Secret Timeline to $1B in Marketplace Revenue & How Distributors Amplify Growth

Hi, it's Roman from Partner Insight—welcome to my newsletter on winning Cloud GTM and partnership strategies.

This week, I'll break down CrowdStrike's little-known 6-year journey to $1B in annual AWS Marketplace sales, revealing the three phases that transformed their cloud revenue. You'll also discover why distributors are driving 166% revenue growth for AWS partners (contrary to channel disruption predictions) and how GitLab solved the "hidden partner" problem that was silently limiting their growth potential.

💡 Before we dive in:

Join us on April 15th at Google's San Francisco office for our special Google Next Strategic Debrief. You'll gain exclusive insights and key highlights from Next, along with insider strategies on accelerating growth with GCP marketplace.

Don't miss our April 24th live reveal of the "2025 State of Cloud Marketplace & Co-Sell" comprehensive research. Learn firsthand what's driving results for top-performing ISVs on marketplaces.

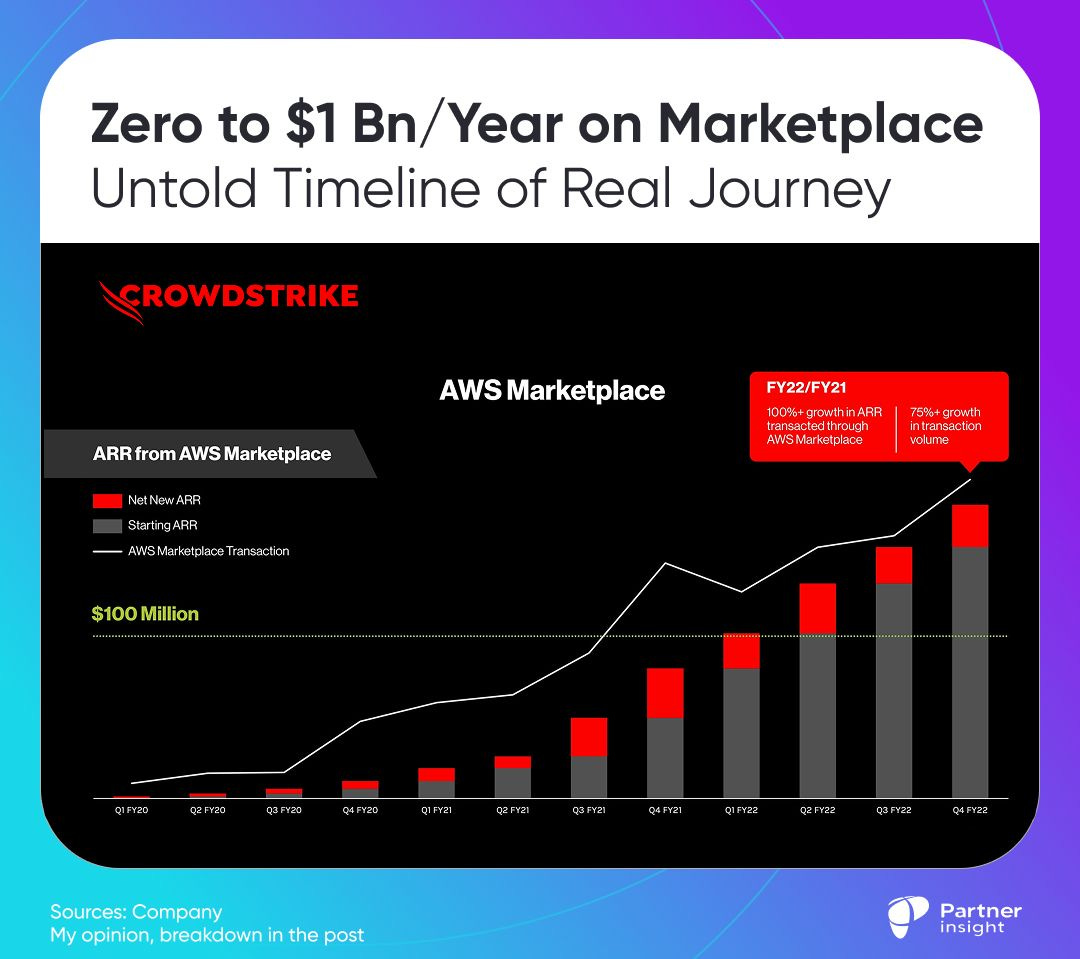

Zero to $1 Bn/Year on Marketplace: Untold Timeline of Real Journey

CrowdStrike and Splunk have just made history as the first companies to exceed $1 billion in annual AWS Marketplace sales. But this massive achievement wasn't an overnight success – it was the result of deliberate strategy and years of execution.

The chart from early days reveals what many marketplace beginners overlook: building momentum takes persistence.

The Multi-Year Journey to $1Bn

Looking at CrowdStrike's marketplace timeline is eye-opening:

2018-2019: First steps on AWS Marketplace with minimal traction

2020: Slowly building foundation, barely visible on the revenue chart

2021: Crossing the $100M milestone as growth accelerates

FY22/FY21: 100%+ growth in ARR transacted through AWS Marketplace

2023: Hitting the $1B in total sales milestone

2024: Finally broke the $1B annual sales barrier, with 91% YoY growth

That's a 6-year journey from marketplace entry to $1 Bn in annual sales milestone. Even a category-defining company with perfect product-market fit needed years of marketplace investment before seeing hockey-stick growth.

Three Phases of Marketplace Maturity: Learnings from CrowdStrike

1️⃣ Foundation Building

CrowdStrike started by setting fundamentals:

Creating marketplace listings

Building internal marketplace expertise

Developing marketplace operational capabilities

2️⃣ Enterprise Scale

With basics in place, they focused on enterprise-grade marketplace adoption:

Strategic co-selling with AWS field teams

Enabling customers to leverage AWS commitments

Driving larger enterprise deals with upsell (platform adoption)

3️⃣ Channel Integration

The critical acceleration came when CrowdStrike unified channel partners with their marketplace strategy:

Focused on channel partner private offers through AWS Marketplace

Enabled distributors to transact through the marketplace

This led to "3,548% YoY global growth in distributor sales" in last year alone

Why This Timeline Matters

What began as a small line on a revenue chart grew into a business transformation with Cloud GTM now producing deals 4X larger than traditional channels. CrowdStrike marketplace customers are also adopting 7 platform modules on average.

For partnership leaders, this serves as both inspiration and a reality check. The $1B milestone is achievable, but it requires:

Executive commitment across multiple fiscal years

Evolving marketplace strategy as you scale

True integration between traditional channel and cloud marketplace motions

Building internal expertise and operations specific to marketplace

The companies reaching Cloud GTM pinnacle took the long view, even as they drove impressive quarterly growth along the way.

Crucially, CrowdStrike shows that marketplace success doesn't mean bypassing partners – in fact, they achieved their biggest growth by bringing partners along, with partners sourcing over 60% of new logos.

What is your learning from marketplace pioneers' rapid progression from $1Bn via marketplace over years to 1Bn+ annually?

Google Next Strategic Debrief: Cloud GTM Leaders Gathering in San Francisco - April 15

Join us on April 15th for curated evening bringing together cloud alliance leaders to break down key insights from Google Next 2025.

We'll cut through the noise to focus on what actually matters in Google Cloud Marketplace strategy today and connect Cloud GTM leaders with each other and Google's leadership team.

When: Tuesday, April 15, 4.30-7.00 PM

Where: Google’s SF office, One Maritime Plaza, 300 Clay St, San Francisco, CA 94111

Featured Speakers:

Subhash Jawahrani, Head of Databases & Analytics, Google Cloud Marketplace

Roman Kirsanov, CEO of Partner Insight

Additional Google Cloud and marketplace leaders to be announced soon

You will learn insider perspectives on accelerating growth on GCP marketplace, leveraging $93Bn+ in Google Cloud commits and the latest marketplace innovations.

Agenda:

4:30 PM - Doors open, welcome networking

5:00-6:00 PM - Strategic Insights

Beyond the headlines: Key GCP marketplace developments from Next 2025

New co-sell models and partner ecosystem evolution

Strategic intelligence: Which marketplace trends are gaining traction

AI marketplace opportunities unique to Google Cloud

6:00-6:20 PM - Peer Small Group Discussion

Implementation strategies for new GCP features and programs

Questions we should all be asking to maximize marketplace revenue

Practical applications for different marketplace GTM models

6:20-7:00 PM - Curated Networking

Continued discussions with Google Cloud leaders

Connect with fellow marketplace strategists over refreshments

Audience:

VPs & Directors of Cloud Alliances from leading ISVs

Partnership Leaders from top cloud-native companies

Select alumni from our 200+ strong Cloud GTM Leader community

Limited participants to ensure meaningful conversations and access to Google Cloud leaders.

Distributor critical role in Cloud Marketplace success

Weren't cloud marketplaces supposed to disrupt distributors? Actually, AWS data shows distributors could be the fastest way to grow in Cloud GTM. Lets explore this.

Over the last two years, Amazon Web Services (AWS) partners working with distributors in the public sector saw impressive growth:

133% increase in transacting partners

155% growth in customers

166% boost in revenue

"Distributors have been a key part of our go-to-market program for partners that are not able to have a direct relationship with AWS, or partners that do have a direct relationship with AWS need access to things that they just can't develop on their own” - explained Rishi Bhaskar, AWS Director of Public Sector Partner Sales at reInvent 24.

What drives this synergy?

Distributors solve key challenges that prevent many software companies and smaller partners from taking advantage of AWS and marketplace opportunities.

They handle complex contracting, provide back-office support, and manage billing - removing major barriers to entry.

Their value-add also includes unified procurement combining cloud and traditional IT, technical expertise and go-to-market support.

Ingram Micro: A Case Study on Evolving Distributors

As AWS Distributor of the Year (2023, 2024), Ingram showcases how distributors are adapting to cloud marketplace dynamics.

Ingram highlights studies that >40% of software buyers today have committed spend agreements with hyperscalers - key reasons for customers to use marketplaces.

Ingram support for partners and ISVs spans all 3 key stages:

1️⃣ Build

Helping partners establish AWS foundations and optimize marketplace presence. It assists in navigating the AWS Partner Network (APN) and helps to scale and optimize tech solutions on the AWS Marketplace.

2️⃣ Market

Running co-branded campaigns, demand generation in AWS marketplace/ecosystem. partner portals help streamline the sales process and drive lead generation.

3️⃣ Co-Sell

Providing strategic marketplace guidance, stakeholder connections for ISVs and channel partners, and professional services to drive marketplace revenue.

Ingram's platform integration with AWS now automates everything from listings to private offers. Ingram has 160K solution provider customers.

The impact?

Distributors bridge traditional IT procurement with cloud marketplaces. They provide essential capabilities that accelerate partner traction and cloud sales— rather than being displaced by marketplaces, they are evolving to amplify them.

This explains why AWS considers distributors strategic in accelerating partnerships and achieving marketplace traction.

Research indicates that on average AWS Marketplace helps partners close deals 50% faster while delivering a 234% ROI for those investing in marketplace presence.

How GitLab is Mastering the Partner Influence on Cloud Marketplaces

David Mauer, frm. Head of Ecosystem Cloud Programs at GitLab, our Cloud GTM Leader course speaker, mentor and alum recently shared his insights on transforming GTM with partners at GCP marketplace. David also just started as VP of Channel Sales at LucidLink - congrats!

GitLab's journey with Google Cloud Marketplace reveals a critical insight that many ISVs miss – the non-obvious influence of resellers in the marketplace ecosystem.

The Hidden Partner Challenge

Before implementing Google's Marketplace Channel Private Offers (MCPO) program in February 2025, GitLab faced a significant complexity:

200+ deals in the last 2 years were impacted by "hidden partners" – resellers who controlled customer billing IDs without GitLab's knowledge.

This created unexpected margin negotiations and deal delays. Gitlab was already in the Scaling stage of its marketplace maturity but needed to optimize its partner management.

David and his team took a strategic approach:

Developed a structured rate card with distinct partner categories (Authorized Partners, Hidden Partners, True Co-sell Partners) with clear negotiation ranges based on partner value contribution

Implemented a verification process requiring early identification of Cloud Billing ID ownership to prevent surprises late in the sales cycle

Created a comprehensive documentation and training program for their sales teams to properly identify, tag, and engage with resell partners

Established a clear support structure with dedicated Slack channels for assistance

Streamlined their Quote-to-Cash process to accommodate the new MCPO requirements while maintaining margin control

The MCPO implementation has provided much-needed structure to their partner margin management.

By categorizing partners and setting clear negotiation ranges, GitLab has:

Protected NetARR while maintaining strong partner relationships

Greater visibility into the procurement process

“Our sales teams now have greater visibility into the procurement process, resulting in more predictable deal closures and improved customer experiences.” highlights David

The Key Insight

The prevalence of hidden partners controlling customer billing IDs was a revelation – something neither GitLab nor their customers fully understood until GCP MCPO launched.

This highlighted the critical importance of early billing ID verification as the foundation for successful marketplace transactions.

GitLab continues refining their MCPO strategy in 2025, with focus on stronger co-sell motions with true value-add partners now that they have a framework for recognizing and rewarding contributions.

Live launch: 2025 State of Cloud Marketplace & Co-Sell: Key Insights for Revenue Teams

In 2024, the fastest-growing ISVs saw 2-4X larger deal sizes on cloud marketplaces vs direct sales. Clearly cloud GTM is no longer a "nice-to-have" but a strategic growth channel. But here's the challenge:

While nearly half B2B SaaS companies report their top-performing deals involve marketplace or co-sell, most teams still struggle with fundamental questions:

Does the marketplace truly drive net-new revenue or just shift channels?

How do co-sell vs. non-co-sell deal sizes and win rates actually compare?

What operational tactics correlate most with marketplace success?

Why do some teams see 40X+ marketplace growth while others stall after initial transactions?

The market is flooded with opinions but starved for concrete data and benchmarks.

That's why we've partnered with Clazar to launch the "2025 State of Cloud Marketplace & Co-Sell" - a comprehensive research into what's actually working for top-performing teams.

After collecting insights from cloud GTM leaders across growth stages, the patterns emerging are fascinating (and sometimes counterintuitive).

Join Our Live Data Reveal: April 24th, 10-11AM PDT

For the first time, we'll unpack the findings with standout Cloud GTM leaders:

Casey Newton - Global AWS Leader at Zoom

Sarah Jackson - Cloud & Partner Alliances Director, UserTesting

Trunal Bhanse - CEO of Clazar

The research explores critical questions like:

How the most successful companies structure their co-sell engagements

Where sellers are seeing shorter cycles and higher ACVs

The tactics that are delivering measurable revenue results (not just vanity metrics)

How top teams are aligning Sales, RevOps, and Partnerships around cloud GTM

Based on patterns I'm seeing in the early data, this may challenge several "best practices" that many companies are following without results.

As a bonus, registrants will first receive access to the full report. This is the playbook many of you have been asking for, backed by actual performance data rather than theory.

This research validates what I've observed working with 200+ Cloud GTM Leader alumni: the gap between top performers and everyone else is widening rapidly, but the playbook for success is becoming clearer.

P.S. Thank you to everyone who contributed to the survey