Okta 3X Deal Size with Partners & 50% of Enterprise Sales Going Digital in 2025

Hi, it's Roman from Partner Insight. Welcome to my weekly newsletter on winning Cloud GTM strategies and trends in marketplaces and tech partnerships.

The data tells a fascinating story of market transformation: Okta, winner of 2024 AWS Global Marketplace Partner of the Year, recently reported 100% of their top deals were partner-influenced. Forrester projects over 50% of $1M+ enterprise purchases will shift to digital self-serve channels like marketplaces this year (2025). We'll also break down key obstacles holding companies back from marketplace growth.

Before we dive in:

Join me and leaders from AWS, Microsoft, Adobe and Forrester at the CloudBlue Monetization Summit (Feb 4-5) where I'll be exploring these marketplace shifts. Register here.

Looking to accelerate Marketplace Growth with Channel Partners? Our 3-week intensive course starts February 18th - perfect timing as Canalys projects 50% of marketplace revenue will flow through partners by 2027. Learn more & Enroll

Now, let's analyze how market leaders are navigating these shifts.

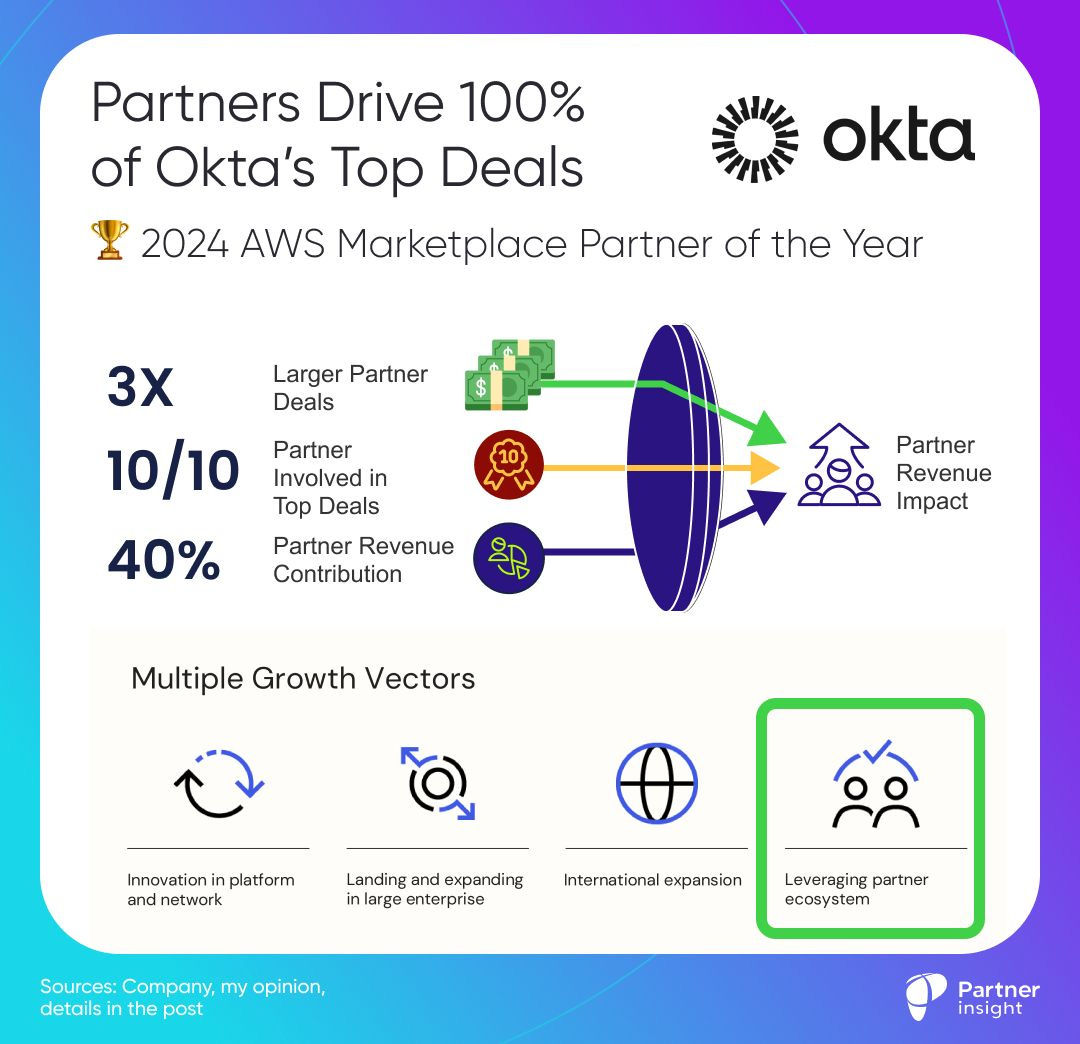

Partners Drive 100% of Okta’s Top Deals

In a strong validation of its partner-first growth strategy, Okta achieved impressive results last quarter: 10 out of 10 top deals were partner-influenced. The company also won both 2024 AWS Global Marketplace Partner of the Year and Google Cloud Technology Partner of the Year awards.

But beneath these accolades lies a deeper transformation worth studying.

The Okta’s Data Tells a Compelling Story:

Partner deals are 3X+ larger than average direct sales

8 out of top 10 global deals in Q2’24 had partner contribution

"All of our top 10 deals in Q3 involved partners... approximately $20M in ACV" - CEO

40%+ of business goes through partners "in terms of billing on their paper"

What's fascinating is how Okta proactively engineered this shift.

Let's break down their playbook:

Embracing Multi-Partner Collaboration

CFO Brett Tighe revealed that the company involves various types of partners at the same time:

"What's interesting about those top 10 deals [all involved partners]... it was GSIs, ISVs, marketplaces, traditional VARs. It was a mix of them all."

This wasn't accidental. Okta deliberately built an ecosystem spanning:

Global System Integrators (GSIs)

Cloud Marketplaces

ISVs

VARs

MSPs

CRO Jon Addison frames it clearly:

"Our partner ecosystem isn't just an extension of our sales team—it's a vital component of our growth and innovation strategy."

Aligning with Partners for Success

CEO Todd McKinnon personally prioritizes partner-first strategy and GSIs in particular: "[GSIs] it's something I've personally been working on, and we have a high priority on, and I'm excited to make progress."

Their strategy includes executive-level engagement and tactical alignment - CFO explains:

"A good example would be one of those GSIs coming to our executive leadership offsite…to go spend time with us, be able to align better, be able to say, hey, this is where we -- how we can partner better. We obviously have teams dedicated to each one of these partners.

And so, it's really us diving in deep and trying to go through the tactical of, OK, you're going to do this, we're going to do that, how can we help each other, both make each other a bunch of money?”

Cloud Marketplace Excellence

The company won 2024 Amazon Web Services (AWS) Marketplace Global Partner of the Year.

This recognized Okta’s record-breaking results, driven by “focusing on co-selling and co-innovating with AWS for global customers”.

Okta's cloud strategy shows impressive technical depth:

Product is natively built on AWS with over 25 integrations live today

It was a launch partner for AWS Fabric, AWS Amplify, and AWS Security Lake, among others.

The company's presence in the AWS Marketplace has grown exponentially since their partnerships was formalized in 2021, focusing on private offers, co-selling, and ongoing market expansion.

Okta's was also recognized in 2024 as Google Cloud Technology Partner of the Year 2024 for Productivity and Collaboration.

Partner-First Growth Strategy

The company leaned on partners and marketplaces over the last few years, before formally announcing its “partner-first growth strategy” in 2024.

Okta committed to elevating partners' role across all functions - from sales and marketing to product development and customer service.

As Bill Hustad, SVP Partner & Alliances explains:

"We're on a multi-year journey to become a world-class, partner-first company. We realize that embedding partners into the fabric of your company doesn't happen overnight. We’re committed to evolving our go-to-market motion, co-investing across the ecosystem, and elevating the partner experience.”

The partner opportunity in identity and security is massive. Okta underscores that “security is a partner-driven market. According to Canalys, 73% of global IT spending goes through partners, but that figure jumps to over 90% in cybersecurity.”

As a core security technology, identity is naturally partner-driven - a fact Okta has now masterfully leverages.

What's your view - is this partner-first approach the new blueprint for SaaS growth?

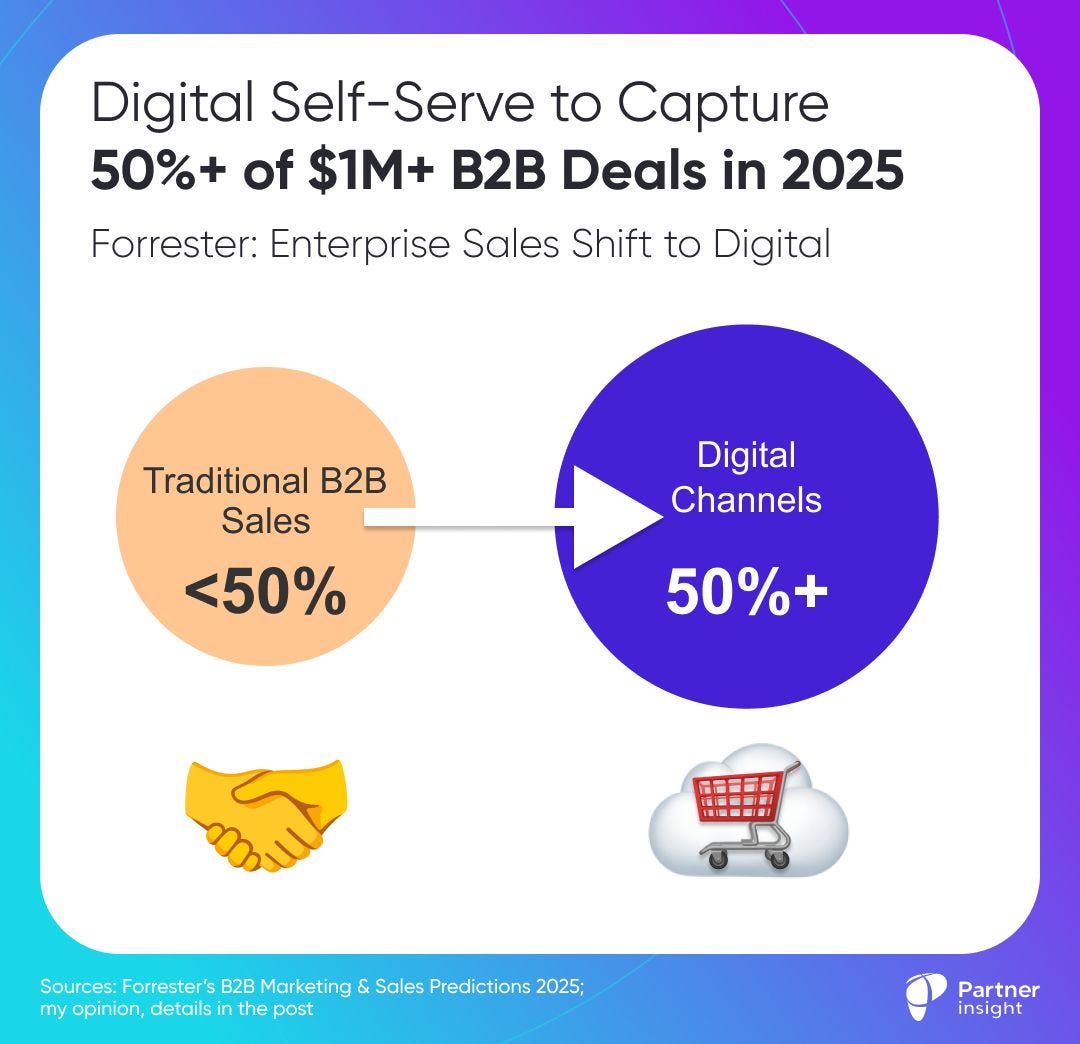

Digital Self-serve to Capture 50%+ of $1M+ B2B Deals in 2025

It's 2025 and enterprise sales are at the tipping point. Over 50% of $1M+ deals will be sold this year via self-serve digital channels like marketplaces. This reshapes the entire GTM playbook.

Forrester's analysis reveals a fundamental shift:

By the end of 2025, the majority of million-dollar+ enterprise purchases will move to self-serve channels - digital marketplaces and vendor websites.

It's a complete inversion of how enterprises were buying just a few years ago.

Sales teams aren't disappearing though, but evolving into guides and navigators. They will spend less time on transaction processing and more on understanding customer needs, driving better buying experiences and higher-value deals.

Three interconnected trends add to this transformation:

Enterprise buying now is VERY collaborative

This year over 50% of younger buyers will consult 10+ external influencers before purchase (up from 30% in 2024).

This means 10 sources outside of the buyer organization (online communities, partners, etc) are now involved in their purchase decisions.

Digital channels, like marketplaces, are uniquely positioned here - they combine digital purchasing with built-in social proof through reviews, rankings, peer validation and increasingly involve partners. (Canalys predicts 50% of cloud marketplace transactions will flow through channel partners by 2027).

Ultimately, self-serve digital channels aren't just simplifying procurement - they're becoming platforms where buying decisions happen.

This explains major recent enterprise software moves

When Salesforce, the pioneer of traditional ecosystem building, increasingly selling its products on Amazon Web Services (AWS) marketplace, it signals more than a new distribution channel. They're following where enterprises increasingly prefer to buy.

The urgency to get smart on marketplaces is critical

Just 7% of marketing leaders believe they have the right skills and competencies to meet their revenue targets in 2025.

From what we see in Partner Insight, this talent gap is particularly acute in digital channels and marketplace expertise.

But here's where it gets really interesting:

While digital purchasing accelerates, Forrester predicts that the number of companies pursuing Product-Led Growth will actually decline from 25% to under 20%.

Why? PLG is difficult and many are now betting on AI-driven sales instead.

This perfectly explains the growth of co-sell strategies on cloud marketplaces. Rather than relying solely on product-led adoption, companies now leverage cloud providers' enterprise relationships to drive growth.

It's not just about listing on marketplaces - it's about deep GTM alignment with hyperscalers who already own the enterprise relationship.

What's your take on this shift & how do you change your GTM?

5 Cloud GTM Obstacles Holding Your Marketplace Growth

Why some SaaS companies struggle to grow on cloud marketplaces? These 5 root causes may not be what you expect.

1️⃣ Strategic Cloud GTM Misalignment

The most critical blocker isn’t technical—it’s strategic.

Many companies treat cloud marketplaces as "just another channel," but success demands a fundamental GTM shift.

Winning in cloud marketplaces requires embracing a partner-led, customer-centric, consumption-focused model where you align with the cloud provider’s priorities—not the other way around.

You’re entering ecosystems of Amazon Web Services (AWS), Microsoft Azure, or Google Cloud as their partner, not the reverse.

2️⃣ Cloud & Customer Centricity Gap

The "build it and they will come" approach fails spectacularly on marketplaces.

Successful ISVs deeply embed themselves in the cloud ecosystem by:

Mapping their solution to the cloud provider’s growth areas and strategic initiatives.

Understanding how and why customers discover, evaluate, and buy solutions in cloud marketplaces and on each cloud platform.

Aligning GTM motions with the cloud provider’s sales cycles and engagement models.

3️⃣ Immature Co-Sell

Many SaaS companies struggle with co-sell readiness, held back by ingrained direct sales cultures, concern of conflict (channel/competition) and lack of Cloud GTM understanding.

Incentives: Sales teams aren’t motivated (or de-motivated) to collaborate with cloud reps or sell through marketplaces.

Value Proposition: SaaS companies fail to articulate how their solution complements the cloud provider’s offerings and drives customer value.

Program Knowledge: ISVs often miss out on cloud program benefits because they don’t meet requirements or focus enough on eligibility.

4️⃣ Lack of Alignment and Internal Resistance

The most insidious obstacle often comes from within:

Siloed Departments: Sales, marketing, product, and finance don’t collaborate effectively, hindering a unified marketplace strategy.

Leadership Gaps: Executives may not fully grasp the strategic importance of cloud marketplaces, leading to misaligned priorities or underinvestment.

Not leveraging marketplace data and insights and not integrating MP into your sales and company operations

5️⃣ Cloud-Native Product Reality

Success on cloud marketplaces goes beyond GTM strategy—your product must also be ready... Ideally its architecture should leverage cloud-native services to enhance consumption and scalability.

What This Means

The gap between leaders and laggards in cloud marketplaces is widening.

Those who treat Cloud GTM as a transformation, not just another sales/partner channel, are experiencing rapid growth.

Others risk being left behind in what’s quickly becoming the largest software distribution channel.

What’s the biggest obstacle you’ve encountered?

Master Cloud Marketplace Channel Growth: February 18th Intensive

50% of 100Bn+ of cloud marketplace revenue will be driven by partners by 2027 (Canalys). Are You Ready? The playbook for channel success in cloud marketplaces is being written right now.

Join our 3-week Cloud Marketplace Channel Mastery course (Feb 18th) to learn from top companies shaping this future.

Who This Is For:

Software companies already on cloud marketplaces looking to unlock channel growth

Channel-centric companies ready to capitalize on marketplace opportunities

Why This Moment Matters

While others wait for "proven" strategies, pioneering companies are already capturing market share and defining best practices. This intensive helps you become one of them, turning the current state of industry evolution into your competitive advantage.

Your Journey: 3 Weeks of Strategic Evolution

Marketplace Foundation & Channel Evolution

Where traditional channel strengths meet marketplace opportunities

Emerging patterns in successful integrations

Integration Strategies & Early Winners

Real-world success patterns from pioneers

Partner activation frameworks that work

Change management

Building Your Marketplace Channel Playbook

Building your unique strategy & KPIs

Execution roadmap that adapts as the market evolves

Learn from Active Market Shapers

Our mentors and speakers include David Mauer (Head of Ecosystem Cloud & Emerging Markets Programs at GitLab), Daniel Roppert (Channel & Alliances Leader - Central Europe, Wiz), and leaders actively defining the marketplace-channel integration space.

Beyond Traditional Learning

Live sessions with practitioners solving these challenges now

Interactive workshops to build your strategy

Access to our exclusive Cloud GTM Leader community

Direct connection to VP-level mentors shaping the industry

Why Join Now?

Get ahead of competitors waiting for "proven" strategies

Shape best practices and build relationships with other pioneers

Cohort starts February 18th. Our 150+ alumni from leading software companies have rated our previous courses 9/10.

Join us in defining how much of $380Bn in cloud marketplace opportunities will flow through partners.

P.S. If you find these insights valuable, please share this newsletter with your network - it’s free.