Salesforce AI Deals: 75% Partner-Led, 2X Marketplace Growth [Analysis]

Hi, it's Roman from Partner Insight. Welcome to my weekly newsletter on winning Cloud GTM strategies and marketplace trends.

Traditional SaaS GTM is facing tough headwinds - new logo growth down 3X and CAC at a 5-year high. Meanwhile, cloud marketplaces are booming: Salesforce just doubled AWS marketplace transactions, with 75% of its AI deals now partner-led; and companies achieving multiple AWS competencies are growing 220%.

Before we dive in:

New Course: Accelerate Marketplace Growth with Channel Partners. Our 3-week intensive starts February 18th. With 50% of cloud marketplace revenue projected to flow through partners by 2027, now’s the time to unlock this frontier. Learn more & Enroll

Find this newsletter insightful? Share it! Earn a featured shout-out for 3 referrals or a private strategy session with me for 10.

Now, let's analyze how market leaders are navigating these Cloud GTM shifts.

75% of Salesforce AI deals are Partner-Led: Inside AI growth

3 out of 4 Salesforce's Agentforce deals are Partner-Led, including 9 out of 10 top wins. Salesforce transactions on AWS Marketplace also doubled in Q3. Is this a blueprint for AI transformation through partnerships?

A year ago, Wall Street questioned if legacy software companies could reinvent themselves for the AI era. While it's too early to declare winners, Salesforce's latest numbers reveal an intriguing blueprint - and it's reshaping how enterprise AI gets adopted.

Salesforce stock up 19% LTM amid broad SaaS selloff, Agentforce launching with 200+ deals in first week, and AWS Marketplace transactions doubling in Q3 after winning top 3 deals in Q2.

But what's fascinating is how they're doing it - by putting partners at the center of their AI strategy.

Partner-Led AI Adoption:

Global partners involved in 75% of Q3 Agentforce deals and 9 of top 10 wins

Over 80,000 system integrators completed Agentforce training in one quarter

Partners built 10,000+ agents in just 3 days at Dreamforce

What's striking is how this partner-first approach is reshaping both sides of the ecosystem.

Brian Millham, COO, captures it well: "We're seeing amazing Agentforce energy across the ecosystem... and our partners are also becoming agent-first enterprises themselves."

Take Accenture's example - they're not just selling Agentforce, they're using it to transform their own 52,000-person global sales organization. This signals a shift: partners are becoming both the delivery channel and proof points for AI transformation.

Cloud Marketplaces and Alliances Accelerating This Trend:

Amazon Web Services (AWS) marketplace is becoming the (default?) strategic channel for enterprise AI buying for Salesforce.

AWS Marketplace transactions doubled in Q3 (top 3 Salesforce's deals in Q2 all transacted via marketplace)

10 marketplace deals exceeded $1M

Full Salesforce platform is now available in 23 countries via AWS

Deep Platform Integration

"By integrating data and AI capabilities across our platforms, Salesforce and AWS are building a strong foundation for the future of agentic systems," explains Brian Landsman, EVP.

This includes zero-copy functionality with Amazon Redshift and Model Builder's integration with Amazon Bedrock - making AI deployment practical at scale.

The results are starting to show.

As Salesforce’s Millham notes: "The number of wins greater than $1 million with AI more than tripled year over year and we signed more than 2,000 AI deals."

To capture this demand, they're hiring 1,400 AEs and using AI agents to augment every seller.

Key Implications for Leaders:

Partner ecosystems are becoming key drivers of AI adoption

Cloud marketplaces are now a strategic channel

Deep integrations are no longer optional

But perhaps the most interesting is how this partner-centric approach might help legacy vendors outmaneuver AI-native startups.

2025 will be the real test, but in 2024 annual report Salesforce highlighted that:

“We expect that marketing and sales expenses will likely decrease as a percentage of revenues in the near term as we continue to focus on leveraging our self-serve and partner-led channels and increasing our sales productivity.”

You see how it’s playing out now.

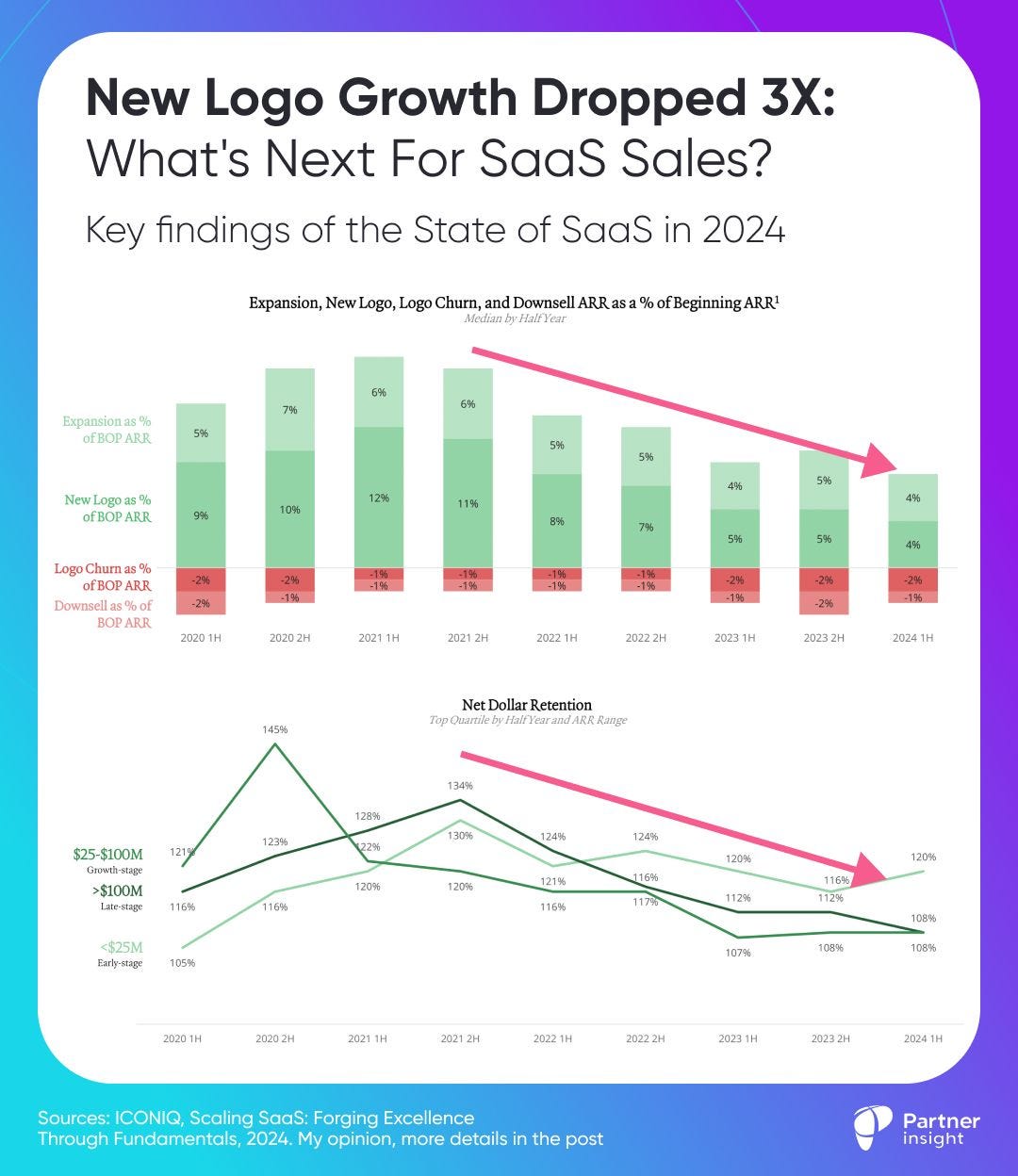

After new logo growth dropped 3X, what's next for SaaS sales?

Traditional SaaS sales is hitting a wall: New logo acquisition plummeted 3X while CAC hit a 5-year high. Yet some companies are growing faster through cloud marketplaces and partnerships. Let’s look at the GTM fundamentals we’re dealing with in 2025.

This analysis comes from a top VC/PE investor managing $83.5Bn, ICONIQ Capital's The State of SaaS in 2024 report.

4 Significant changes in GTM performance:

1️⃣ Sales Efficiency Reset

Net Magic Number (measures how efficiently sales & marketing spend generates new revenue) fell below 1.0x for the first time since tracking began in 2017.

Companies now spend more than $1 in Sales & Marketing to get $1 in net new ARR next quarter - a dramatic shift from 2 years ago when top performers delivered ~1.5x.

It "has significantly deteriorated as selling SaaS tools became increasingly difficult."

2️⃣ Customer Acquisition Challenge

New logo contribution to ARR growth dropped from 10-12% to 4% of beginning period ARR. Traditional GTM motions are showing unprecedented friction, as the cost to acquire customers (CAC payback period) stretched to 34 months - the longest in 5 years.

3️⃣ Net Dollar Retention Pressure

Net Dollar Retention (measures how much recurring revenue grows from existing customers) dropped from peak average of 120-130% to 108% in 1H 2024.

Logo churn (complete loss of customers) now represents 59% of all lost revenue (more than downsells). Buyers are becoming more selective in their tech stack decisions.

4️⃣ Shift to Expansion Led Growth

Companies are pivoting hard from new logo focus to generating more revenue from existing customers. In just 8 quarters, expansion revenue grew from 32% to 45% of new ARR.

How are companies adapting?

Here is what we see:

Market leaders shift to Cloud GTM and partnerships

Companies recognize that B2B purchases are shifting to Digital Self-Serve Channels (50%+ of large B2B sales will be there in 2025)

SaaS companies already see 80% larger deal sizes and close a higher percentage of deals (27%) when transact via cloud marketplaces, like Amazon Web Services (AWS)

Dynatrace sees 2X larger deals via marketplace, with 15 of 18 seven-figure deals in Q2 closed through hyperscalers and GSIs

Wiz: 70% of revenue through marketplaces

For Software Leaders in 2025:

Build systematic expansion motions - it's now fundamental

Invest in cloud marketplace presence and partner ecosystems

Align sales compensation to favor efficient channels

How are you adapting your growth strategy for 2025?

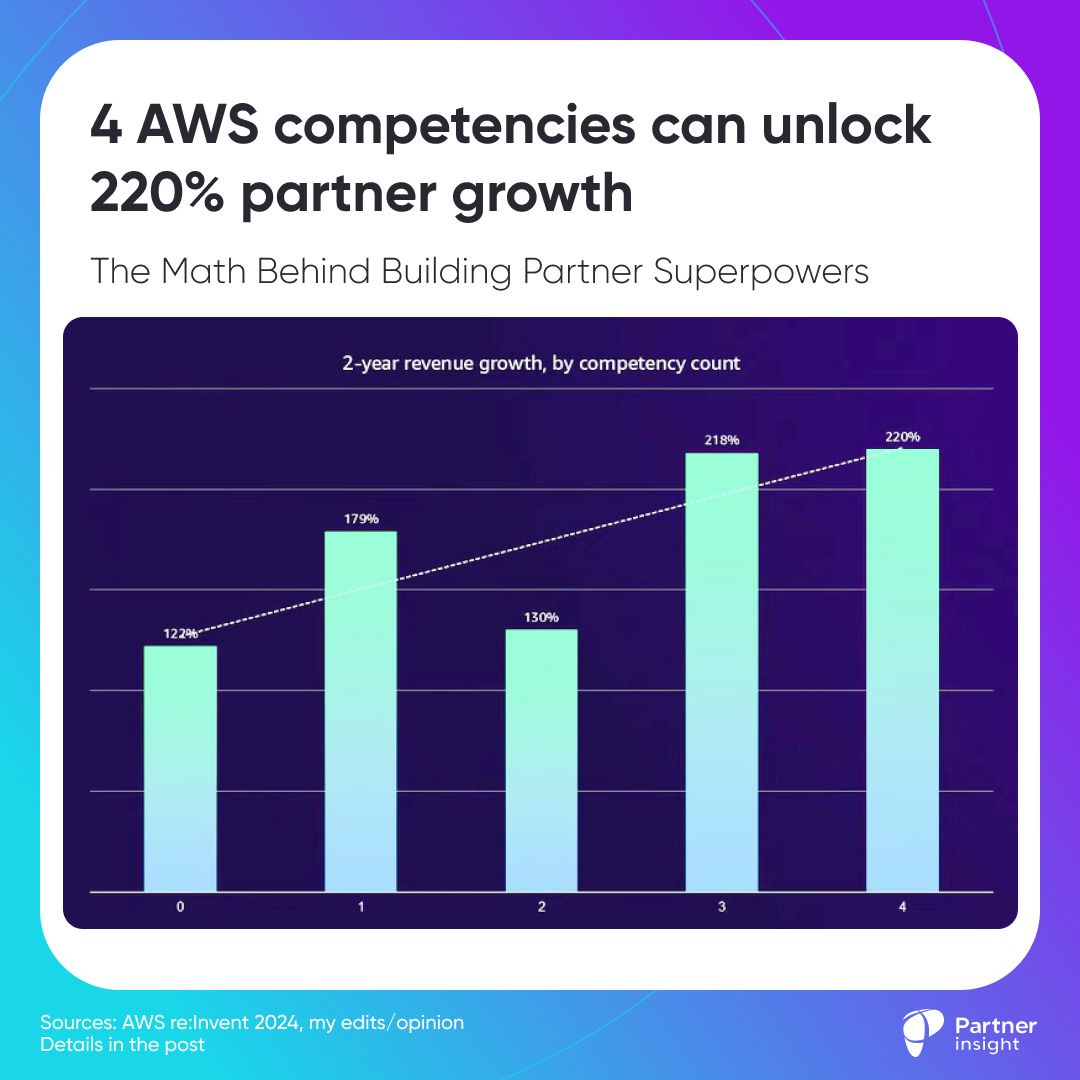

Achieving AWS competencies can unlock 2X+ growth

Partners with 4 AWS competencies achieve 220% revenue growth, while even a single competency boosts growth to 179%. Is this the most overlooked lever in cloud partnerships and marketplaces?

New data from Amazon Web Services (AWS) re:Invent 2024 reveals a direct correlation between competencies and partner revenue growth that's impossible to ignore.

Rishi Bhaskar, AWS Director of Public Sector Partner Sales, recommends partners aim for 4 competencies, backed by data showing those who do achieve 220% growth over two years.

Ruba Borno, VP of AWS Global Specialists and Partners, explained why this matters:

"87% of customers look at partner competencies to determine which partner to work with. The tech landscape is actually really complicated - they don't know who's an expert in what area, what industry, what products they want to work with."

This customer behavior isn't surprising - 74% of AWS customers review their partners' certifications at least twice annually. It's a clear signal that competencies aren't just badges; they're becoming essential criteria in vendor selection, including cloud marketplaces.

AWS is doubling down on this trend. "We have 119 partner specializations," notes Dr. Borno, "and we've invested in these because we learned that customers actually look at partner competencies."

They're now launching competencies simultaneously with new services - a first for AWS that signals deeper integration of partners into their core offerings.

The business case is compelling

The data shows a clear progression: partners with one competency achieve 179% growth, those with three reach 218%, and four competencies push it to 220%.

What's particularly interesting is how even gaining that first competency creates a significant uplift in growth.

Still, many companies don’t have competencies...

This disconnect between clear data and partner adoption raises an interesting question: Are we underestimating the ROI of investing in cloud competencies?

Master Cloud Marketplace Channel Growth: February 18th Intensive

In just two years, 50% of 100Bn+ of cloud marketplace revenue will be driven by partners (Canalys). But, the playbook for channel success in cloud marketplaces is being written right now.

Join our 3-week Cloud Marketplace Channel Mastery course (Feb 18th) to learn from top companies that are already wining with partners on marketplaces.

Who This Is For:

Software companies already on cloud marketplaces looking to unlock channel growth

Channel-centric companies ready to capitalize on marketplace opportunities

Why This Moment Matters

While others wait for "proven" strategies, pioneering companies are already capturing market share and defining best practices. This intensive helps you become one of them, turning the current state of industry evolution into your competitive advantage.

Your Journey: 3 Weeks of Strategic Evolution

Marketplace Foundation & Channel Evolution

Where traditional channel strengths meet marketplace opportunities

Emerging patterns in successful integrations

Integration Strategies & Early Winners

Real-world success patterns from pioneers

Partner activation frameworks that work

Change management

Building Your Marketplace Channel Playbook

Building your unique strategy & KPIs

Execution roadmap that adapts as the market evolves

Learn from Active Market Shapers

Our mentors and speakers include David Mauer (Head of Ecosystem Cloud & Emerging Markets Programs at GitLab), Daniel Roppert (Channel & Alliances Leader - Central Europe, Wiz), and leaders actively defining the marketplace-channel integration space.

Beyond Traditional Learning

Live sessions with practitioners solving these challenges now

Interactive workshops to build your strategy

Access to our exclusive Cloud GTM Leader community

Direct connection to VP-level mentors shaping the industry

Why Join Now?

Get ahead of competitors waiting for "proven" strategies

Shape best practices and build relationships with other pioneers

Cohort starts February 18th. Our 200+ alumni from leading software companies have rated our previous courses 9/10.

Join us in defining how much of $380Bn in cloud marketplace opportunities will flow through partners.