Record $419Bn Cloud Commits Signal Marketplace Momentum

Hi, it's Roman from Partner Insight. Welcome to my weekly newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

Today, I'll break down remarkable new data that signals a massive shift in enterprise tech buying: hyperscaler cloud commits just hit $419Bn after an unprecedented $38.9Bn jump in 90 days. To put this in perspective - this quarter's increase alone exceeds the combined market cap of MongoDB and Okta. I'll analyze what this means for tech leaders, sharing fresh insights from AWS, Azure, and Google Cloud's latest earnings that reveal an accelerating AI and cloud transformation.

Before we dive in:

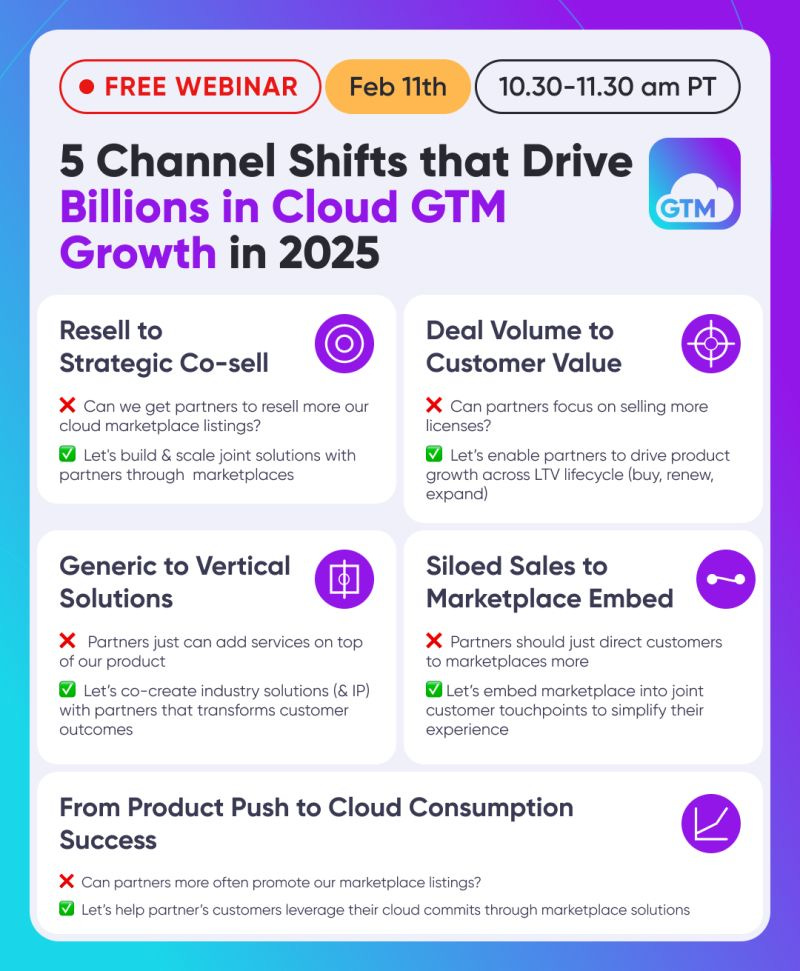

[Online Workshop] 5 Channel Shifts Driving Billions in Cloud GTM Growth in 2025.

Join me and Darren Sharpe (Microsoft Commercial Marketplace Lead - UK Services Partners) on Tuesday, February 11 as we decode the winning playbook for marketplace growth with channel partners. Sign up here

Justin Zimmerman (CEO at PartnerPlaybooks) just released 13 partner-revenue focused sessions you can join for FREE on Thursday, February 13.

My session (with Luca Gianaschi) will show you how to accelerate your growth on The Big 3 cloud platforms! Sign up here

Now, let's analyze the record-breaking cloud commitments driving marketplace momentum.

Cloud Commits Hit $419Bn: Full Breakdown

Hyperscaler cloud commits just hit a new record $419Bn total - after they added an unprecedented $38.9Bn in just 90 days.

Here is what this means for tech leaders.

To put this in perspective: The $38.9Bn increase in commitments this quarter alone exceeds the combined market cap of MongoDB and Okta. These aren't just projections - they're signed contracts.

Breaking Down the Numbers (as of Dec 31 2024):

Amazon Web Services (AWS)

Commitments: $177Bn

Growth in Q4: $13Bn

Notable: AI business achieving "triple-digit percentage YoY" growth on a "multi-billion dollar revenue run rate" despite supply constraints

Microsoft Azure

Commitments: $149Bn

Growth in Q4: $19.5Bn

Notable: Largest quarterly jump as Azure closes the gap, maintaining 31% revenue growth despite capacity constraints

Google Cloud

Commitments: $93.2Bn

Growth in Q4: $6.4Bn

Notable: Number of $250M+ deals doubled YoY, 30% revenue growth, despite capacity constraints

Three Key Shifts Happening Now

1️⃣ Acceleration Beyond Expectations: $500Bn in commits in 2025

At Partner Insight, we previously forecast cloud commits hitting $500Bn in 2026. We underestimated AI's impact on cloud acceleration.

Current growth trajectories suggest commits will cross half a trillion dollars in Q4 2025, ~6 months earlier.

2️⃣ AI Driving Unprecedented Consumption

Azure's AI services reach $13Bn run rate

AWS reports >100% YoY growth in AI on "multi-billion dollar revenue run rate"

Google Cloud sees 5x growth in Vertex AI platform adoption

3️⃣ Marketplace Momentum Building

The $419Bn in commits is accelerating software procurement through cloud marketplaces. This creates a powerful flywheel: customers commit more confidently knowing they can use these funds in marketplaces.

Google's CEO Sundar Pichai highlighted that "customers purchasing billions of dollars of solutions through our Cloud Marketplace." The scale is likely proportionately more significant for AWS and Azure.

What This Means for GTM Leaders

Enterprises are making structural, multi-year bets on cloud and AI infrastructure

These commitments are flowing into third-party software purchases

Current capacity constraints suggest sustained cloud growth as infrastructure expands

While quarterly revenue growth captures headlines, commitment numbers tell the deeper story - revealing future spending patterns and the acceleration toward marketplace-first software purchasing.

Stay with me as we break down more Q4 earnings insights, but first—don’t miss this workshop tomorrow:

5 Channel Shifts that Drive Billions in Cloud GTM Growth in 2025: Online Workshop

While most ISVs chase direct marketplace deals, the top 1% is quietly unlocking billions in "marketplace channel" opportunity. After training 200+ Cloud GTM leaders, here's their playbook.

One pattern is crystal clear:

The old approach of treating marketplaces as "just another channel" or "waiting for partners to adopt marketplaces" simply doesn't work anymore.

Join us to learn what does. It’s free.

Top performers are taking a different path and many of them leverage partners:

They recognize that channel partners will continue to influence customer buying decisions

They're creating joint solutions with partners to address specific industry challenges

They're reaching new customers and revenue streams by enabling partners to build services around their marketplace offerings

Join me and Darren Sharpe, Microsoft Commercial Marketplace Lead - UK Services Partners, for an insight-packed session where we'll break down these trends and proven strategies driving marketplace-channel success in 2025.

Darren Sharpe is one of the most experienced experts in transformation of traditional channel models in the cloud and AI era. And one of the best speakers on this topic that I know.

📅 When: February 11, 10.30-11.30 AM PT

and now back to breaking down Q4 insights.

Cloud Growth Remains Strong Across Hyperscalers

AWS: $115B Annual Run Rate, 19% Growth in Q4

AWS posted 19% year-over-year growth in Q4, reaching an impressive $115 billion annualized run rate.

Amazon CFO emphasized continued momentum across both generative AI and non-generative AI offerings:

“We continue to see growth in both generative AI and non-generative AI offerings as companies turn their attention to newer initiatives, bring more workloads to the cloud, and tap into the power of generative AI."

Microsoft Azure: 31% Growth at Massive Scale

Microsoft Azure reported 31% growth, an impressive achievement given its massive revenue base. While 1-2 percentage points lower than previous quarters, it remains a strong result.

Even excluding AI, which contributed 13 percentage points to growth, Azure’s core cloud services expanded by 18%—demonstrating solid momentum in traditional cloud migration and modernization.

Microsoft expects Azure growth to remain strong at 31-32% next quarter.

Google Cloud: $12B Revenue, 30% Growth—Despite Capacity Constraints

Google Cloud revenue reached $12 billion, reflecting 30% year-over-year growth—still among the fastest-growing hyperscalers. However, this growth was slightly below Q3’s 35% increase and some investor expectations (>30%).

A "tight supply/demand situation" suggests Google Cloud could have grown even faster if more infrastructure capacity had been available.

Capacity Constraints Holding Back Hyperscaler Growth

All three cloud giants indicated that they would be growing even faster if not for capacity limitations.

Looking ahead, Google’s CFO highlighted that 2025 growth rates may fluctuate depending on how quickly new capacity is deployed. This suggests that Q4's supply constraints could ease as new infrastructure comes online, allowing Google to fulfill pent-up demand throughout 2025.

AWS echoed similar sentiments, stating that growth may be "lumpy" in the coming years due to enterprise adoption cycles, infrastructure expansion, and evolving technology advancements.

However, Amazon remains highly optimistic:

“AWS is a reasonably large business by most folks' standards. And though we expect growth will be lumpy over the next few years as enterprise adoption cycles, capacity considerations, and technology advancements impact timing, it's hard to overstate how optimistic we are about what lies ahead for AWS customers and business.”

AI is More Than Hype

AWS

AWS’s AI business is already growing at a triple-digit percentage YoY on a multi-billion dollar revenue run rate.

CEO Andy Jassy called AI:

"Probably the biggest technology shift and opportunity in business since the internet."

Microsoft

Microsoft was the most specific on AI revenue, revealing an impressive $13B AI run rate, contributing 13 percentage points to Azure’s overall growth.

This signals real enterprise AI adoption, not just experimentation.

Google Cloud

Cloud customers now use 8x more compute for AI than they did 18 months ago.

Vertex AI platform saw 5x customer growth YoY.

These numbers underscore accelerating AI adoption across Google Cloud customers.

$255B+ in Infrastructure Investments in 2025

AWS: $100B+ AI Investment

AWS spent $26.3B in Q4 CapEx, with plans to maintain this quarterly pace throughout 2025—putting them on track for $100B+ in annual infrastructure investment, making them the largest AI infrastructure investor among hyperscalers.

"The vast majority of that CapEx spend is on AI for AWS."

Why Such Massive Investment?

AWS has seen this play out before: Lower prices → More adoption.

When asked about cheaper AI models like DeepSeek, Jassy drew a powerful parallel to early cloud adoption:

"When we launched AWS in 2006... people thought companies would spend a lot less on infrastructure. What happens is companies spend a lot less per unit... but then they get excited about what else they could build that they always thought was cost-prohibitive before, and they usually end up spending a lot more in total."

AWS expects the same pattern to emerge in AI:

"The cost of inference will substantially come down... making it much easier for companies to infuse all their applications with inference and generative AI."

AI is set to become a core building block of software development—as fundamental as compute, storage, and databases.

To enable this, AWS is pushing:

Trainium2 AI chips, offering 30-40% better price-performance than current GPU-based instances.

Project Rainier, a collaboration with Anthropic, using hundreds of thousands of Trainium2 chips to build the world’s largest AI compute cluster.

Amazon Bedrock Marketplace, featuring 100+ top AI models for customers to choose from.

Microsoft: Confirming $80B AI CapEx for the Year

The market has been eagerly awaiting Satya Nadella’s confirmation on whether Microsoft would hit its $80B AI CapEx target for this fiscal year.

Microsoft has already increased CapEx by 13% QoQ, from $20B in Q1 to $22.6B in Q2, spending $42.6B of the planned $80B in just the first half of the fiscal year.

For the next two quarters, Microsoft expects CapEx to remain at Q2 levels, effectively confirming the $80B annual spend despite concerns around DeepSeek and competitive AI pricing.

Google Cloud: AI Investment Surges nearly 50% to $75B in 2025

In response to high demand (and increasing competition?), Google is boosting its AI infrastructure investment to $75B in 2025, up from ~$52B in 2024.

This capital will primarily fund AI-ready servers and data centers, reflecting Google's confidence in sustained cloud demand.

Google continues to advance its custom silicon strategy.

In Q4, there was strong adoption of Trillium, Google’s sixth-generation TPU. Sundar Pichai highlighted:

"Trillium delivers 4x better training performance and 3x greater inference throughput compared to the previous generation."

This technological edge is a key differentiator for Google Cloud’s AI offerings.

The Bigger Picture

Despite their massive scale, cloud growth remains strong. With hyperscalers planning to invest $255B+ in AI infrastructure in 2025, this trend is set to continue.

This raises a key question for leaders: If AI is becoming as fundamental as cloud and compute, how are you rethinking your product, GTM, and partnership strategy?

Marketplace Transactions Reach Billions

Google Cloud CEO Sundar Pichai highlighted the growing role of partners and cloud marketplace, stating:

"Customers are purchasing billions of dollars of solutions through our Cloud Marketplace."

Google Cloud’s enterprise momentum is accelerating, with strategic deals reaching new highs and partners playing an increasingly critical role in large enterprise wins:

$250M+ deals have doubled year-over-year

Several $1B+ customer deals closed in 2024

These numbers underscore the massive customer shift to cloud and AI—and their increasing reliance on cloud marketplaces for enterprise adoption.

Given AWS and Azure's larger market share, it’s safe to assume their marketplace scale is even greater.

What This Means for Tech Leaders

The record-breaking $255B+ infrastructure investment in 2025 signals hyperscalers’ aggressive expansion—driving cloud, AI, and marketplace growth at an unprecedented pace.

This rapid evolution will:

Accelerate AI-driven applications and cloud infrastructure growth

Further establish cloud marketplaces as a dominant distribution channel

How is your organization adapting its cloud marketplace strategy to capitalize on this shift?

P.S. If you find these insights valuable, please share this newsletter with your network - it’s free.

Have feedback or a topic you'd like us to cover in a future edition? Just hit reply—I’d love to hear your thoughts!