our course mentor, he's helped 200+ alliance leaders transform marketplace theory into revenue reality. His track record? Building transformation programs that get both internal teams and cloud sellers to champion your solution.

David Mauer brings fresh battlefield insights from GitLab, where he led Ecosystem Cloud Programs and helped drive $100M+ in marketplace revenue.

Now Vice President of Channel & Alliances at LucidLink, he's mastered turning partner complexity into competitive advantage.

What you'll walk away with:

The Stakes & The Path — When and how to tap into cloud commits through co-selling

The Internal Battle To Win — 5 steps to get your org co-sell ready and turn sellers into marketplace champions

Cloud Pitch — How to get cloud teams to actually champion YOU over competitors

Jonathan's Cloud Desk Insights — Transform your organization into a co-sell powerhouse

David's Partner Playbook — How he's leveraging partners in enterprise deals

Plus live Q&A on your specific co-sell challenges.

This isn't theory. We'll break down real case studies showing how this playbook helps companies like GitLab, Okta, Zoom and 200+ of our alumni accelerate marketplace revenue.

Reality check: While 56% of companies list on marketplaces for co-sell, only a third run dedicated programs. The rest? They're leaving millions on the table.

Wednesday May 28 at 9-10am PT we fix that execution gap— join us to learn tactics you can implement.

This workshop leads into Cohort 11 of our comprehensive Cloud GTM Leader course starting June 3rd - the program alliance leaders from companies like Citrix, Wiz, and Darktrace trust to accelerate their cloud marketplace revenue.

Box's Partner and AI Shifts & Partnership Economics That Makes It Work

While AI launches grab headlines, behind the scenes many well-known companies are rewiring their GTM around partners to capture this higher-value business.

Case in point: Box's CEO Aaron Levie recently underscored this on a recent call:

“As we bring intelligent content workflows to the enterprise with AI, going to market with partners is also going to become increasingly critical.”

CFO Dylan Smith explained that Box is doubling down on the investments they started last year:

“We’re really standing up and making and setting up our partner ecosystem for success.”

Why? Because the partner economics works: “Our indirect customers are actually effectively just as profitable as our direct customers” - more below.

In fact Box historically had been a “mostly direct business other than Japan, which is very channel-heavy”, underscored Aaron Levie.

Now, with Japan making up ~65% of Box’s international revenue (~1/3 total ex-US), Levie wants to export that success:

“There’s a lot of lessons in Japan that we’d like to bring to other regions.”

Why is this shift now?

Box is evolving from traditional file storage into higher-value "core transformational workflows" that include moving to the cloud and "automating more business processes." These use cases "need implementation" and "bigger strategy" where partners excel.

“There's now obviously very, very relevant partners in all of these categories that help customers every single day, in every single industry with those types of transformation. So we wanna be embedded in each of those partners.’ - Levi explained

Box’s new partner motion includes:

1️⃣ Scale with GSIs – Deepening ties with Deloitte, Slalom, TCS.

“We’ll bring them into more deals... build flywheels with top GSIs, boutique, and regional firms.” Partner-led wins drove Q4 growth in the enterprise segment.

2️⃣ Multi-year investment – From dedicated partner headcount, co-marketing, and joint POCs to 10x partner revenue (see attached slide)

3️⃣ Marketplace Acceleration – Building marketplace presence on Google Cloud, etc.

Their strategy is “Being Transparent. Easy to work with. Fast moving.” with clouds.

Their GCP motion started modestly—“just get 12 deals done”—and led to winning Google’s Sales Partner All-Star. (see my previous breakdown).

Why Box’s new partner economics works?

CFO broke it down:

“Even when factoring in whatever margin or payments the partner’s getting, it still nets out to be fairly neutral…

because in a lot of cases, those customers are getting other benefits, cost leverage by working through that partner—whether it’s marketplace credits or part of broader spend with them

and tends to come in at slightly higher pricing, which offsets some of the margin impact.”

Efficiency gains are real:

“That doesn’t even speak to a lot of the other support our partners provide—on customer support, and certainly in going out and finding these customers, which is more efficient relative to our own sellers or marketing spend.”

Box three-year plan to increase its scale and reach through its partner ecosystem.

Box’s partner playbook shows a deliberate progression, increasing in complexity and impact each year (see slide above):

Year 0 (FY25) - Laying the Groundwork for Partner Success:

Actionable Investments: Box is currently making foundational investments. This includes launching targeted co-marketing initiatives to build awareness, dedicating specific headcount to support and manage partner relationships, and engaging in joint Proofs of Concept (POCs) to validate solutions and build early momentum.

Targeted Results: The immediate goal for Box is to establish robust Go-To-Market (GTM) strategies and operationalize co-delivery models, especially with key Global System Integrators (GSIs). This sets the stage for more extensive collaboration.

Year 1 (FY26) - Accelerating with "Time to Win" Initiatives:

Strategic Expansion: Box will then focus on significantly expanding its partner ecosystem to broaden its market coverage. Simultaneously, they will work on deepening their existing partnerships, transforming them into more strategic alliances.

Driving Repeatability: A critical action for Box during this phase is to develop and codify repeatable industry-specific solutions and common use-case patterns. This will enable both Box and its partners to scale their joint offerings much more efficiently.

Year 2 (FY27) - Achieving "10x it" Scale and Impact:

Partner-Led Growth: Box's strategy culminates in empowering partners to become major growth driver. They anticipate partners will be actively sourcing new deals, developing their own sales motions, and bringing in a significant number of new logos for Box.

Deep Integration & Platform Pull-Through: Box will be fostering comprehensive, 360-degree relationships that lead to joint deployments for large, complex customer opportunities. The ultimate measure of success here is achieving substantial "platform pull-through," where partner activities drive adoption and consumption of Box's core platform and services.

Throughout this playbook, Box is systematically building partner capabilities and deepen engagement. They’re moving from foundational activities to a highly leveraged, partner-driven ecosystem that significantly amplifies their market presence.

Inside Binding Cloud Commitments Driving Marketplace Growth

Ever wondered if these billions of cloud commits driving hyperscalers' backlogs (we’ve been discussing) are just accounting tricks?

SailPoint, MongoDB, and Lyft's filings show exactly how these multi-year, non-cancelable agreements work and grow over time.

Here is what we can learn from these public companies about these binding commitments:

SailPoint: Growing Commitment Nature

SailPoint shared that they have a 5-year cloud contract that's "enforceable and legally binding" with annual spending that increase each year:

Year 1: $54M

Year 2: $59M

Year 3: $62M

Year 4: $65M

Year 5: $67.5M

Total commitment: $307.5M.

Their filing explicitly states that "if we do not meet the minimum purchase obligation during any of those years, we are required to pay the difference."

MongoDB: Strategic Approach

MongoDB took an unusual step that shows how seriously companies view these commitments. Michael Gordon (CFO & COO) told investors last August:

"In Q2, we started paying some of our cloud provider commitments upfront in exchange for better economics. We see this as a very low risk, high ROI use of our cash and one that will benefit our gross margin going forward."

The trade-off? "These prepayments will represent a negative impact to our operating cash flow in the back half of the year of roughly $20 million per quarter."

When a CFO is willing to take a $20M quarterly hit to cash flow, it demonstrates the binding nature of these commitments.

Lyft's Multi-year Minimum Spend

Lyft disclosed that they committed to spend with Amazon Web Services (AWS) ”an aggregate of at least $350 million between February 2022 and January 2026."

They must spend a "minimum amount of $80 million in each of the four years."

The consequence of missing targets? They warn that failure to meet minimums "may require us to pay the difference, which could adversely affect our financial condition and results of operations."

These examples aren't just relevant for enterprise giants.

Smaller companies sign similar commitments, just at appropriate scales. The structure remains consistent: binding contracts with minimum spend requirements and penalties for shortfalls.

For Cloud GTM and alliance leaders, these commitments create marketplace opportunities:

When companies have already allocated the cloud budget they must spend, they become motivated buyers on cloud marketplaces (where they can spend some of them).

Unlike discretionary spending that can be cut, these contracts represent protected budgets that must be utilized - creating stable opportunities for marketplace sellers

Commits tend to increase over time, as shown by SailPoint's YoY growth, as companies expect their cloud usage to expand, especially with using AI.

Are you helping your customers leverage their commits, or are you still think they are “not real”?

Unlock Your Growth on Cloud Marketplaces: Cohort 11 starts June 3

I'm thrilled to invite you to join Cohort 11 starting on June 3 (next week)! We recently celebrated our milestone tenth cohort, but with so much momentum and innovation happening in cloud marketplaces, we're just getting started.

Our Cloud GTM Leader course has grown into the industry's leading program for mastering cloud marketplaces, with 200+ alumni accelerating their growth on AWS, Azure, and Google Cloud.

But here's what truly excites me - the wins our alumni are consistently achieving:

"We went from 0 to millions on Marketplaces. Definitely have more buy-in now across the org." - one of them shared.

This doesn't happen by accident. Many of our alumni, grew from 0 to $M and from $M to $MM in cloud marketplace revenue, some scaling 4X+ YoY.

However, the playbook to unlock Cloud marketplaces isn't obvious. That's why we've worked with 50+ exceptional speakers and mentors who’re sharing their actual battle-tested strategies in our courses.

💡 Why join Cohort 11?

Learn directly from VPs of Partner of the Year winners and hyperscaler experts

Master co-sell tactics that drive real pipeline ($0 to $200K+ in 8 weeks for one alumni)

Get practical frameworks to align your org and accelerate cloud GTM

Join a growing community of 200+ cloud alliance leaders

But don't just take my word for it. We asked our recent alums, and here's what they highlighted:

“I came in knowing almost nothing and now I feel equipped to have in depth conversations with leadership and stakeholders“

“The highlight was learning a clear, actionable GTM framework and how to align teams around cloud buyer needs through ecosystem partnerships.”

Our alums highlighted the "open discussion with peers from different business functions and companies covering SaaS, Cybersecurity and Hyperscalers." They loved the "tactical elements and the measurement tools to measure progress."

"People with real experience sharing the how - how did they win, how did they fail, how did they tackle challenge X or Y”

Ready to master cloud marketplaces and accelerate your growth?

Cohort 11 kicks off on June 3rd - don't miss out on your chance to join this transformative program recognized by Canalys as a Top Education Program for Channel & Partnership professionals.