SaaS $1B Cliff: 99% Fail, Cloud GTM Can Change Who Makes It

Hi, it's Roman from Partner Insight. Welcome to my newsletter on winning Cloud GTM and partnership strategies.

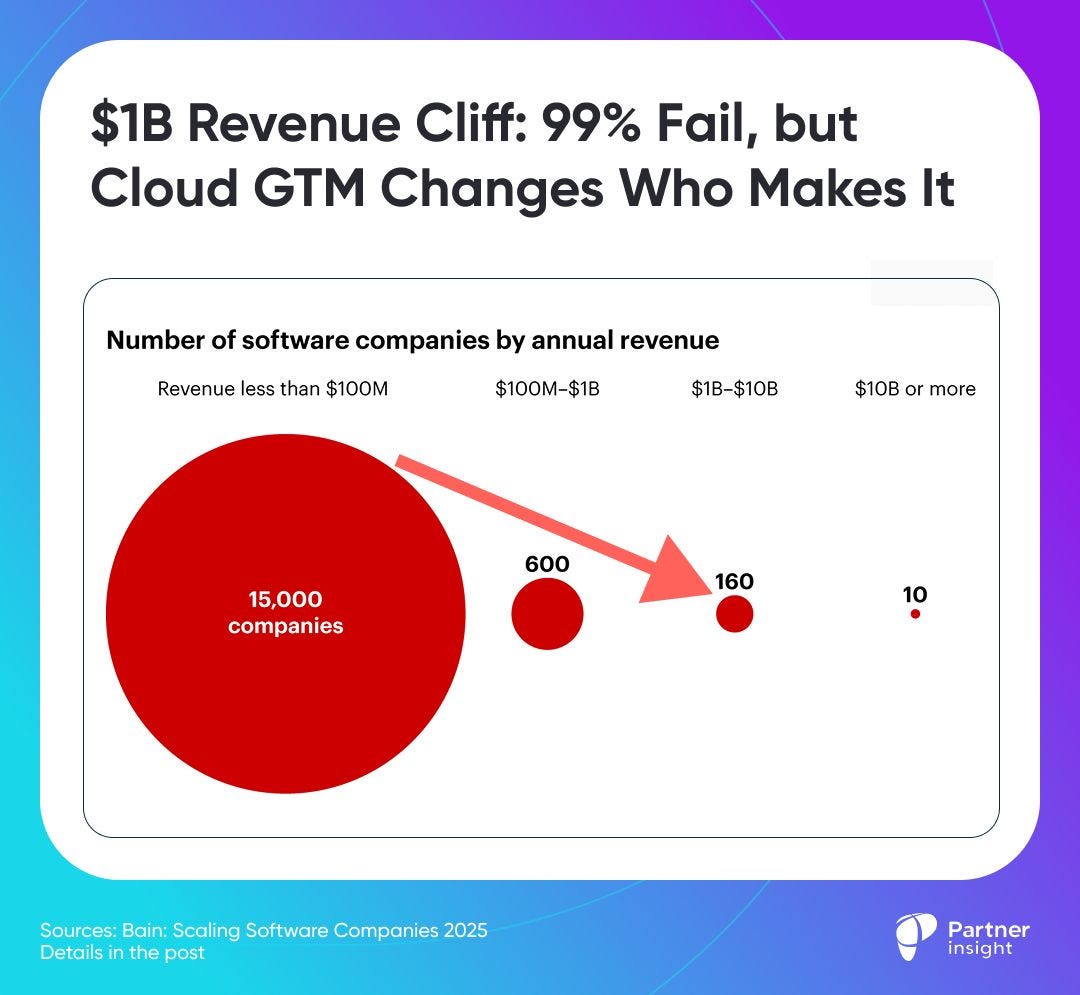

This week we're unpacking the brutal math behind the $1B revenue cliff—of 15,000 SaaS companies, only 160 make it—and how Cloud GTM can change who breaks through. Plus, we'll reveal what many finance teams don't know about turning the 25% marketplace spending cap into their negotiation leverage, and why the AI-marketplace convergence mirrors the same underestimation patterns we saw with cloud a decade ago.

But before we dive in, don't miss our exclusive workshop tomorrow with Palo Alto Networks, AWS, and Spektra SaaSify on July 1st at 10am PT.

We'll decode how Palo Alto built their $1B+ AWS Marketplace revenue engine with 70% of marketplace sales through partners. Still time to register to learn their playbook.

$1B Revenue Cliff: 99% Fail, but Cloud GTM Can Change Who Makes It

Of 15,000 SaaS companies only 600 hit $100M revenue. The path from to $1B? Even steeper — just 160 make it. The "growth cliff" is brutal, but there are patterns in who breaks $1B.

The conventional wisdom says you need market disruption or category creation to hit these milestones.

But Bain & Company found that the most common path to $1B isn't about creating new markets — its methodical TAM expansion across four vectors: new products, geographies, customer segments, and verticals.

This is where Cloud Marketplaces are becoming a critical strategic lever for the key vectors of TAM expansion Bain identifies:

Geo expansion without infrastructure:

2/3 of $1B+ software firms generate 30%+ revenue internationally. AWS, Azure, and Google Cloud marketplaces give instant access to 150+ countries without local entities, banking, or other overhead.

New Customer Segments

Moving into the enterprise segment is a common $1B scaling strategy, but it introduces challenges like complex buying behaviors, longer sales cycles, etc. Marketplaces allow you to tap into $439B of enterprise cloud commits. This simplifies procurement for large enterprises, a major scaling unlock.

Multi-product velocity:

80% of software companies at $1B+ sell at least 2 major products. Marketplaces let you launch and test new SKUs instantly, and reach new personas — all leveraging the same procurement vehicle.

New Industry Verticals:

Almost all single-industry SaaS firms that reach $1B have expanded beyond their core vertical. Meanwhile, all hyperscalers are aggressively pursuing vertical-specific GTM strategies (e.g., AWS for Health, Google Cloud for Retail). Aligning with these is a massive force multiplier.

Case in point: Palo Alto Networks with $8B+ ARR

Palo Alto not only crossed $1B in sales on AWS Marketplace, but also made partners the centerpiece of that strategy.

A stunning 70% of their marketplace sales are generated with partners.

Their multi- product "platformization" strategy drove 52% YoY growth in $10M+ deals last year, with cloud marketplaces as a key distribution lever.

This isn’t accidental success. It’s a systematic GTM machine that turns hyperscaler marketplaces and channel partners into a force multiplier. The result? 2024 AWS Global Technology Partner of the Year and other industry recognitions.

Tomorrow, July 1st, I'm hosting an online workshop to break down $1B marketplace playbook of Palo Alto Networks

Join me and leaders from Palo Alto Networks, Amazon Web Services (AWS), and Spektra SaaSify. We will decode the $1B+ marketplace playbook that made them a powerhouse.

Tomorrow: Palo Alto's $1B+ Marketplace Strategy with Co-Sell, Partners and Automation

When four marketplace leaders gather to decode a $1B marketplace strategy, you know something insightful is about to unfold. Tomorrow's workshop assembles the rare combination of expertise in cloud GTM.

What makes our speaker lineup unique? Each represents a different critical angle of marketplace mastery that many never get to see together.

Louise Strandoo brings the hyperscaler perspective.

As Head of AWS Marketplace AMER she created the COSS framework that became the North Star for ISVs worldwide. Marketplace is “the central point of all things partnership," Louise revealed, highlighting how AWS, a platform with 20,000+ listings, transformed into the ecosystem's gravitational center.

Paul Liao offers something very hard to find: operational excellence across the entire marketplace ecosystem.

He's the rare pro who's built success from hyperscaler (supporting 1,280 ISVs at AWS), integrator (guiding Series A to Fortune 500 at Tackle), and ISV perspectives (scaling Outreach's Cloud GTM from zero to millions). Now at Palo Alto, he's the operational architect eliminating bottlenecks behind their billion-dollar momentum.

Pashupathi Kura has the strategic ecosystem orchestrator viewpoint.

As Director of Product Management for Ecosystems, he drives the strategy that generates 70% of Palo Alto's marketplace sales through channel partners. His background spans ServiceNow's alliance building and Salesforce's AppExchange architecture—the blueprint for platform ecosystems.

Manesh Raveendran brings the deep automation insight.

His SaaSify platform powers $3B+ in annual marketplace transactions, transforming traditionally manual marketplace processes into no-touch systems. "Navigating operational complexity can be a significant drain on time and resources," Manesh explains, which is why automation became essential for companies like Palo Alto scaling to billion-dollar marketplace operations.

Tomorrow's tactical deep dive covers:

Marketplace and Co-sell orchestration with AWS and Palo Alto Networks

How Channel Partners are driving 70% of its marketplace revenue

Automations and operations powering a $1B in marketplace transaction scale

With AWS customer commits reaching $189B last quarter, there's an unprecedented budget waiting to be unlocked via marketplace strategies. This workshop dissects exactly how the leaders who cracked the code built their GTM systems.

Join us tomorrow, July 1st, 10-11am PT and learn how they built this incredible $1B+ marketplace revenue engine.

What Finance Teams Don't Know About the 25% Marketplace Limit

What happens when your customer (or your own company) hits a 25% marketplace spending cap on their cloud commitments?

If you think it's game over—think again.

Both Amazon Web Services (AWS) and Google Cloud cap marketplace purchases at 25% of customers' total cloud commitments (even if you're buying software build on their stack).

Some finance teams see hitting this threshold as a dead end—why keep buying through the marketplace if it doesn't reduce your commitment anymore?

Instead, turn additional marketplace spending into your secret negotiation leverage.

One of our Cloud GTM Leader course members suggested the counterintuitive answer on how sellers can frame this for their customers who buy on marketplaces above the limit:

You can position spending above the 25% cap as leverage for better renewal terms.

Companies exceeding the cap and demonstrating significant marketplace engagement signal strategic cloud commitment that hyperscalers value highly during contract negotiations.

This "excess" marketplace spend becomes data points showing you're building your entire software stack through their preferred channels and on their platform.

But the benefits extend beyond negotiation leverage on your next cloud contract.

Continued marketplace usage delivers budget consolidation, simplified procurement, streamlined vendor management, and pre-integrated solutions that reduce deployment friction.

These operational advantages compound regardless of commitment status.

The strategic reframe is powerful: instead of seeing caps as limitations, present your total marketplace spend as evidence of cloud-first strategy during renewals.

Hyperscalers recognize high marketplace volume as partnership depth, even if that spend doesn't count toward the 25% cap.

3 ways to leverage post-cap spending:

1️⃣ Track total marketplace spend, not just the capped portion for renewal discussions

2️⃣ Position excess marketplace activity as proof of strategic cloud alignment

3️⃣ Use spending patterns above caps to negotiate better discount tiers at renewal

What's your experience with hitting these spending caps? Have you tried turning them into negotiation advantages?

Déjà Vu Moment: Why AI Mirrors Cloud & Marketplace Convergence

Will AI-natives use cloud marketplaces to dominate enterprise the same way SaaS overtook on-prem a decade ago? AI and marketplaces are already colliding in ways that will reshape GTM.

The Pattern of Underestimation

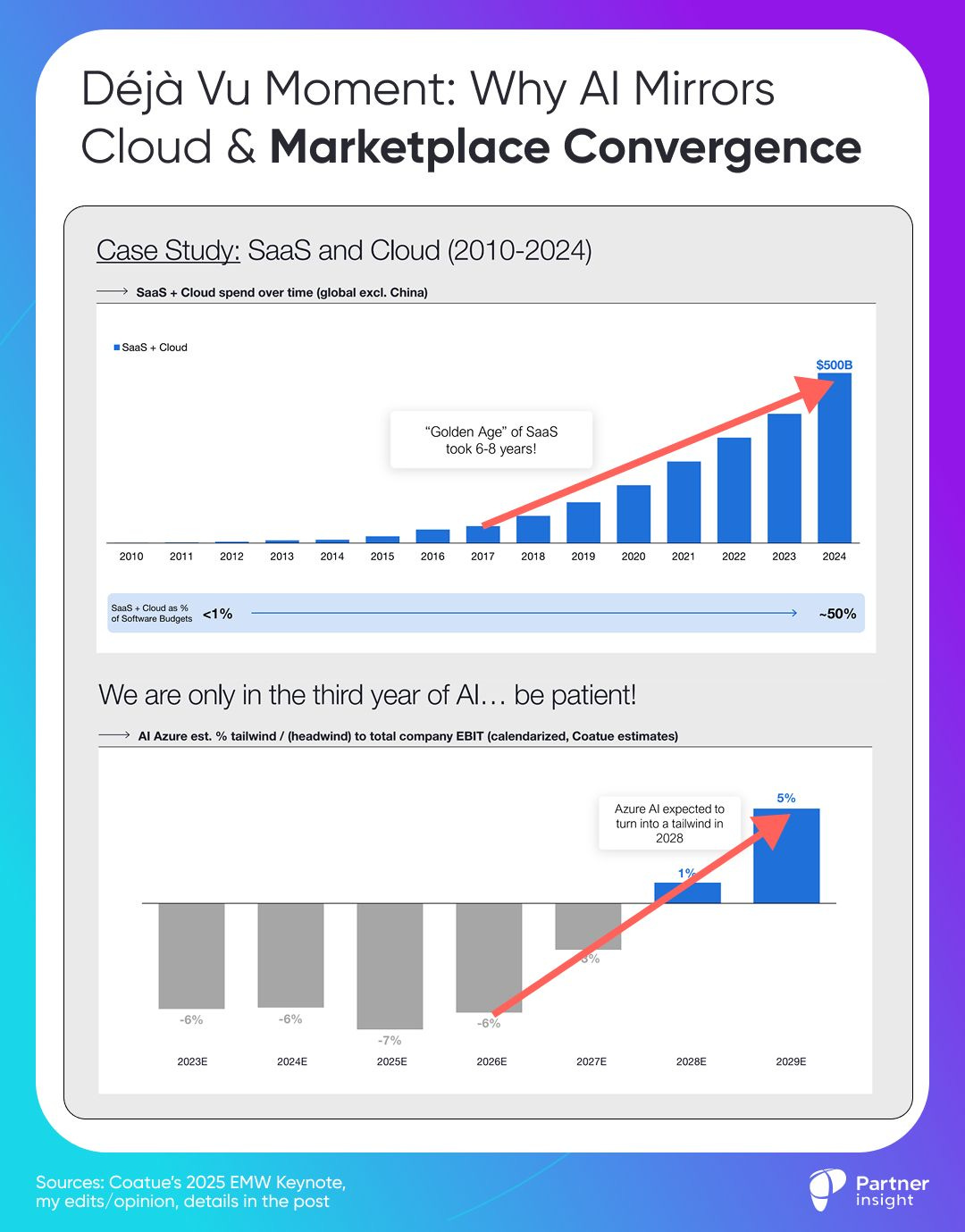

Coatue's latest EMW25 conference revealed an uncanny parallel: analyst skepticism about AI today mirrors identical commentary from 2013-2015 about cloud.

Analysts warned of "deteriorating margins" and questioned massive cloud bets by Amazon and Microsoft a decade ago. Yet cloud skepticism gave way to the "Golden Age" of SaaS, creating a $500B market.

As its CEO Philippe Laffont noted, investors often "misread the shape of these curves" during transformational cycles.

Sound familiar? We see identical commentary from 2024-2025, this time aimed at AI investments. But look at their analysis - they expect to turn into positive EBIT for Microsoft in just 3 years.

This pattern of underestimation isn't just about infrastructure—it happened with GTM models too.

Cloud Marketplaces faced the same dismissal

Initially, many dismissed AWS, Azure, and Google Cloud marketplaces as niche channels, mere bolt-ons to the "real" business of cloud consumption. "It's just for startups," or "Serious enterprise procurement won't happen there," they said.

Wrong again.

The Marketplace Vindication

After Jay McBain of Canalys projected cloud marketplace explosion from $16B in 2023 to $85B by 2028, insiders now quietly confirm this is directionally on track.

The skeptics missed the gravitational pull of cloud commits, simplified procurement, and creation of a high-velocity, low-friction channel for software delivery.

The AI + Marketplace Convergence

If AI mirrors cloud, and marketplaces can become the dominant GTM force, what happens when you combine them?

Data Gravity Meets AI Gravity

AI models require data access, and hyperscalers are the center of data. AI applications will inevitably be discovered, procured, and deployed right next to the data they need to work with.

AI-Powered Procurement

The future of software buying won't be scrolling through catalogs. It will be AI agents, understanding business problems and suggesting solutions from multiple ISVs listed on marketplaces. Discovery and procurement become intelligent and (partially?) automated.

A New GTM for AI-Native ISVs

An entire generation of AI-native companies is being born on the cloud. For them, the marketplace isn't an alternative GTM motion; it's their primary one, offering immediate access to customers, budgets, and immediate distribution globally.

Multiply this on AI Agent Marketplace —a storefront within larger Cloud Marketplaces where enterprises will discover and deploy specialized AI Agents.

Google Cloud has already moved here, others are following. They will be soon selling thousands ready-to-deploy "digital employees".

For GTM leaders

Are you planning for the AI-Marketplace convergence, or making the same underestimation for the third time?

P.S. If you find these insights valuable, please share this newsletter with your network - it’s free.

And if there are topics you'd like us to explore in future editions, please reply to this email with your thoughts.