Hi, it's Roman from Partner Insight—welcome to my newsletter on winning Cloud GTM and partnership strategies.

This week, we're diving into exclusive insights revealed in our recent Google Cloud Marketplace event by GCP leaders, top ISVs and partners.

I'll share the strategies behind remarkable 42X YoY marketplace growth that Glean achieved through internal and co-sell alignment. We’ll discuss why Databricks sees 2X higher conversion rates from Google traffic on its GCP marketplace listings, and how World Wide Technology managed to drive 40% of their marketplace business to be net new revenue, while also recently hitting $1Bn across top marketplaces.

This edition wouldn't be possible without Rachael Wright, a brilliant Cloud GTM leader and our course alumna, who helped not only to host our event but also to distill its most valuable insights.

Let's dive in.

Partner Ecosystems: The Secret Behind Accelerating Growth - Jay McBain's Analysis

In his keynote, Jay McBain, Chief Analyst at Canalys, stressed the growing power in cloud marketplaces and a fundamental market transformation: "Services are growing faster than products. Partners are growing faster than vendors." This trend is shaping the competitive landscape among tech vendors and hyperscalers.

Perhaps his most striking revelation was about Google Cloud's acceleration since Q2‘22, when they committed to a "100% Partner-Assist" strategy. Since making this strategic pivot, Google Cloud growth has accelerated and shows no signs of slowing down.

Jay framed this as part of a larger competitive and ecosystem narrative: "How Microsoft outgrew AWS, GCP is attempting to outgrow Microsoft" — highlighting a fundamental shift in cloud market dynamics where partner ecosystems are becoming the primary growth drivers.

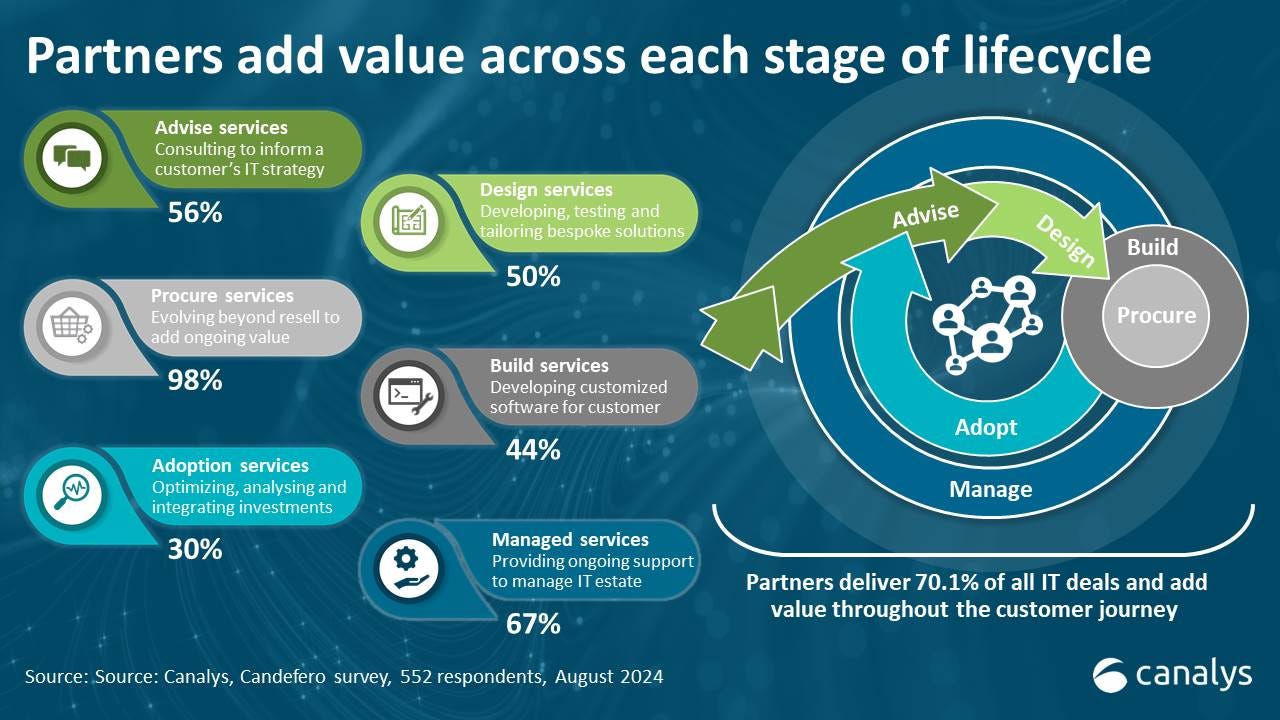

His data shows partners no longer just want leads; they demand recognition for the value partners bring throughout the entire customer journey. This includes:

56% of value delivered in Advisory

98% in Procurement

50% in Design

44% in Build

67% in Managed services

30% in Adoption

This comprehensive partner involvement transforms how customers adopt and deploy products and services, creating opportunities for integrating them even deeper into (your) marketplace strategies.

Explosive Growth and Strategic Vision: Insights from Dai Vu, Managing Director of GCP Marketplace

In his keynote, Dai Vu, Managing Director of Google Cloud Marketplace & ISV GTM Initiatives, shared impressive growth metrics and strategic priorities underscoring Google's commitment to making their marketplace the primary online distribution model for cloud software.

The numbers tell a compelling story: Google Cloud Marketplace is experiencing impressive momentum with 160% YoY growth in new listings and 170% YoY growth in transaction value through channel partners. Perhaps most striking is the 500% YoY increase in Gen AI transaction volume – clear evidence that AI is not just accelerating, but transforming the marketplace adoption.

The marketplace is also evolving its financial mechanisms, with the launch of Marketplace Customer Credit Program (MCCP) - a 3% general use Google Cloud credit called for customers purchasing eligible marketplace solutions for the first time – a lever that's proving critical for jointly winning new customers. GCP also relaunched upfront multi-year payments with drawdown capabilities.

Strategic Benefits for ISVs

ISVs strategically leveraging the marketplace are seeing significant advantages:

42% deal acceleration through standardized agreements

35% increase in win rates via co-sell engagements and access to committed cloud spend

32% larger deal sizes on average

However, "success in Marketplace can't be a side project or a go-to-market experiment," Dai Vu emphasized. "You have to approach it as a very long term, strategic revenue growth play that's going to scale over multiple years."

2025 Marketplace Priorities

Google Cloud is doubling down on several key initiatives:

Unlocking the channel to expand the partner ecosystem

Expanding offerings beyond traditional categories

Harnessing the power of data and AI to drive innovation

Accelerating time to value for customers and partners

Driving GTM and incentives - including expanding the Marketplace Customer Credit Program and introducing deal-level, variable revenue sharing

Practical Guidance for ISVs

For ISVs looking to maximize their marketplace success, Dai Vu shared practical advice:

Designate a dedicated alliance leader as your single point of contact, backed by an executive revenue sponsor

Ensure sales compensation neutrality and invest in sales enablement

Be strategic about co-sell: register meaningful deals with clear asks for Google sellers

Think beyond traditional "partner-sourced" or "Google-sourced" deal categories to create collaborative impact

In the early days you are going to have to lean in quite a bit. Focus on specific segments or verticals initially and amplify those early wins

Mastering Co-Sell & Joint GTM: How Top ISVs Scale with Google Cloud Marketplace

Our Co-Sell & Joint GTM panel featured an exceptional lineup of leaders from Glean, Databricks, Google Cloud, and Tackle and was one of the most anticipated.

The Alignment & Co-Sell Advantage: Glean's 42X Marketplace Growth

Isaiah Lott, Head of Alliances at Glean, shared a counterintuitive approach that helped them achieve remarkable results: instead of immediately seeking external help, they focused internally first.

"Most look externally and ask 'Hey Google, how can you help me?' but a lot of success is changing internal business so it's aligned with what customers want."

Lott's methodical approach included:

Finding and enabling internal champions: Creating internal win wires demonstrating why specific transactions went via marketplace and how this were easier

Continuous seller enablement: Ensuring sales teams knew both how to operate in the marketplace and how to communicate its value to customers

Finding the right talk track: Isaiah took 100s of calls with FSRs until he found the talk track. He iterated. He listened. He asked questions like “what made a difference in this sales process that helped you lean in.” He did it until he discovered what resonates with cloud sellers

He highlighted that “Everyone wants to partner with Google, but the reality is what dollars are you making Google sellers? And how can you lean into that story?”

Honing co-sell: Even as Head of Alliances Isaiah joins co-sell calls as often as he can/needs. He starts with an alignment call. He will do a Glean, GCP, and customer call when he has the opportunity.

This relentless focus on internal and external alignment contributed to Glean's extraordinary marketplace trajectory, turning them from minimal marketplace traction to a top 2 AI startup on GCP Marketplace with a 42X increase in transactions YoY.

For startups specifically, Lott stressed that marketplaces are becoming increasingly critical. He encourages startups to think carefully about their story with the clouds and how you communicate it to them. “You can't just do that same sales talk track. You have to find what matters to your GCP counterparts and really hone in,” Lott advised, underscoring the importance of tailored messaging in the cloud marketplace ecosystem.

Databricks' Marketplace-First Mentality

Drew Herd, Sr. Director WW Business Development & Strategy at Databricks - Google Cloud, emphasized their fully committed marketplace approach:

"Databricks is Marketplace first all the time and built on GCP. We're a consumption-first company."

Their strategy yields over 500 new signups monthly from Marketplace alone, leaning on several key elements:

Pay-as-you-go is critical on marketplace: Creating frictionless paths for customer adoption

Deep marketplace alignment with their sales process: Integrating marketplace fully into their customer journey and acquisition strategy

Realistic expectations: "We don't look at Google Sellers as people who are ever going to sell Databricks. We look at them for top of funnel and bottom of funnel."

Higher conversion rates: Databricks sees 2X higher conversion rates on its GCP marketplace listings from Google traffic compared to traffic from their own website. The key differentiator? Buyers from Google arrive with their billing IDs already in place, significantly streamlining the purchase process.

Drew's assessment underscores the power of PAYG strategy and that even for a marketplace powerhouse like Databricks (sporting 60% YoY growth), there are "no shortcuts" to marketplace success.

The Google Cloud Perspective on Marketplace and AI acceleration

Oliver Schulz, Business Development Manager at Google Cloud Marketplace, offered an insightful perspective on what distinguishes leading partners:

"Both Top 10 ISVs and scale partners treat marketplace not as a side hustle, but as a very integral part of their business."

This complete integration of marketplace into core business strategy separates those achieving extraordinary results from those merely experimenting.

Oliver Schulz highlighted that GCP is leading the shift to AI Agents with the announcement of the AI Agent Ecosystem Program in November 2024 and creating a dedicated AI Agent category in Google Cloud Marketplace. He outlined three key convergence trends they're already seeing:

Service partners like system integrators are essentially becoming build partners by providing repeatable agents and repeatable IP

ISVs are enhancing their software stacks with agentic capabilities

On the buy side, customers can use autonomous agents to optimize spend and pricing negotiations, extracting efficiencies that can be reinvested into their business

Schulz encouraged anyone with interesting agentic AI capabilities to stay tuned because GCP has really bold plans, and to reach out to him directly.

Moving Up the Funnel with Tackle

John Jahnke, CEO of Tackle.io, also challenged the common misconception that marketplaces are purely a fulfillment channel:

"Most people who are just entering Marketplace think about fulfillment, bottom of funnel. But when you start talking about data, you have to think: How do you move as far up the funnel as possible?"

This shift in perspective—from seeing marketplaces as merely a transaction mechanism to leveraging them as a comprehensive GTM channel—represents the evolution in marketplace maturity that the most successful ISVs have embraced.

Key Takeaway: Internal & External Alignment Drives Marketplace Success

The panel revealed a consistent theme: marketplace excellence requires both internal transformation and external alignment. The most successful partners don't view GCP Marketplace as a separate channel, but as an integral component of their overall GTM strategy—driving alignment across internal sales teams, partner operations, and customer journeys.

The Channel R/evolution in Cloud Marketplaces: 50% of Sales Soon to Flow Through Partners

One of the most revealing panels brought together cloud marketplace experts from both the ISV side (Snyk and Fastly) and the channel partner perspective (World Wide Technology), moderated by Marc Harpster, Resell Strategic Initiatives Lead at Google Cloud.

Channel Partners: From Revenue Share to Growth Engine

The panel revealed a surprising insight that challenges conventional thinking about cloud marketplaces. Joshua Bushman of World Wide Technology (WWT) shared that what they initially expected to be just a "share shift" in revenue has instead become a powerful net new business engine:

"We've found that 40% of our marketplace business is actually net new," Bushman explained. WWT has achieved remarkable success, hitting $1 billion through the top 3 marketplaces.

Marc Harpster, who helped launch Marketplace Channel Private Offers (MCPO) at Google Cloud after spending years at AWS, noted that Google's differentiator is letting channel partners maintain billing relationships and customer ownership—creating stronger alignment between all parties.

ISVs Shifting to Channel-First Strategies

Rebecca Spataro, Global Cloud Alliance Manager at Snyk, revealed that her company has deliberately pivoted toward a channel-centric approach in 2025:

"We entered this year with the intention of building a channel-first strategy, merging GSIs, channel partners, and cloud providers to serve customers better while achieving the scale and growth we're targeting."

She acknowledged that integration doesn't happen overnight: "It's okay to experience growing pains because everyone is headed toward full alignment. Marketplace is a team sport that traverses finance, deal desk, sales, and alliances."

The Convergence of Direct and Channel in Cloud GTM

Erica Ford, Senior Director of Cloud Alliances at Fastly, shared a candid perspective on their journey from a primarily direct sales model toward embracing channel partnerships:

"Cloud Alliances had been siloed, but with the growth of MCPO, we've seen those channels converging. The early transition was challenging—we didn't even know which resellers were involved in deals we had traditionally done direct."

At the same time, Ford sees cloud marketplaces becoming the default purchasing method: "Marketplaces make things faster from the procurement side, so our sellers can spend time on solutions and delivering value rather than paperwork."

Building Successful ISV-Channel Relationships

What makes channel partnerships work in practice? Snyk and WWT offered a behind-the-scenes look at their successful collaboration, which has already closed multiple major deals.

"The earlier everyone can connect to discuss logistics, process, stages, and steps, the better it will be for everyone," Spataro emphasized.

Their approach includes monthly or bi-monthly pipeline reviews looking as far as six months ahead—allowing them to have solution-focused conversations rather than transactional ones.

Marc Harpster offered a crucial insight that ties it all together: "Marketplaces are meant to remove friction, but you still need to know who is doing what and who is working with whom. Communication remains essential."

As Canalys predicts that more than 50% of marketplace sales will flow through channel partners by 2027, this panel offered a timely blueprint for success in the evolving cloud GTM landscape.

Closing soon: Your Cloud GTM expertise needed (10 min survey, $25 gift card)

We're approaching the final stage of our first major Cloud GTM research on "Cloud Marketplace & Co-Sell: State of the Union in 2025," and your expertise would make a significant difference.

Having just taken the survey myself, I can confirm it takes 10-15 minutes to complete thoughtfully. Your insights will form the foundation of what may become an industry benchmark that we're planning a major educational campaign around.

This research explores critical questions:

Which marketplace strategies are delivering measurable revenue results

How successful companies structure their co-sell engagements

What realistic success metrics look like across different growth stages. etc.

Just to be clear:

Your information remains strictly confidential - all data will be used only in aggregate form

We will not share individual responses with sales teams (Clazar is our research partner)

High-level insights are valuable - no need to disclose sensitive details

For your valuable contribution, you'll receive:

$25 Starbucks gift card 🎁 (sent upon completion, requires a business email)

Exclusive early access to the complete findings before public release

Ability to benchmark your performance against industry peers

The survey closes soon, and your participation would significantly strengthen this resource for our entire Cloud GTM community.

Thank you for considering this final request to share your expertise!

I found Jay's comments to be interesting around the traditional channel model. He said value-add services around software and technology products are the new measure, with discounts, rebates, etc. taking a back seat. Marketplace transactions are driving this change.

I agree, value-add metrics are finally becoming the standard for partner evaluation and incentives - a positive shift for the entire ecosystem.

Jay recognized this trend years ago